AMM to CLOB Prediction: How DeFi Trading is Evolving

Listen to the Audio :

Decentralized trading is on the rise, and in 2026, a new concept that is capturing everyone’s attention is the AMM to CLOB prediction. Simply put, it combines two trading systems: AMM, which always maintains liquidity, and CLOB, which precisely matches buyers and sellers. This combination has the potential to make trading more efficient, fast, and smart than it has ever been.

Traders are excited as it can lower costs, increase prices, and facilitate large trades. But how does this work, and why is it such a hot issue in DeFi?

In this blog, we’ll go into AMM and CLOB in simpler terms, explain what the prediction implies, and look at how it might affect the future of decentralized trading.

What is AMM (Automated Market Maker)?

An Automated Market Maker is a key component of decentralized finance (DeFi), allowing cryptocurrencies to be traded directly via smart contracts rather than relying upon a traditional order book or a central middleman. Instead of manually matching buyers and sellers, AMMs rely on liquidity pools, which are funds supplied by users known as liquidity providers.

These pools allow traders to instantly swap tokens, while the AMM algorithm automatically calculates the price depending on the ratio of tokens in the pool. AMMs' primary benefit is their constant liquidity, which allows traders to purchase or sell assets whenever they want without having to wait for a matching counterparty.

AMMs are now well-known in the DeFi ecosystem due to popular platforms like Uniswap, Curve, and Balancer. More users are encouraged to contribute liquidity since liquidity providers earn a portion of the transaction fees generated by the trades in the pool. However, slippage can occur with AMMs, particularly for large trades, because prices change automatically based on the pool's balance.

What is CLOB (Central Limit Order Book)?

A trading system called a Central Limit Order Book (CLOB) matches buy and sell orders based on time and price priority. Both centralized cryptocurrency exchanges and traditional financial markets make extensive use of it. Traders make orders in a CLOB model by indicating the quantity and price they wish to purchase or sell.

After that, these orders are stored in an order book until they match with a proper counter-order. The software automatically matches the highest buying price to the lowest selling price, providing accurate and open price discovery. Because prices reflect real time supply and demand, CLOBs are highly efficient in markets with active trading.

CLOBs are essential to traditional stock markets and exchanges like Binance and Coinbase as they offer accurate pricing and improved control over trade execution. The main benefit of CLOBs is low slippage, particularly for big trades, because orders match directly instead of against a liquidity pool. Additionally, limit orders, market orders, and stop orders provide traders greater flexibility.

But to keep liquidity, CLOBs need enough trading activity. Trading slows down if there aren't enough orders. Despite this, professional and institutional traders continue to choose CLOBs because of their accuracy, efficiency, and openness.

AMM and CLOB Prediction: Why It Matters for DeFi in 2026

As the DeFi ecosystem moves into a more mature phase in 2026, predictions about combining AMM and CLOB models are receiving a lot of attention. The primary goals of early decentralized exchanges were liquidity and accessibility, which AMMs effectively delivered.

However, when trading volumes rise and more experienced traders enter the market, limitations such as excessive slippage, inefficient prices during large trades, and limited trading control become more apparent. Many of these problems are solved by CLOB-based systems, which are popular in traditional finance and provide accurate price matching and clear order execution.

Combining AMM liquidity with CLOB order-book efficiency is thought to be an effective approach that strikes a balance between performance and simplicity. This hybrid method is now theoretically possible due to developments in blockchain scalability, reduced transaction costs, and faster settlement layers.

Simultaneously, user expectations changed, with traders still valuing decentralization but demanding professional-level tools. The AMM and CLOB prediction is seen as a crucial step toward the future of decentralized trading in light of this change.

Improved trading performance with more precise pricing

Lower slippage for large, frequent trades

Order-book accuracy combined with constant liquidity

Enhanced appeal to professional and institutional traders

Improved pricing discovery and transparency

Support from layer-2 solutions and faster blockchains

Better user experience, similar to centralized transactions

A more robust and advanced DeFi trading system

AMM vs CLOB: Key Differences

| Aspect | AMM (Automated Market Maker) | CLOB (Central Limit Order Book) |

|---|---|---|

| Trading Model | Make use of smart contracts & liquidity pools | Using an order book, match buyers and sellers |

| Order Matching | Lack of direct order matching | Matches buy and sell orders based on timing and price |

| Liquidity Source | Provided via liquidity pools | Provided by active traders who place orders |

| Price Setting | Based on pool ratios, prices automatically change | Market supply and demand determine prices |

| Slippage | Higher for large trades | Even for large trades, lower |

| Trade Execution | Instant and constant | Depending on the available matched orders |

| User Control | Limited pricing control | Complete control over market orders and limits |

| Best For | Beginners and retail merchants | Institutional and professional traders |

| Liquidity Requirement | Constantly available | Requires a high level of market participation |

| DeFi Usage | Common in popular and early DEXs | Used in hybrid and advanced DeFi systems |

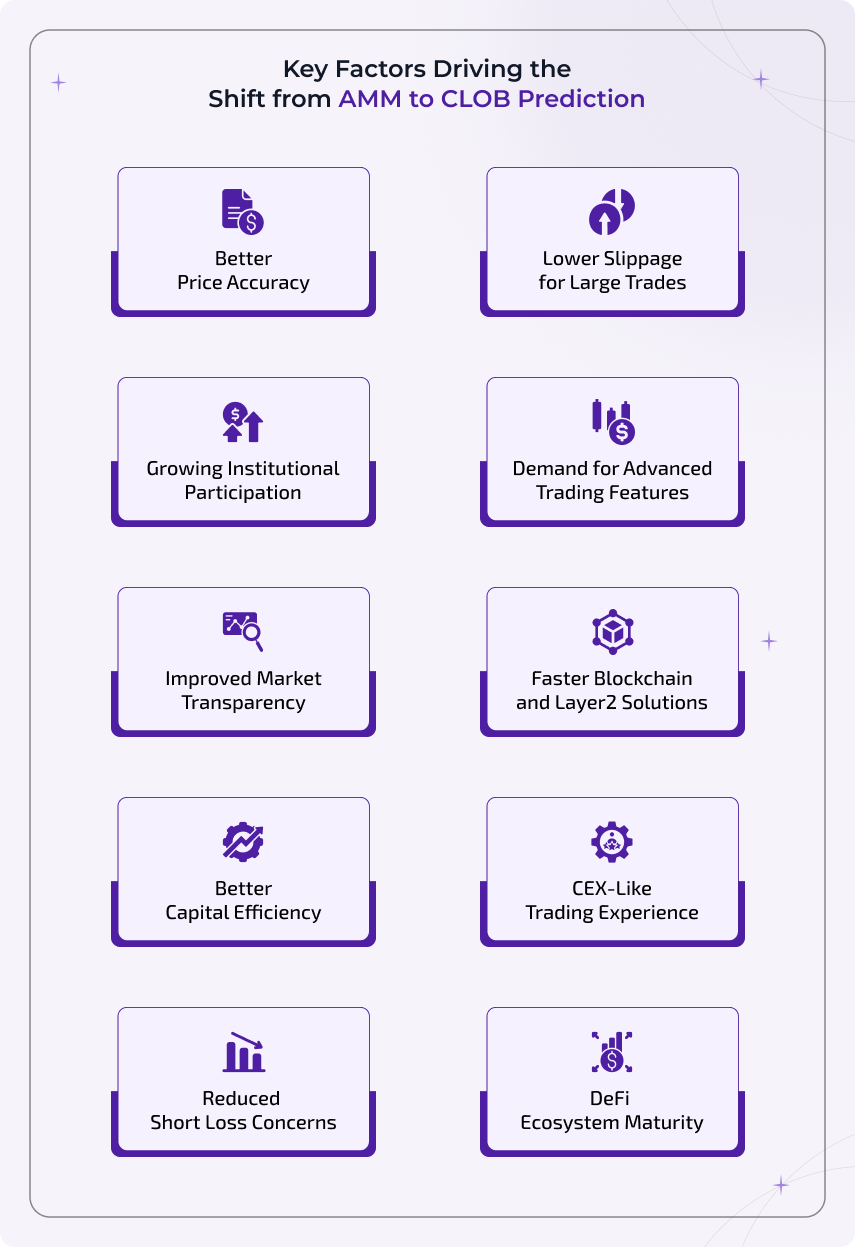

Key Factors Driving the Shift from AMM to CLOB Prediction

Decentralized trading is set to evolve in 2026 as users need greater control, lower costs, and better pricing. Although AMMs made DeFi accessible, their limitations are now apparent. As a result, platforms are exploring CLOB and hybrid models that provide a growing user base with enhanced efficiency, transparency, and professional trading features.

Better Price Accuracy:

Liquidity pool ratios, which can fluctuate quickly during large trades, are the basis on which AMMs calculate pricing. CLOB systems match buy and sell orders at exactly the prices that traders have set. This results in fair trade execution and more accurate pricing, especially in volatile and high-volume markets.

Lower Slippage for Large Trades:

Large trades on AMM systems can cause significant slippage due to shifting pool balances. CLOB models minimize this problem by directly connecting buyers and sellers at predetermined prices. Because of this, CLOB-based trading is more appealing for large-scale, institutional transactions.

Growing Institutional Participation:

In 2026, more professional and institutional traders will join DeFi. These users use CLOB models as they offer advanced trading controls, comprehensive order books, and predictable execution. The trend toward CLOB-based and hybrid platforms is mostly due to their growing presence.

Demand for Advanced Trading Features:

While CLOB systems allow limit orders, market orders, and stop-loss features, AMM platforms often provide simple swaps. Traders need these modern instruments as they gain more expertise. CLOB-based models are gaining popularity as the need for professional trading features increases.

Improved Market Transparency:

CLOBs present traders with a clear picture of market supply and demand by displaying buy and sell orders in real time. This transparency helps consumers make smart choices. Traders seek clarity and accuracy like order-book-based systems since AMMs lack this visibility.

Faster Blockchain and Layer2 Solutions:

Earlier blockchains had trouble supporting CLOB systems due to issues with cost and speed. Many of these issues have been resolved in 2026 due to layer-2 solutions and faster blockchains. On-chain CLOB and hybrid trading methods are becoming more feasible and scalable via advances in technology.

Better Capital Efficiency:

Large volumes of locked liquidity are required for AMMs to operate effectively. By directly matching orders, CLOB models make better use of capital. This increases the efficiency of CLOB systems for both traders and platform operators by increasing liquidity use and reducing idle funds.

CEX-Like Trading Experience:

Traders expect decentralized platforms to resemble centralized exchanges. Order books, depth charts, and accurate trading control are common aspects of CLOB systems. Decentralization and this CEX-like experience are major forces underlying the change.

Reduced Short Loss Concerns:

During price swings, liquidity providers on AMM platforms may experience temporary losses. This risk reduces since CLOB models do not rely on pooled liquidity in the same manner. For users who are worried about long-term capital protection, this increases the appeal of CLOB-based solutions.

DeFi Ecosystem Maturity:

DeFi is no longer in its early experimental phase. Platforms aim to provide reliable, efficient, and expert trading environments as the ecosystem develops. As the next step in DeFi trading, this natural process encourages the use of CLOB and hybrid models.

Top Platforms Using AMM and CLOB Trading Models in 2026

In 2026, decentralized trading platforms will adopt several approaches to meet the demands of a growing and diversified user base. While some platforms use Central Limit Order Books (CLOBs) to provide accurate pricing and improved transaction management, others rely on Automated Market Makers (AMMs) to provide fast liquidity and simple token swaps.

Also, a new set of platforms is merging the two models to provide a more effective trading experience. The leading platforms using AMM to CLOB prediction trading methods in 2026 are listed below. Each has a significant impact on how decentralized exchanges develop in the future.

AMM-Focused Platforms (Using Automated Market Maker Model)

Uniswap:

One of the best-known AMM-based decentralized exchanges is Uniswap. Instead of using an order book, it enables users to swap tokens straight from liquidity pools. Uniswap is popular for trading Ethereum-based tokens and participating in DeFi due to its ease of use and high liquidity.

PancakeSwap:

A prominent AMM decentralized exchange built on the Binance Smart Chain is called PancakeSwap. It uses liquidity pools to provide fast and cheap token swaps. Yield farming, staking, and other DeFi features allow users to earn rewards in addition to trading, which is why retailers like it.

Raydium:

Raydium is an AMM platform built on Solana that combines order book access with liquidity pools. With this hybrid strategy, users benefit from both deeper liquidity and fast swaps. Raydium is renowned for its lightning-fast transactions, cheap fees, and solid Solana ecosystem integration.

STON.fi:

Built on the TON blockchain, STON.fi is a decentralized exchange that trades tokens using the AMM model. It offers liquidity to earn rewards and makes it simple for users to trade assets. STON.fi prioritizes speed, ease of use, and effective liquidity provisioning inside the TON network.

CLOB-Focused (Using Central Limit Order Book Models)

Hyperliquid:

Hyperliquid is a highly advanced decentralized on-chain CLOB exchange that specializes in trading perpetual futures. It provides deep liquidity, fast order matching, and low slippage. Hyperliquid is a decentralized platform that offers a centralized exchange-like experience for professional and active traders.

Aster:

Aster is a new trading platform combining hybrid liquidity models with CLOB mechanics. It aims to operate in a decentralized environment with high performance comparable to centralized exchanges. Aster is becoming more well-known for its speed, effectiveness, and increasing trader use.

dYdX:

Using a CLOB model on its own blockchain, dYdX is a well-known decentralized derivatives exchange. Professional traders often use it for perpetual trading for its accurate pricing, minimal slippage, and advanced trading tools.

Bulk Trade:

Bulk Trade is a decentralized exchange with a Solana-based platform that specializes in CLOB-driven perpetual trading. It prioritizes effective order matching and low-latency execution. Bulk Trade is designed for high-speed applications and is intended for traders who need accurate price execution along with fast performance.

Polymarket (Hybrid):

Prediction market platform Polymarket has moved to a trading model based on CLOB. It retains specific AMM features while providing better liquidity and narrower spreads through the use of order books. The user experience and price efficiency are both improved by this hybrid approach.

Why BlockchainX Leads AMM and CLOB Predictions

As decentralized finance evolves, businesses that want to develop or upgrade crypto exchanges must grasp the right trading model. Predictions from AMM and CLOB show how DeFi will trade in 2026. BlockchainX discusses these models to help businesses and startups make wise choices, steer clear of costly errors, and create trading platforms that are scalable and future-ready.

The guidance we provide helps startups and companies create future-ready trading platforms that meet market needs, client needs, and long-term growth in the decentralized financial ecosystem.

Deep DeFi Market Knowledge

BlockchainX keeps a close eye on exchange performance, user behaviour, and DeFi market developments. This clarifies how AMM and CLOB models impact price, liquidity, and scalability, enabling companies to choose which trading model best suits current and future market demands.

Expertise in DEX and Exchange Development

BlockchainX provides real-world insights based on hands-on experience creating AMM, CLOB, and hybrid exchange platforms. Instead of relying just on theory, these explanations are grounded in real-world development issues, performance outcomes, and user demands.

Guidance for the Right Trading Model

BlockchainX helps companies in selecting the best trading model for their objectives, customers, and predicted volume. Clients make well-informed decisions for the long-term viability of the platform by receiving detailed explanations of AMM and CLOB projections.

Put Performance and Scalability First

BlockchainX describes how various trading models manage growth, large trades, and heavy traffic. This helps companies in creating systems that are scalable, reliable, and efficient as user demand and transaction volume increase.

Support for Institutional-Ready Platforms

BlockchainX outlines the significance of CLOB and hybrid models as institutions move into DeFi. Expert traders who require accurate pricing, minimal slippage, and advanced trading controls are attracted to platforms by these insights.

Future-focused DeFi Approach

BlockchainX helps firms keep ahead of developments in the industry by evaluating AMM to CLOB predictions. By taking a forward-looking perspective, platforms are made to accommodate upcoming DeFi trends, user demands, and technology developments.

Conclusion

The move from AMM to CLOB is not a fleeting fad, but a sign of how decentralized trade will evolve in 2026. As DeFi develops, traders and companies want advanced trading tools, less slippage, and better pricing. While AMMs will always be crucial, CLOB and hybrid models are starting to take the lead in effective and competent trading.

Businesses develop or upgrade decentralized exchanges more intelligently if they are aware of these predictions. Platforms can provide a better trading experience and maintain their edge in the moving DeFi market with the right tools and information. Success now hinges on selecting the right framework based on user demand, market behaviour, and long-term scalability rather than just implementing a popular model.

At this point, BlockchainX shows as a reliable partner. BlockchainX's expertise in DeFi development, DeFi exchange development & design, and market analysis enables businesses to clearly grasp AMM and CLOB predictions.

BlockchainX offers end to end prediction market development customized to evolving market demands, from assessing the optimal trading model to creating scalable and secure platforms. Whether you are designing an AMM-based prediction market, a CLOB-driven trading platform, or a hybrid solution, BlockchainX ensures that your platform is in line with upcoming DeFi trends.