8 Easy Steps to Create Your Own Fiat-Backed Stablecoin

Listen to the Audio :

Are you an individual or an entrepreneur, interested in entering the cryptocurrency world, but worried about its market value? No worries, we have got you here. With our professional stablecoin development company, you can create your own fiat-backed stablecoin with just 8 easy steps and learn to back your real-world currency reserves with high security standards and global financial accessibility.

Fiat-backed stablecoins have emerged as a crucial and advanced innovation that can help tackle price fluctuations in the competitive crypto ecosystem.

Additionally, you can also enhance new opportunities for businesses and build trust and grow demand for digital financial solutions with enhanced liquidity.

What is Fiat-Backed Stablecoin?

A fiat-backed stablecoin is a type of crypto digital asset that mirrors the value of a traditional fiat currency. In essence, their value remains stable and fixed by being directly pegged to the real-world funds of the fiat currency, like a bank account or a regulated custodian.

Unlike volatile digital cryptocurrencies like Bitcoin, fiat-backed stablecoins aim to offer the benefits of blockchain while maintaining steady price value through direct trusted banking reserves. This platform is essentially beneficial for users seeking a stable medium of exchange, especially to undergo smooth and reliable transactions within the cryptocurrency ecosystem.

Overall, these digital assets bridge the gap between the traditional financial system and the world of decentralized finance (DeFi) together.

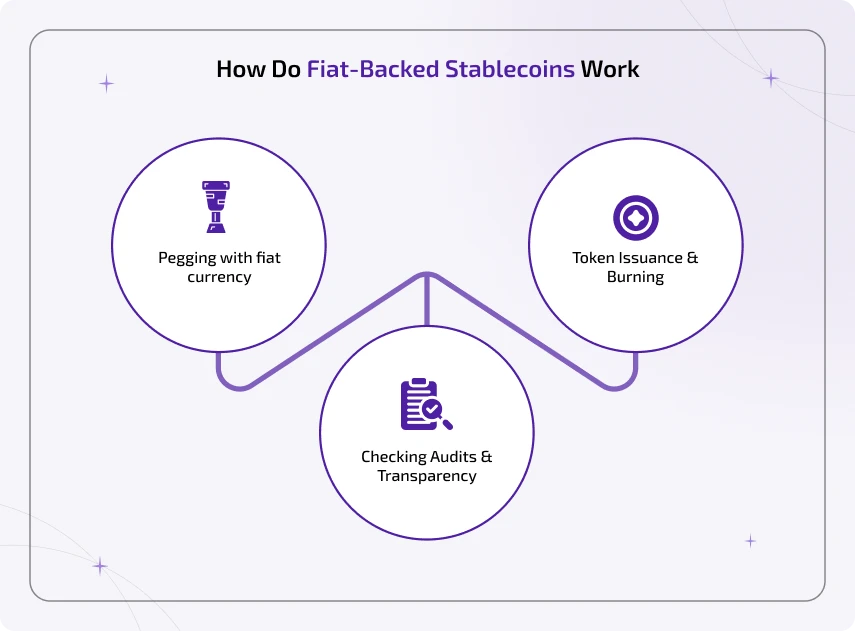

How Does Fiat-Backed Stablecoins Work?

The operational workflow of a fiat-backed stablecoin is relatively simple, which works by issuing digital tokens on a blockchain. It primarily relies on organized management with effective oversight and trust in centralized authorities. Let's see how it works.

Pegging With Fiat Currency

For every stablecoin issued, its price value is maintained by relying on a reserve of fiat currency that is stored in a secure account or a regulated bank account. For example, if an asset associated with 100 USD-backed stablecoins is issued, it must exactly hold and be equivalent to the value of $100 USD.

Token Issuance & Burning

Now, the holders will exchange their fiat currency for the equivalent amount of stablecoins that are created, and the fiat amount is regulated in a bank account by the issuer. Orderly, blockchain verifies all the transactions securely and transparently.

Checking Audits & Transparency

Regular audits are conducted using trusted third parties to verify the reliability of fiat-backed stablecoins. This ensures that the tokens are original and safe to hold the issued stablecoins with high transparency and security, building confidence among users.

8 Easy Steps to Create Your Own Fiat-Backed Stablecoin

Thinking about how to create a fiat-backed stablecoin of your own in 2025? Come, let’s together develop an effective coin, blended with deep technologies and robust security audits.

Step 1 - Define Your Stablecoin's Framework

Start the stablecoin development process by clearly determining its purpose of , target audience, and its different types. Then, decide which fiat currency your stablecoin is pegged to. Say, for example, determine whether it is pegged to USD, EUR, etc and explain whether the management will be centralized or decentralized.

Step 2 - Regulatory Compliance Checks

Legal standards are the mandatory procedures of fiat-backed stablecoins. So, check the necessary local and international financial licenses and ensure that the coins comply with the chosen authorities. You can even seek help from a legal advisor or a regulator to ensure transparent operation and to avoid future violations.

Step 3 - Fund Management

Now, you need to secure your fiat funds in a trusted bank account or with custodians. This ensures that every token safely holds the stablecoin’s value in a 1:1 ratio for most of the fiat-backed stablecoins. Once created, conduct auditing and verify the necessary protocols to enhance trust among users about the stablecoin.

Step 4 - Pick Your Blockchain Network

As a next step, you need to choose the right blockchain platform to create a successful fiat-backed stablecoin with robust security. To implement this, look for the widely used platforms like Binance Smart Chain, Ethereum, and Solana, and finalize any of the platforms by considering their price and security support.

Step 5 - Create the Smart Contracts

Create a blockchain smart contract to tackle various functions like redeem, stablecoin token transfers, burning, minting, and more. This development of smart contracts ensures reliable transactions with minimal cost, reduced operational risks, and further supports automated, secure, and trustless transactions of stablecoins.

Step 6 - Creating and Redeeming Stablecoin

Now, design an automated reserve management, to mint and burn the stablecoins. This process will be carried out when users deposit fiat and redeem it as cash. Further, enhance the users' experience with certain integrations like live auditing systems, APIs, real-time dashboards, and liquidity providers, while maintaining its trust and transparency.

Step 7 - Conduct Security Audits

Now, it's time to do multiple testing and security audits to check your smart contracts. Conduct tests like external audits, penetration tests, and more to make sure the platform is free from security breaches and online hacks. Then, monitor the platform continuously to build confidence among users, strengthening the stablecoin’s value.

Step 8 - Stablecoin’s Launch & Maintenance

Finally, deploy your stablecoin on the chosen blockchain network and list it on exchanges for users' visibility. You can make the platform reach globally by conducting market campaigns, ramps, or partnering with top entrepreneurs.

Then, maintain regular audits and provide transparent reserve reports and compliance updates to enhance long-term sustainability and user confidence.

But following the above simple procedures, you can build fiat-backed stablecoin on your own and maintain a stable value for your assets in this crypto world without the need for any central authorities.

Business Benefits of Fiat-Backed Stablecoin Creation

Fiat-backed stablecoins offer various benefits ranging from price stability to currency fluctuation protection. Let’s together discover their benefits to boost your proficiency in crypto finance.

Efficient Transactions

Unlike traditional banking systems, fiat-backed stablecoins remove middlemen and support instant transfers across borders. This enables businesses and individuals to undergo rapid payments and instant financial operations.

Reduced Volatility

Stablecoins, in contrast with cryptocurrencies like Ethereum or Bitcoin, are tied to assets like fiat currencies with stable prices. Here, companies can smoothlyundergo transactions and get rid of market price fluctuations without the fear of sudden loss.

Better Accessibility

Stablecoin supports worldwide business transactions without relying on centralized banks, authorities, or digital wallets. This makes global users easily engage in digital payments and access the previously restricted financial services.

Financial Inclusion

Supporting all types of users, stablecoin helps both unbanked and underbanked users to take part in the global financial system without access to traditional banking. Any user can easily use stablecoins for payments, savings, online commerce, remittances, and other activities.

DeFi Integration

Stablecoins are an integral part of DeFi, which makes it more accessible to all users in a user-friendly way. They enable DeFi applications such as lending, borrowing, and staking in a smooth way with reduced risk and without relying on traditional authorities.

Low Transaction Cost

Fiat-backed stablecoin removes middlemen and supports rapid and affordable transactions, increasing customer satisfaction. This is one of the major advantages for businesses or individuals who frequently conduct borderless payments.

Hedge Against Local Currency Volatility

Fiat-backed stablecoins serve as one of the best ways to secure and store the value of an unstable currency in a high-inflation country. This makes users preserve their purchasing power by handling stablecoins as a practical tool for financial planning and economic stability.

Industrial Use Cases of Fiat-Backed Stablecoins

Fiat-backed stablecoins maintain stable value and simplify global transactions and payments, making businesses ideal in this crypto world. However, various users are increasingly using these stablecoins to enhance their accessibility, and the following section will give a precise description of which industries are getting benefited with these coins.

Remittances

Fiat-backed stablecoins stand as a crucial component for undergoing seamless cross-border remittances. They enable businesses, individuals, and other migrant workers to easily go through fast and low-cost transactions without any middlemen. Eventually, this minimizes the dependency on high-money transfer services or banks.

Trading & Hedging

Fiat-backed stablecoins are widely used in the trading and hedging platforms due to market stability. Traders use these coins as a trusted tool to safeguard their assets from market fluctuations and secure them in digital form. This helps them to avoid sudden losses and quickly move their funds between exchanges.

E-Commerce Transactions

Businesses gain a lot from fiat-backed stablecoins by accessing instant settlements and borderless transactions for online purchases at a minimal price. This is in contrast with the volatile cryptocurrencies, where global users secure their transactions without being affected by market fluctuations.

Payroll & Salaries

To bypass international banking delays and slow transfers, stablecoins enable companies to pay their employees, freelancers, and contractors with quick and efficient settlements. This becomes highly effective in cross-border scenarios, where remote workers and international employees instantly receive their payments without any delays.

Borderless Transactions

Stablecoins allow every individual to perform instant international money transfers without any traditional banking systems. This process simplifies money transactions and makes the cross-border payments secure, fast, and reliable with no delays or high transfer charges.

Micropayments & Subscriptions

If you want to make seamless micropayments and subscription-based transactions, stablecoins make it happen. Regardless of high transfer costs, any user can make instant payments without considering market fluctuations. They can seamlessly make micro-payments for various activities such as online digital content, gaming, etc.

Why Businesses Should Consider Launching Fiat-Backed Stablecoins in 2025?

Stablecoins are becoming an essential part in this digital economy by connecting traditional financial systems with blockchain technology. So, by developing their own fiat-backed stablecoin any businesses can create a trusted digital currency ecosystem under their reputable brand, with improved efficiency and trust.

This will eventually strengthen customer loyalty and increase direct payment controls. Here, the adoption of fiat-backed stablecoins also opens new revenue streams and empowers businesses as innovators in the digital finance and Web3 ecosystem.

It also increases financial inclusion for global consumers, enhancing seamless cross-border transactions with robust regulatory standards and stability. However, below reasons combine to give a clear overview of why businesses and developers should launch a fiat-backed stablecoin in 2025.

Businesses can be a competitive edge in Web3, integrating with platforms like DeFi, NFT, and blockchain.

Reliable transactions can be done with consistent value.

Fiat-backed stablecoins enhance the overall trust and credibility within the innovative digital ecosystem.

Stablecoin’s stable value protects businesses from sudden market price fluctuations.

Ensures fast and reliable digital transactions with minimal risks and security issues.

Stablecoin helps businesses and organizations to simplify local and international payrolls for their employees.

Enables businesses to manage assets beyond traditional banks, while safeguarding their financial resources.

Why Choose BlockchainX to Create a Fiat-Backed Stablecoin ?

If you are new to the crypto world and are about to develop your fiat-backed stablecoin for the first time, then you need to partner with a leading company that provides end-to-end stablecoin development solutions like BlockchainX.

We have a team of professionals who have expertise with more than 8 years of experience in blockchain, having the proficiency to deliver a secure, reliable, and feature-rich fiat-backed stablecoin that satisfies users' needs.

Our in-depth knowledge of the cryptocurrency sector, from initial planning to implementation, will help any businesses or individuals to develop fiat-backed stablecoin to convert their business concepts into trusted digital assets.

By particularly create a stablecoin for scalability, security, and regulatory compliance, we use popular networks like Solana, Ethereum, and BNB Chain to create a fiat-backed stablecoin and sync it with the blockchain ecosystem of your choice.

End-to-End Development - BlockchainX continues to provide end-to-end solutions from ideation and smart contract creation to deployment of stablecoins, all in one place.

Proven Expertise - With a strong understanding of both blockchain and Web3 solutions, we provide scalable, secure, and regulatory-compliant digital asset platforms.

Faster Market Launch - The pre-built frameworks, smart contracts, and APIs will enable any user to launch their stablecoin in a much easier and more effective way.

Customization & Scalability - Our wide support for users' tailored solutions will make the cross-border payments and DeFi integrations more secure and scalable for future growth.

24/7 Technical Support - Our team is ready to provide continuous day and night technical support regarding the coins' upgrades, performance, and the potential risks associated with them.

Conclusion

Fiat-backed stablecoins are no longer a crypto trend! It’s just becoming a crucial pillar of the global financial ecosystem. By maintaining better efficiency and security, these coins continue to control all the financial activities implemented in the digital space, provided by reduced volatility.

However, to develop your fiat-backed stablecoin that gives you seamless access to quicker payments and income streams, you need to contact a professional development company like BlockchainX. Follow our simple step-by-step procedures that clearly illustrate technical infrastructure and regulatory standards, and effectively execute the launch process.