8 Steps to Create Your Own Crypto Margin Trading Exchange

Listen to the Audio :

The demand for leveraged trading is at an unprecedented level; therefore, this is the right time to create your own crypto margin trading exchange. With people constantly getting more involved in leveraged trading, almost every entrepreneur, industry and corporates will want to ride on this new demand to start their own crypto margin trading exchange.

If you opt to build your own crypto margin trading exchange, you invite high-volume traders, enhanced liquidity, and diversified revenue lines. This type of service also involves the exchange of currencies using leverage, which makes the trading activity both more profitable and intense.

In case you are intimidated by the task of how to create your own crypto margin trading exchange, this guide provides all you need from compliance to technology stack and features to security. By implementing an effective plan, you can successfully launch your own crypto margin trading exchange and lead the market.

Why Create Your Own Crypto Margin Trading Exchange?

With the adoption of cryptocurrencies, the market is now shifting its focus to more developed trading systems such as margin trading. In fact, investors are interested in creating their own crypto margin trading exchange since these platforms go way beyond traditional exchanges in terms of volume and user engagement.

When you create your own crypto margin trading exchange, you attract professional traders for enhanced returns, institutional investors for further advanced tools, as well as retail traders for opportunities to increase their profit levels.

Hence, these margin trading exchanges have become a hit, and this is a plausible explanation behind why entering into one's own crypto margin trading enables you.

To achieve this effectively, collaborating with a reputed cryptocurrency exchange software development company ensures your platform is future-ready, compliant, and capable of competing in today’s fast-growing digital economy.

8 Steps to Create Your Own Crypto Margin Trading Exchange

A proper roadmap must be followed when you create your own crypto margin trading exchange. Each of those steps marks the assurance of utmost quality for business planning, from the technology domain till compliance, where they all will contribute towards making a profitable platform.

A step-wise guide on how to create your own crypto margin trading exchange is mentioned below.

Step 1: Conduct Market Research & Define Business Goals

Before you start your own crypto margin trading exchange, analyze the current trends:

Get everything about current trends, before start your own crypto margin trading exchange:

List down competitors and methods used for revenue by them.

Define your target audience (retail, institutional, or professional)

Study the regulating environment in the targeted countries.

Calculate revenue potential and ROI.

Pro Tip: The more specific your niche is, the easier it is for you to develop your own crypto margin trading exchange that stands out.

Step 2: Ensure Legal & Regulatory Compliance

Compliance is the most default base for any financial setup.

Get the licenses required in your jurisdiction

Setup KYC & AML Policies

Tax reporting integration

Consult your crypto legal advisors

It is impossible to launch your own crypto margin trading exchange at scale without compliance.

Step 3: Choose the Right Technology Stack

The choice of technologies has to be such that it ensures that the platform has the speed, scalability as well as security.

Backend Developers can use Node.js, Python, Go, Java in their work.

Frontend Developers work with React, Angular, Vue.js etc.

Database options for developers are PostgreSQL, MongoDB, Cassandra etc.

Blockchain developers can integrate such popular blockchains as Ethereum, Binance Smart Chain, Solana and any other layer-1 chain of their choice.

If you plan to build your own crypto margin trading exchange, do keep in mind that the architecture must be far more robust and scalable.

Step 4: Decide on Core Features

When you create your own crypto margin trading exchange there should be some features that we wish to emphasize:

Simple Trading Dashboard

Various leverage levels (2x, 5x, 10x, 50x, 100x)

Cross margin and isolated margin types

Real-time price feeds and charting tools

Risk management — auto-liquidation and margin calls

Payment gateways and wallet support

Multiple layers of security (2FA, SSL, cold wallet, DDOS Protection)

Step 5: Build Liquidity Management System

Liquidity always helps to attract traders. Liquidity being the lifeblood of a trading platform, even the most well-developed platform will perish without it:

Integrate with Liquidity providers

Make APIs available for institutional clients

Run market-making bots

Set aside insurance funds for risk coverage

Afterward, forging traders' trust shall be key for you when you start your own crypto margin trading exchange.

Step 6: Develop a Risk Management Engine

You cannot neglect risk management when you develop your own crypto margin trading exchange.

Set margin requirements dynamically

Enable automatic liquidation

Allow stop-loss, take-profit, and hedging instruments

Keep insurance fund reserves

Step 7: Test the Platform Rigorously

A platform needs to be thoroughly tested before it hits the market.

Unit tests, integration tests, and security audits

Stress tests under heavy workload

Run bug bounty programs

Conduct trading simulations of real-world situations

This is what ensures security when you launch your own crypto margin trading exchange.

Step 8: Launch & Promote Your Exchange

By now, it is the time to launch the exchange.

Setup and deployment of exchange software in cloud servers with backup nodes in place

Marketing activity by leverage SEO, influencer reviews, and referral bonuses

24/7 customer support

Continuous feature upgrades

Consider this as a last step in how to create your own crypto margin trading exchange which puts your business on track for continued growth.

Comparison Table: Steps for Spot Exchange vs. Margin Exchange

| Step | Spot Exchange | Margin Trading Exchange |

|---|---|---|

| Business Planning | Basic target market research | Detailed leverage demand/pro-trader needs |

| Compliance | General licenses | Specific license + harsher KYC/AML |

| Technology Stack | Moderate back-end requirements | High performance back-end with risk engine and liquidity APIs |

| Features | Buy and sell orders for normal trading | Leverage trading, liquidation engine, cross/isolated margin, risk management tools |

| Liquidity | Needs organic price signaling | Require third party LPs, bots, and insurance funds |

| Revenue Model | Transaction fees | Fees, interest, liquidation income, premium subscriptions and trader advanced tools |

| Risk Management | Almost none | Urgently needed - liquidation systems, margin calls, automated triggers |

The roadmap to successfully create your own crypto margin trading exchange covers every single topic from compliance to technology, liquidity, and risk management. These checkpoints ensure your exchange is secured, scalable, and highly profitable in the long run if you look forward to launch your own crypto margin trading exchange.

You can also opt to create your own white label crypto exchange software in order to launch a scalable platform quickly instead of doing everything from scratch.

Looking to expand beyond margin trading? Learn how to Create Your Own Swap Exchange to diversify your crypto business portfolio.

Top Reasons Why Margin Trading Exchanges Are Gaining Popularity

1. Higher Profit Opportunities

Traders could borrow some funds and open a bigger position than the traders could on their own capital.

Here, trading positions of $1,000 become $10,000 with 10x leverage

This attracts high-volume traders who want greater returns.

Those high-volume traders who seek greater returns.

The higher number of trades will definitely contribute to transaction fees.

Choosing to create your own crypto margin trading exchange would equate to a scenario where your platform reaps the benefits of this added trading activity.

2. Growing Demand from Professional Traders

Experienced traders need advanced tools like:

Stop-loss orders

Trailing stops

Advanced charting tools

Risk management features

Trading on such margin exchanges involves a higher level of sophistication.

By deciding to develop your own crypto margin trading exchange means addressing their issues.

They stick to platforms that offer stability and services of the highest standards.

3. Multiple Revenue Streams for Exchanges

Margin trading exchange does not stand on one revenue line instead; these exchanges derive revenues from:

Trading fees on leveraged transactions.

Interest on capital borrowing.

Premium features such as advanced analytics or API.

Penalties from liquidations.

Partnered liquidity services.

When you launch your own crypto margin trading exchange means you are building out an increasingly diversified and scalable revenue stream.

4. Competitive Advantage in a Crowded Market

There are so many spot trading exchanges that exist that the industry failed to set one apart.

Then fewer margin trading platforms exist, each serving a very narrow set of clients.

If you build your own crypto margin trading exchange you gain recognition as a professional-grade platform.

It lends your firm credibility and better positioning for your brand.

5. Global Adoption of Margin Trading

Earlier, there was mainly localized demand for margin trading; it is spreading much wider now.

Asia

Europe

North America

Middle East

Traders, at least, will expect the:

Multi-currency support

Fiat-to-crypto on-ramps

Compliance across many jurisdictions

So just by virtue to start your own crypto margin trading exchange, you are aiming at an actual globally targeted population.

6. Integration with Future Technologies

Margin trading exchanges are ready for next-gen innovations:

AI Integration: Intelligent trade insights and automated strategies.

DeFi Lending: Decentralized pools for funding margin trades.

Web3 Wallets: Smooth transactions and self-custody.

Advanced Security: Multi-signal, cold wallets, and real-time monitoring.

If you create your own crypto margin trading exchange will thus help, put your business at the forefront of future technologies.

Recommended Read: If you want to understand the existing market landscape before launching, explore our detailed blog on top cryptocurrency exchanges in the USA.

Quick Comparison: Spot vs. Margin Trading

| Factor | Spot Trading | Margin Trading |

|---|---|---|

| Capital Requirement | Only the user's funds are used | With leverage inbuilt into the system (from the exchange or third party liquidity providers), user funds are to be used. |

| Profit Potential | Returns shall not exceed the amount invested | Because leverage is involved, from 2x to 100x, serious traders flock to this market for higher revenues. |

| Risk Level | Lower, beginner-friendly; suitable for a casual investor | Higher; suited for an advanced professional trader type who can handle volatility. |

| Revenue for Exchange | Mainly transaction fees | Multiple income streams such as transaction fees, interest on borrowed capital, premium subscriptions, house liquidation, etc. |

| Audience | Beginner, casual, and risk-averse traders | Advanced institutional professional market for high profits |

| Market Liquidity | Trade liquidity, so liquidity comes naturally | Better liquidity from leveraged trades and trade volumes |

| Trading Flexibility | It is limited to straightforward purchase and sell order execution | Short selling, cross margin, isolated margin, and hedging options |

| Revenue Stability | Simply put, it is stable but relatively less so | Higher and relatively diversified revenue streams contribute to running a profitable crypto margin trading exchange |

| User Engagement | Simply put, it is stable but relatively less so | Highly engaging as traders are attracted by leverage options and return possibilities. |

| Business Scalability | Slower scalability because of lower margins | Faster scalability and monetization options if you build your own crypto margin trading exchange |

| Exchange Adoption | Common, basic needs of any crypto exchange | Increasing adoption by newer businesses in starting their own crypto margin trading exchanges to stay competitive |

So, in short, margin trading has become mainstream and is something any serious cryptocurrency trader would look into. Riding this wave gives you the opportunity to develop your own crypto margin trading exchange.

Either you choose to build your own crypto margin trading exchange from scratch or use a white-label model to launch your own crypto margin trading exchange; this will give you opportunities for income, scale, and global acceptance.

So, if you seek an answer to how to create your own crypto margin trading exchange, it is by bringing together trader-friendly features, compliances, security, and innovations.

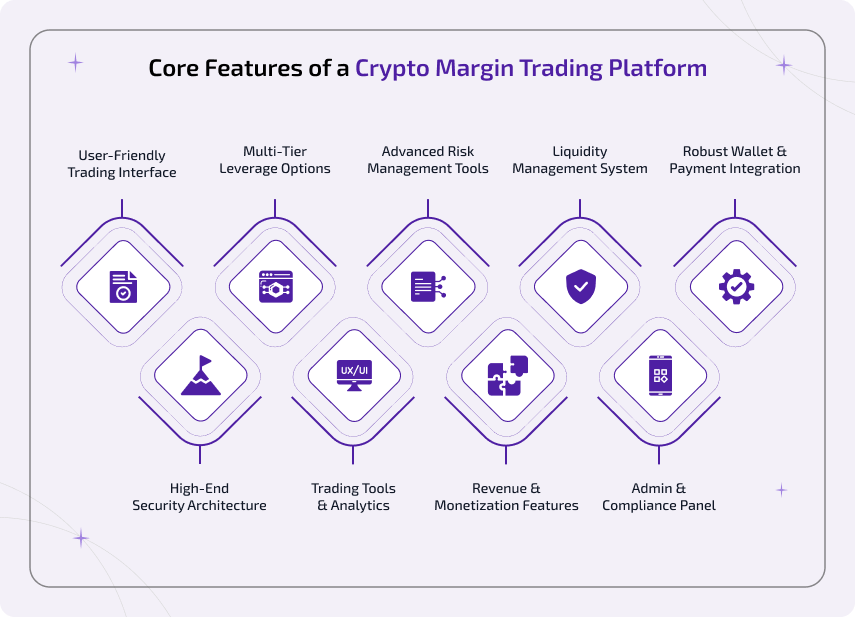

Core Features of a Crypto Margin Trading Platform

When you decide to create your own crypto margin trading exchange, one factor for success depends upon the set of features that are built into the platform.

A margin trading platform should be built with more than just basic trading, to attract margin trading traders of professional level like some advanced tools and system of risk management, along with the highest-grade security. The following are core features that need to be considered when you build your own crypto margin trading exchange.

1. User-Friendly Trading Interface

A simple class dashboard to work with for both beginners and experts.

Live charts and prices, order-book, and market-depth information.

Layouts can be customized according to the user's needs.

Mobile compatibility - for on-the-go trading.

Trading interface in the first look of the interface while you develop your own crypto margin trading exchange.

2. Multi-Tier Leverage Options

Traders can borrow funds to multiply their position size.

The system shows different leverage like 2x, 5x, 10x, 50x, or even 100x.

Get notified of margin call alerts and liquidation warnings.

Trading modes: Cross Margining and Isolated Margining.

This is the one feature that you simply cannot go without if you start your own crypto margin trading exchange with the vision of competing with other global exchanges.

3. Advanced Risk Management Tools

Auto liquidation engine, which heals of any losses on the platform

Margin calls with real-time notifications

Order type for stop-loss, take profit, and trailing stop

Insurance funds for extreme volatility

Risk management is key when you create your own crypto margin trading exchange to protect the users and platform revenue.

4. Liquidity Management System

Integration with external LPs.

Market-making bots for deep order books.

APIs for institutional trading.

Insurance reserves for volatility.

In simple terms, your platform cannot survive without liquidity, and hence, this must be the primary focus if you want to launch your own crypto margin trading exchange.

5. Robust Wallet & Payment Integration

Multi-currency wallet (BTC, ETH, USDT, etc.)

A cold wallet for storing funds and a hot wallet for managing funds.

Integration of onramp and offramp in the fiat sphere.

Gateway types include card payment, bank transfer, and cryptocurrency transfer

The security element comes first if you wish to build your own crypto margin trading exchanges that traders will actually want to trust.

6. High-End Security Architecture

Multifactor authorization (2FA, biometric login)

SSL encryption and DDOS protection

The majority of funds are stored in cold storage.

Perform penetration testing and audits periodically

The security component has to be considered if you wish to develop your own crypto margin trading exchange that traders may actually entrust.

7. Trading Tools & Analytics

Technical indicators & live candlestick charts.

Order history functionality, investment summary; profit & loss reports.

Implement trading bots and offer passive trading services to traders

Normalized market prices and market news.

Equipping and enabling professional support options is crucial, as it is vital for the success when you create your own crypto margin trading exchange.

8. Revenue & Monetization Features

Trading fees: maker and taker charges

Interest on margin lending

Premium memberships for pro traders

Revenues from liquidations, penalties

Such revenue models will make the venture profiting if you are determined to start your own crypto margin trading exchange.

9. Admin & Compliance Panel

Full admin dashboard for user and liquidity management

KYC/AML verification tools

Tax compliance reporting

Fraud detection and risk alerts

This will make sure that sustainable legality is in place when you launch your own crypto margin trading exchange. Having such features in place helps you to successfully create your own crypto margin trading exchange of a truly competitive, secure, and scalable.

Hybrid crypto exchange development takes it further by blending centralized liquidity with decentralized security that helps to make margin trading efficient. Build your own crypto margin trading exchange with these features that will allow for the exciting long-term existence of life in the digital-based trading ecosystem.

Technology Stack for Building a Margin Trading Exchange

After deciding to create your own crypto margin trading exchange, the choice of the right technology is most important. A tech stack must ensure speed, security, and scalability.

Especially when you want to build your own crypto margin trading exchange for startups or develop your own crypto margin trading exchange for enterprise-level users -The real deciding factor for a platform is the tech stack.

1. Frontend Technologies

The frontend creates the user interface—the first impression for traders.

The first impression for traders is the user interface that can be created using the frontend.

React.js / Angular / Vue.js: Simple, responsive web apps with modular designs.

HTML5 / CSS3 / JavaScript: Lightweight, optimized for many devices.

WebSocket Integration: For real-time trading data and updates to charts.

If you want to start your own crypto margin trading exchange, then the first thing to do is to consider designing some very intuitive dashboards and mobile compatibility.

2. Backend Technologies

Backend works behind order execution, leverage management, and risk control.

Node.js / Python / Go / Java: Useful for instances in which you require a high-performance backend engine.

Order Matching Engine: Executing trades at a fast pace and with relatively low delays and latencies.

Risk Management System: The system manages leverage, issues margin calls and deals with liquidations.

It means that while you develop your own crypto margin trading exchange it comes as the underlying framework.

3. Database Management

For the margin exchange, thousands of transactions are being processed in a second.

PostgreSQL / MySQL: For structured data storage.

MongoDB / Cassandra: For exchanging unstructured trade data quickly.

Redis: Adding a caching layer for speedy updates of the order book available in real-time.

Strong databases are required if you want to launch your own crypto margin trading exchange.

4. Blockchain & Smart Contract Layer

If you wish to create your own crypto margin trading exchange with decentralized features:

Ethereum / Binance Smart Chain / Solana / Polygon: These have been most common to write smart contracts.

Custom Blockchain Development: For enterprises where the greatest amount of control is to be exercised.

Cross-Chain Bridges: In order to provide multi-chain margin trading support.

5. Wallet & Payment Infrastructure

Wallets and payments help to control the way the users manage their funds.

Hot Wallets: Secure storing for active trading.

Cold Wallets: In essence, these are secure storage mechanisms for coins for longer periods.

Multi-Signature Authentication: It safeguards funds against an unauthorized withdrawal without granting absolute control to any one party.

Payment Gateways: It supports both fiat and crypto.

That brings global accessibility when you build your own crypto margin trading exchange.

6. Security Protocols

One way or another, the security of financial assets is important when you start your own crypto margin trading exchange.

Two Factor Authentication & Multi- Factor Authentication

All Communications Use SSL Encryption & HTTPS

Prevention from DDOS Attack

A barrage of Penetration Testing

Bug Bounty Programs

In any case, lacking such kind of safety measures doesn’t allow you to launch your own crypto margin trading exchange legally or ethically.

7. APIs & Third-Party Integrations

APIs serve as catalysts to foster flexibility and third-party acceptance.

REST APIs & WebSocket APIs: Used mostly by traders and developers.

Liquidity Provider APIs: Allows for deep fulfillment that goes beyond the level of the order book.

KYC/AML APIs: Provides an automated compliance engine.

Analytics & Reporting APIs: Used by administrators and regulators.

With the right technological infrastructure, you can confidently create your own crypto margin trading exchange that is secure, expandable and profitable.

With the correct technological setup, you can be sure to create your own crypto margin trading exchange that is safe and scalable.

Future Trends Shaping Crypto Margin Trading

The world of crypto is no longer limited to anyone with its dynamic and rapid transformation. In this case, margin trading exchanges will become an essential functionality of all cryptocurrency exchanges, reshaping the financial ecosystem.

It is expected that in 2026 and beyond, margin trading will evolve and reach a height through deeper institutional participation and with the transformations driven by advanced technologies. The integration of trading bots with AI, ML, and automation will enhance the trading precision, while Layer-2 scalability will enable low-cost and faster trading.

In some cases, margin trading will drive clear global regulations with a perfect balance between centralized and decentralized margin platforms. Beyond this, the advancements in cross-chain interoperability will allow traders to use margin trading across multiple blockchain networks, expanding its opportunities globally with high potential returns.

With a deep understanding of these upcoming trends and a commitment to innovation and automation, BlockchainX can help you create your own crypto margin trading exchange platform that meets the evolving tides of tomorrow’s market.

How to Ensure Security and Compliance in Margin Trading Platforms

There are several concerns that you may intend to create your own crypto margin trading exchange will raise; security and compliance issues are at the very top of the list. Due to margin trades involving leverage, borrowed money, and higher risks, these exchanges must be fitted with the highest levels of security and strict adherence to the law.

If you plan to develop your own crypto margin trading exchange, credibility is the key that is based on how well you have taken security and compliance measures.

Core Security Practices for Margin Trading Platforms

If you want to create your own crypto margin trading exchange, the foremost layers of security is needed:

1. Two-Factor Authentication (2FA) – Another layer added for login via email/SMS/OTP.

2. Cold Wallet Storage – Keeping at 90%+ offline and hence zero instances of hacking.

3. Multi-Signature Wallets – Multiple authorizations needed for the approval of a withdrawal.

4. DDoS Protection – Protects the platform against downtime and malicious attack.

5. End-to-End SSL Encryption – States-secure for all transactions and communications.

6. Regular Penetration Testing – Trigger any present flaw even before the hacker does.

7. Bug Bounty Programs – White-hat hackers are rewarded for finding and reporting bugs.

Hence, without the above, you cannot launch your own crypto margin trading exchange in a safe manner.

Compliance & Legal Framework

A good legal setup would prevent an exchange from being shut down by regulators. Consider the following when you develop your own crypto margin trading exchange:

KYC (Know Your Customer) – Verifying the identity of a trader may prevent the occurrence of fraud.

AML (Anti-Money Laundering) – Constraints illegal transferring of money.

GDPR/Data Privacy Laws – Protect user data as per the international norms.

Licensing Requirements – Vary from USA, EU, UAE, Singapore, and others.

Automated Tax Reporting – Compliance with international tax regulations.

Regulatory compliance forms the basis of the steps to create your own crypto margin trading exchange in a fully legally viable manner.

Why Security & Compliance Matter When You Create Your Own Crypto Margin Trading Exchange

It builds trust among the users, hence, building adoption.

It ensures that the platform can operate internationally without any shutdown accords.

It helps to protect user funds from hacks or insider fraud.

It is easy to scale alongside regulators.

Differentiates you from non-compliant competitors.

It helps to distinguish yourself against non-compliant competitors.

In short, if your intention is to create your own crypto margin trading exchange, always look to keep security systems that adhere to global security standards and regulatory compliance protocols, as this will bring success to the platform in all respects.

Revenue Models and Business Opportunities in Crypto Margin Trading Exchange

One major aspect to keep in mind when you create your own crypto margin trading exchange is income generation. In addition to transaction fees, margin trading exchanges truly exploit various tools to make money and sustain themselves for a longer time. Let's go through.

Core Revenue Models for a Crypto Margin Trading Exchange

1. Trading Fees

A charge per order, for spot as well as leverage trading.

Typical range: For about 0.1%–0.5% for any given transaction.

Since it is the primary source for income, it is also the first option to choose when you start your own crypto margin trading exchange.

2. Margin Lending Interest

The exchanges get interest on funds borrowed.

The higher the number of users, the greater is the demand for loans, and hence more profits are realized.

This is a sustainable way to build your own crypto margin trading exchange with recurring revenue.

3. Liquidation Fees

Once a leveraged position in the system is found to have failed under particular criteria, it will be closed out.

Such a forced liquidation of the position generates a liquidation fee for the exchange..

4. Premium Features Subscription

Subscription plan includes advanced charting, bots, and APIs.

This module allows you to develop your own crypto margin trading exchange with tier-based user plans.

5. Withdrawal and Deposit Fees

For deposits or withdrawals, the platform may charge a fixed fee for processing, or maybe a fee in percentage terms.

Even better earnings from high-volume transactions.

6. Listing Fees from Tokens

Projects pay for the listing of tokens in your margin trading platform.

After you've successfully launched your own crypto margin trading exchange, this would be the best way to generate money.

7. Market-Making and Spread Revenue

Market-making services provide liquidity to the exchange.

With the help of spread, the platform generates profits from the difference in buy and sell orders.

8. Staking and Yield Services

They provide another way to make profit from staking and yield farming.

Can help to increase loyalty among users for one platform by making it more competitive.

Business Opportunities When You Start Your Own Crypto Margin Trading Exchange

Global User Base: Traders leverage opportunities across borders looking for leverage.

Institutional Partnerships: White-label margin trading software for banks and fintech companies.

Crypto + DeFi Integration: Integrate margin trading with DeFi lending pools.

Tokenization & NFTs: Other services to attract wider investors.

Regional Niches: Adherence to local laws might be considered as an opportunity to stand out.

For instance, when deciding to create your own crypto margin trading exchange, you avail various sources of income, for example, from fees for transactions, lending money and other costs related to coin listing and subscriptions for a fee.

This will help you launch your own crypto margin trading exchange as a successful business model in 2025 where security and innovation are at a high level while the costs are low.

Download the PDF : Create Your Own Crypto Margin Trading Exchange.pdf

How BlockchainX Helps You Create Your Own Crypto Margin Trading Exchange

BlockchainX, a leading blockchain development company, enables enterprises, entrepreneurs, and startups to Create Your Own Crypto Margin Trading Exchange, guaranteeing that the system is supremely secure, scalable, and legal. If you want to launch your own crypto margin trading exchange, we provide end-to-end business solutions tailored precisely to your business needs.

We help you create your own crypto margin trading exchange having a trading engine designed and developed with your particular requirements in mind. Our solution ensures high speed order execution with real-time price and risk management updates.

We advocate the highest standards in security, with an automated KYC/AML workflow, so you can safely launch your own crypto margin trading exchange on multiple jurisdictions. As a leading Centralized Crypto Exchange Development Company, BlockchainX delivers secure and scalable margin trading platforms that meet global compliance standards.

We equip you to create your own crypto margin trading exchange with features that are required by modern traders-- from leverage choices, AI-powered risk management, to analytics dashboards.

Once you start your own crypto margin trading exchange, technical support, server monitoring, updating, and security auditing shall be provided by our team to make sure your platform is running flawlessly.

With BlockchainX, you can confidently create your own crypto margin trading exchange that is secured, scalable, and profitable. From ideation to launch, and all the way through, your journey should remain true to your vision, regulatory standards, and commercial requirements.

FAQs

1. What is a crypto margin trading exchange?

A crypto margin trading exchange is a platform where traders obtain loans to increase their trading position in the market to trade higher amounts than the capital they have. At BlockchainX, we assist you create your own crypto margin trading exchange provided with advanced leverage options and dependable trading mechanisms.

2. How does a crypto margin trading exchange work?

Crypto margin trading exchanges work by helping users open bigger positions than they could have from their pocket through borrowed capital from the platform or from other traders on the platform. Gains and losses thus get multiplied by the leverage given. At BlockchainX, we allow you to create your own crypto margin trading exchange which provides features such as fully automated risk management, margin call, and liquidation.

3. How do I create my own crypto margin trading exchange?

To create your own crypto margin trading exchange, it involves creating a secure trading engine for crypto margin trading along with KYC & AML, wallet integrations, and liquidity solutions. BlockchainX can also help you launch your own crypto margin trading exchange efficiently and legally with a complete-service approach.

4. Can I integrate multiple cryptocurrencies in my margin trading exchange?

Yes. When you create your own crypto margin trading exchange with BlockchainX, we provide multi-crypto support to allow users to margin trade Bitcoin and Ethereum, stablecoins, and altcoins with leverage, which adds on to the trading experience with more flexibility.

5. How much leverage can I get on a crypto margin trading exchange?

Leverage goes from 2x to 100x usually, depending on the rules and regulations of the respective platform. When you create your own crypto margin trading exchange with BlockchainX, customizable leverage tiers could be designed to cater to the needs of a novice and an expert.

6. How much does it cost to build a crypto margin trading exchange?

The price to develop your own crypto margin trading exchange varies, depending mostly on features, technology, and the level of customization. Building a custom exchange could cost anything from $300K to over $1 million, whilst a white-label option shall be comparatively cheaper. At BlockchainX, create your own crypto margin trading exchange with an efficient approach that balances investment, security, and scalability.

7. What features should a crypto margin trading exchange have?

The basic features that are considered given include multi-tiered leverage, trading engine, wallet integration, risk management, KYC/AML compliance, liquidity, and advanced analytics. BlockchainX helps you launch your own crypto margin trading exchange with all these features, and much more.

8. How is a margin trading exchange different from a spot trading exchange?

Spot trading uses only the funds of the users. Whereas, margin trading involves the borrowing of funds to take higher positions in the market. Hence, a BlockchainX-built exchange would have both forms of trading-spot and leveraged-for larger clientele attraction.

9. Can I start my own crypto margin trading exchange without coding knowledge?

Yes; a white label can be purchased, or developers can be hired. BlockchainX allows you to create your own crypto margin trading exchange without any in-depth technical knowledge while maintaining control over all the features, security, and branding.

10. How long does it take to launch a crypto margin trading exchange?

Generally, it takes anywhere between 1 and 4 months to launch a white-label solution, whereas 4 to 8 months are needed for a fully customized platform. BlockchainX lets you launch your own crypto margin trading exchange with ease.