ICO vs IDO Crypto Launchpads Explained: Which Is Better in 2026?

Listen to the Audio :

Have you ever noticed that investors and crypto innovators often argue about how to launch a token? The debate around ICO vs IDO crypto launchpad models shows up everywhere—whether it’s in deep-dive Telegram chats or heated Twitter arguments. While some people speak for ICOs, others think IDOs are the way of the future.

Welcome to the dynamic world of crypto launchpads. Choosing between an ICO vs IDO crypto launchpad in 2026 is more than just a technical choice; it can affect your project’s long-term growth, community trust, and financial success. We analyze ICO (Initial Coin Offering) and IDO (Initial DEX Offering), describe how each model works, and help you choose which launch approach makes the most sense in the present and fast-changing crypto environment in our comparison guide.

Introduction

Launching a crypto project is basically about raising funds, building trust, and getting your token into the hands of the ideal users. Investors and founders have argued about how to do this over the years. Will you start through a decentralized platform with instant liquidity, or should you sell tokens directly to early supporters? Crypto fundraising models have evolved due to this issue.

This is where ICO vs IDO crypto launchpads come in. These two models each with special benefits, risks, and applications, will dominate token launches in 2026. IDOs prioritise decentralization, transparency, and faster market access, whereas ICOs focus on direct financing and control. We'll go over ICO vs. IDO, how they work, and which launchpad approach is right for modern crypto projects and companies in this comparison guide.

What Are Crypto Launchpads ?

Crypto launchpads are platforms that allow new blockchain projects to raise funds and launch their tokens in a structured and secure manner. Think of them as a bridge between early stage crypto projects and investors. A launchpad offers the tools, audience, and guidance required for a successful token sale, as compared to launching a token on your own and seeking buyers by hand .

At its most basic, crypto launchpad development allow businesses to introduce their tokens to the market while also providing investors with early access to potential ideas before they become popular. These platforms manage important tasks like investor allocation, token sales, smart contract execution, and even liquidity generation .

Early crypto projects primarily relied on initial coin offerings (ICOs), in which teams sold tokens to users directly. Crypto launchpad platforms evolve as the industry grows and concerns about security, transparency, and fraud increase, resulting in IDO-focused platforms that run top decentralized exchanges. These days, crypto launchpads are essential for ensuring safer launches, improved visibility, and faster access to liquidity .

Understanding ICO Launchpads

ICO launchpads are platforms that help blockchain projects to conduct an Initial Coin Offering (ICO) in a more structured and accessible manner. Projects use an ICO launchpad to manage investor participation, token distribution, and funding on a single platform rather than managing the full token sale separately. Projects that use an ICO launchpad development model sell their tokens to investors directly before they are listed on any exchange.

Investors often participate by sending cryptocurrencies such as ETH, BTC, or stablecoins and receiving project tokens at a fixed or tier-based price. The launchpad serves as a facilitator, offering basic infrastructure, exposure, and even marketing support .

Key Features of ICO Launchpads

The pricing and sale structure of tokens are entirely in the hands of project teams.

The founders set the fundraising limits, token distribution, and sale timeline.

Before being listed on an exchange, tokens are often sold at fixed or tiered values.

Exchange listing occurs after the initial coin offering (ICO); liquidity is not instant.

Marketing and exchange listings may incur additional costs.

Compared to IDO launchpads, vetting is usually more limited.

When ICO Launchpads Are Used in 2026

Ideal for large-scale fundraising goals

Projects aimed at institutional or private investors prefer

Common in long-term or enterprise blockchain projects

Strong brand reputation and transparency are necessary.

Investors place a high value on the project team's reputation and roadmap

Overview of IDO Launchpads

IDO launchpads are platforms that use decentralized exchanges to help cryptocurrency projects raise funds through an Initial DEX Offering (IDO). In contrast to initial coin offerings (ICOs) & initial coin offerings (IDOs) are conducted directly on blockchain-based platforms ,where smart contracts manage the whole token sale process, making it more automated and transparent .

Tokens are sold and listed on a decentralized exchange immediately under an IDO launchpad model, letting users trade as soon as the sale concludes. Investors participate by linking their crypto wallets and swapping tokens that are supported, usually without middlemen. Through DEX pools, the launchpad ensures secure execution, fair participation, and instant liquidity.

Key Features of IDO Launchpads

On decentralized exchanges (DEXs), token sales are done directly.

Token distribution and fundraising are automated using smart contracts.

After the IDO, tokens are listed immediately, allowing for fast trading.

DEX liquidity pools are used to add liquidity.

For fair participation, launchpads frequently use whitelisting or tier systems.

Higher transparency about on-chain transactions and public information

In comparison to ICO launchpads, stronger community reviews and vetting

When IDO Launchpads Are Used in 2026

Ideal for community-driven projects, Web3, and DeFi

Best suited for rapid token launches with instant liquidity.

Preferred by projects aimed at both local and global investors

Effective for startups looking for trust and decentralization

Investors appreciate early trading access, speed and transparency.

ICO vs IDO Crypto Launchpads: A Detailed Comparison

You can select the best launch model for your blockchain project by using this crypto launchpad comparison guide, which explains the main distinctions between ICO and IDO platforms .

| Feature | ICO Launchpads | IDO Launchpads |

|---|---|---|

| Launch platform | Hosted on the project’s website or ICO platform | Conducted on decentralized exchange (DEX) launchpads |

| Level of Control | Full control by the project team | Smart contract-driven with limited manual control |

| Token Sale Method | Direct token sale to investors | Token swap via DEX smart contracts |

| Token Pricing | Fixed or tier-based pricing | Market-driven or preset with liquidity pools |

| Liquidity Availability | Delayed until exchange listing | Instant liquidity after IDO |

| Exchange Listing | Requires separate CEX/DEX listing | Automatically listed on the DEX |

| Transparency | Limited, off-chain processes | High, fully on-chain transactions |

| Vetting Process | Minimal or optional | Stronger vetting and community review |

| Investor Access | Open or private sale based | Wallet-based, often whitelist or tier system |

| Fundraising Speed | Slower, multi-step process | Faster and more streamlined |

| Risk Level | Higher risk for investors | Lower risk (but still market volatility) |

| Best Suited For | Institutional or large-scale fundraising | DeFi, Web3, and community-driven projects |

| Popularity in 2026 | Moderate, niche use cases | High, widely adopted |

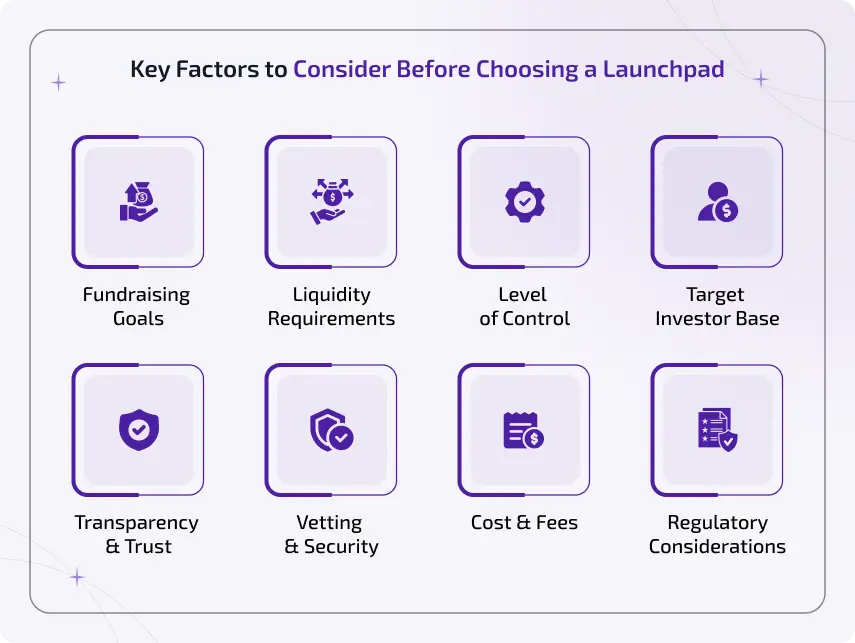

Key Factors to Consider Before Choosing a Launchpad

Choosing the best crypto launchpad in 2026 is a crucial choice, whether you're a project creator looking to raise funds effectively or an investor looking for high-quality early opportunities with strong ROI potential . The wrong choices can cause poor fundraising performance, low visibility, major hazards, or missed alpha.

Launchpads differ greatly: various offer hybrids, some excel in community-driven fair launches (DeFi/memes/GameFi), while others excel in rigorous vetting and compliance (e.g., for regulated tokens or RWAs). Here is an accurate picture of the most important aspects to consider, based on current market regulations and expert analysis .

Fundraising Goals

Your fundraising goals set your choice of launchpad. Large-scale capital raising projects tend to prefer organized ICO models, whereas community-driven funding projects gain from IDO launchpads. Aligning your target amount with the right framework provides a smoother fundraising process and higher investor engagement.

Launchpads with large capital → ICO

Raised by the community → IDO launchpads

Define sales size and structure.

Liquidity Requirements

The liquidity of your token impacts how quickly investors may trade it after its launch. IDO launchpads provide instant liquidity through decentralized exchanges, but ICO launchpads usually include delayed exchange listings. Understanding your liquidity requirements helps maintain trust among investors and avoid post-launch discontent or price volatility.

Instant access to trading

Timelines for exchange listings

Impact of market demand

Level of Control

Launchpad models differ significantly in control. ICO launchpads let users to actively manage token allocation, pricing, and timescales. IDO launchpads, on the other hand, rely on smart contracts, which provide more automation, fairness, and transparency throughout the token sale process but less manual control .

Total control → ICO launchpads

Automation of smart contracts → IDO launchpads

Impacts allocations and prices

Target Investor Base

Different launchpads attract a wide range of investors. ICOs are usually appealing to institutional and private investors looking for structured involvement. IDOs attract Web3-native and retail consumers who value decentralized trade and open access. Selecting the ideal launchpad enables you to connect with investors who share your vision for the project.

Institutional investors - ICOs

Retail and Web3 users - IDOs

Impacts the marketing strategy

Transparency & Trust

Investor trust relies heavily on transparency. IDO launchpads make the process more transparent by providing transactions and allocations with on-chain visibility. ICO launchpads depend more on the project's credibility; to win over investors, they need to have a strong brand, transparent paperwork, and constant communication.

Transparency on-chain → IDOs

Trust based on reputation → ICOs

Builds investor trust

Vetting and Security

Vetting and security standards vary between launchpads. IDO launchpads frequently use community screening and smart contract audit company to reduce risks. ICO launchpads have fewer strict rules, placing greater pressure on the project team to prove legitimacy, security standards, and long-term commitment to investors .

Smart contract audits

Launchpad screening process

Community reputation checks

Cost & Fees

The cost of each launchpad model varies. ICO launchpads might need to pay more for exchange listing and marketing. IDO launchpads can include platform fees, staking requirements, or liquidity pool commitments, although they usually reduce listing costs. Budget planning is much easier when total costs are known.

Platform and setup costs

Listing and marketing costs

Requirements for a liquidity pool

Regulatory Considerations

Launch models and jurisdictions have distinct regulatory requirements. IDOs work in a more decentralized environment, whereas ICOs often face stricter compliance and legal inspections. Early legal expert consultation keeps projects compliant and helps them prevent future regulatory issues .

ICOs face harsher regulations

IDOs have more decentralized operations.

Legal counsel is crucial.

ICO vs IDO: Which Launch Method Is Better in 2026?

In 2026, there is no one-size-fits-all answer when choosing between an ICO and an IDO. Your project's objectives, target market, and funding plan will figure out which launch strategy is optimal . ICOs are still right for projects looking for large, institutional, or private finance with more control over the token sale process. However, they require a high reputation and delayed liquidity.

In contrast, IDOs are now the most popular option for the majority of modern crypto projects. They provide fast funding, increased transparency, faster launches, and simpler access for regular investors globally. IDOs reduce listing costs and more successfully build trust due to decentralized exchanges and smart contract automation.

Why IDOs are Generally Better in 2026

Market Dominance - The most active/upcoming launches are IDOs on platforms like DAO Maker, Seedify, Polkastarter, ChainGPT Pad, Legion, and Gems.

Investor & Founder Preference - IDOs provide community alignment, improved transparency through certified contracts, and instant liquidity: all crucial in volatile markets. IDOs beat ICOs in terms of transparency, reduced fraud, and post-launch performance for the majority of projects, according to sources from 2025–2026 evaluations (e.g., Scaling Parrots, Coinlaunch, Blockchain-Ads).

Trends - In fundraising, decentralized models are preferred . IDOs incorporate reputation systems, AI vetting, multichain support, and more fair distribution (e.g., lotteries over pure staking). Pure initial coin offerings (ICOs) are specialized and have been revived for compliance-first or hybrid presales (like CoinList-style).

Performance Data - Due to vetting, top IDO pads have lower failure rates and high historical ROI (e.g., 5–15x ATH averages on several platforms).

When ICO Might Still Be Better

If your projec4 requires as much customization as possible (e.g., complex vesting, targeted investors).

For regulated/4WA tokens, where institutional appeal, securities compliance, and KYC are important (CoinList excels here).

If you prefer 4ontrolled distribution and are risk-averse to DEX volatility or sniping.

IDO is currently the best option for more than 80% of projects (DeFi, innovative Web3, community-focused). It provides faster liquidity, increased community interaction, less scam risk, and better compatibility with the decentralized ethos that drives cryptocurrency .

ICO (or hybrid presale) is still viable and even preferred for highly tailored, business, or regulated launches.

Hybrid strategies, such as compliance presale (ICO-style) followed by IDO liquidity, are becoming more popular.

Always DYOR: Verify audits, token locks, team transparency, launchpad performance (using CoinGecko and CryptoRank), and community sentiment . The sector is changing fast, with regulatory clarity and features like AI-vetting shifting toward safer, more efficient models such as IDOs.

If you're a startup or investor looking for "best" shifts in specific areas (e.g., GameFi vs RWAs), please contact us for customized guidance !

How BlockchainX Supports Secure ICO and IDO Launchpads?

BlockchainX is a well-known blockchain development company specialising in the development of crypto launchpads. They offer complete solutions for creating turnkey, white label, and custom launchpads that facilitate Initial DEX Offerings (IDOs) and Initial Coin Offerings (ICOs). They prioritize investor safety and regulatory alignment while developing safe, transparent, and scalable platforms that help businesses raise funds .

BlockchainX, as a development service provider (as opposed to an operational launchpad like DAO Maker or Binance Launchpad), enables businesses, investors, and projects to launch their own branded ICO/IDO platforms with built-in security. This is especially helpful for people who desire complete control over their fundraising ecosystem in the emerging cryptocurrency market of 2026.

Key Ways BlockchainX Supports Secure ICO and IDO Launchpads

Custom & White4Label Launchpad Development

Security-first4Architecture

Advanced Fundr4ising & Token Sale Tools

Multichain and4scalable Infrastructure

DEX integratio4 and liquidity setup

Why Choose BlockchainX for Secure Launchpads in 2026?

Trust & Credib4lity

Investor & Pro4ect Benefits

Customization<4p>

Market Alignme4t

BlockchainX doesn't run a public launchpad, but instead provides expert development services to help others create secure, professional-grade ICO and IDO launchpads. This technique helps projects avoid common pitfalls (e.g., hackers, low liquidity, regulatory concerns) while creating trustworthy fundraising environments .

Always DYOR if you're thinking about launch your own ico platform or partnering on a token sale: Analyze their portfolio, ask for case studies or audits, and compare it with competitors. Visit our official website (blockchainx.tech) or get in touch with us directly for the most recent news .

Download the PDF : ICO vs IDO Crypto Launchpad.pdf

Conclusion

Choosing between an ICO vs IDO in 2026 is more than simply a tactical choice. It also reflects the vision of your enterprise, your awareness of regulations, and the type of community you wish to create. IDOs provide speed, decentralization, and robust community involvement, whereas ICOs provide more control but present compliance issues.

Your goals, target audience, and available resources will determine which launch model is best for you. One thing is certain: the right partner and platform are necessary for a successful token launch. BlockchainX provides top-notch crypto launchpad development services, giving companies the resources, technology, and planning they need to start safe and scalable ICOs and IDOs in any blockchain ecosystem .