AI in RWA Tokenization: Market Intelligence Outlook 2026

Listen to the Audio :

The world is slowly altering how real assets are owned and traded. Gold, bonds, buildings, and even private loans are becoming digitized, modular, and globally accessible, rather than being stuck behind paperwork and slow middlemen. The integration of AI in RWA tokenization in 2026 is significantly making this transformation. AI raises tokenization, not just supports it. Assets react to market signals in real time, problems are identified before they get worse, and decisions are made with exceptional speed and precision.

Tokenized assets begin to behave like living financial instruments adaptive, transparent, and always active when AI and blockchain converge. What's emerging is not only faster finance, but also better infrastructure designed for a truly global, always-on economy. In this article, we'll go over the growing value of AI in RWA tokenization and its implications for 2026.

Rise of Intelligent Real World Asset Tokenization

Real-world asset tokenisation is evolving from basic digitalization to a more advanced and automated approach. Earlier approaches focused on using the blockchain to indicate ownership of physical or financial assets. These days, tokenized assets have grown smarter, more responsive, and able to adapt to real-time situations due to the integration of AI. This shift signifies the emergence of intelligent tokenization of real-world assets.

AI is used in intelligent asset tokenization to analyze large amounts of data on risk factors, market movements, and asset performance. These insights allow tokenized assets to allow automated activities via smart contracts, update values, and continually evaluate risk. For example, AI can assist in predicting price movements, detecting unusual activity, and altering asset features to changing market conditions.

Get Free Consult on AI in RWA Tokenization - Connect now

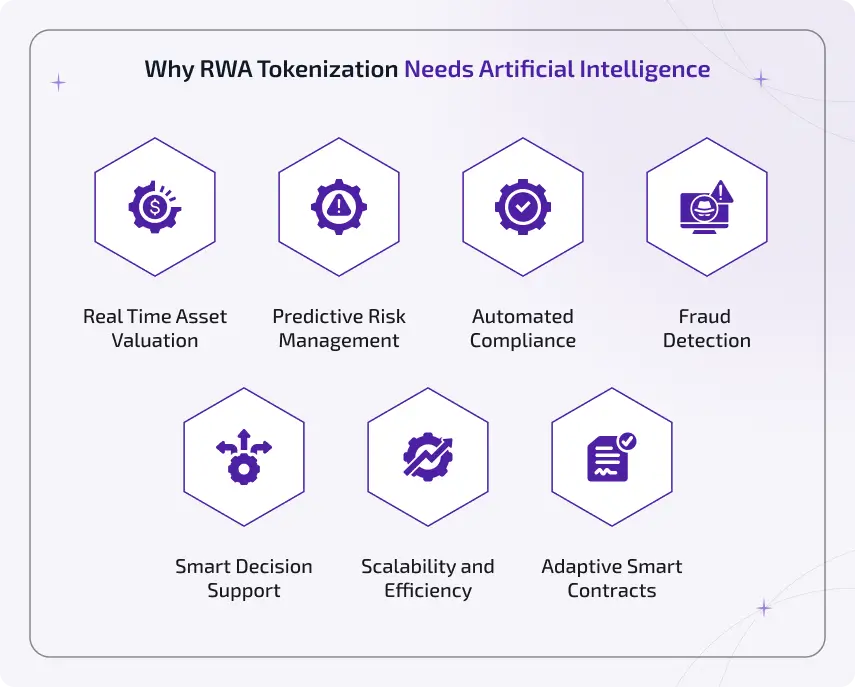

Why RWA Tokenization Needs Artificial Intelligence in 2026

AI is leading the rapid growth of RWA tokenization in 2026. Tokenized assets become efficient, safe, and adaptable by integrating intelligence. AI builds a smooth, scalable financial ecosystem by enabling real-time valuation, risk prediction, automatic compliance, and more intelligent decision-making.

Real Time Asset Valuation

AI provides precise, real-time pricing for tokenized assets by analyzing historical performance, market trends, and other external variables. It builds trust and transparency in trading and asset management, ensures that investors and platforms receive up-to-date, trustworthy values, and reduces errors from manual evaluations .

Predictive Risk Management

AI keeps an eye on tokenized assets all the time to identify potential threats, including default opportunities, market volatility, and liquidity shortages. AI enables platforms and investors to take proactive steps towards reducing losses and protecting stability in volatile financial markets by predicting problems before they occur.

Automated Compliance

AI-powered RWA tokenization simplifies regulatory compliance processes, including reporting, AML, and KYC. Automation ensures compliance with global regulations, speeds up onboarding, and reduces human mistakes .RWA Tokenization solutions run quicker and more securely by integrating intelligence into compliance operations, allowing for larger institutional and retail use.

Fraud Detection

AI improves tokenized asset security by instantly detecting suspicious transactions and unusual activities. Continuous monitoring and pattern detection assist in avoiding fraud, protecting shareholders, and maintaining market integrity . This makes real-world asset management and trading on blockchain systems safer.

Smart Decision Support

AI optimizes asset performance and returns by giving investors and platforms valuable insights. It helps make well-informed decisions, enhances portfolio management, and permits strategic modifications by examining trends, risk factors, and market behaviour. RWA tokenization processes are certain to be profitable and efficient with intelligent guidance.

Scalability and Efficiency

AI allows RWA systems to manage huge amounts of assets and transactions more effectively. Automation eliminates operational bottlenecks, speeds operations, and provides consistent results. Tokenization is scalable, robust, and equipped for large financial ecosystems due to intelligent mechanisms that facilitate fast growth and wide adoption.

Adaptive Smart Contracts

AI-driven asset tokenization helps smart contracts to adapt dynamically to changing market circumstances and asset performance. Contracts can minimize human participation by automatically altering parameters like payments, collateral requirements, or risk thresholds. As a result, tokenized assets for modern financial markets become more versatile, smart, and self-sustaining.

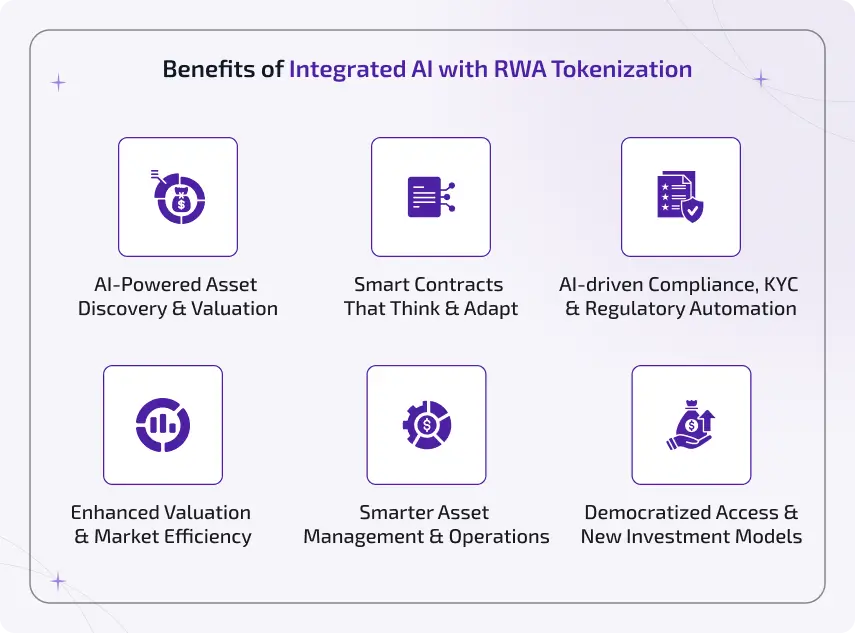

Benefits of Integrated AI in RWA Tokenization

In 2026, the combination of AI in RWA tokenization convert real-world assets into intelligent, adaptable financial instruments. AI creates scalable, transparent, and investor-friendly ecosystems for world markets by enabling smarter valuation, automated compliance, risk prediction, and effective operations.

AI-Powered Asset Discovery & Valuation

AI provides accurate asset identification and valuation by analyzing historical patterns, real time market data, and external variables. Tokenized real-world assets save human labour, reduce errors, and increase transparency while offering platforms and investors with instant insights into asset performance and future opportunities.

Smart Contracts That Think & Adapt

AI-enhanced smart contracts can dynamically modify terms and conditions to change asset performance and market conditions. This automation makes asset management safer and more effective by reducing human interaction, ensuring fast execution, and enabling tokenized assets to work more intelligently.

AI-driven Compliance, KYC & Regulatory Automation

AI ensures platforms stay compliant while lowering operational delays and human error by automating KYC, AML, and regulatory reporting for tokenized assets . Businesses can swiftly recruit investors, maintain transparency, and easily follow new regulatory requirements via ongoing monitoring and intelligent verification .

Enhanced Valuation & Market Efficiency

Tokenized assets can be accurately priced and updated regularly with AI. This real-time knowledge improves liquidity, reduces price disparities, and increases market efficiency. While markets gain from more reliable and transparent trade, investors and platforms can make faster and more informed choices.

Smarter Asset Management and Operations

AI makes predictive maintenance, operational automation, and data-driven asset management possible. Platforms can minimize manual involvement, predict problems, enhance operations, and track asset performance. This superior approach improves efficiency, reduces operating costs, and improves the general management of tokenized real-world assets.

Democratized Access & New Investment Models

AI paired with tokenization enables fractional ownership and global access to assets formerly only available to institutions. By matching investors with the right opportunities, developing cutting-edge financial products, and offering easily accessible investment models, intelligent platforms can facilitate greater participation and increase access to global real-world asset markets.

Features of AI Using RWA Tokenization Platforms

AI-powered RWA tokenization platforms lend intelligence to how real-world assets are issued, managed, and traded. These innovations offer more intelligent valuation, risk control, liquidity management, and scalable asset operations across multinational digital markets by combining automation, data analytics, and blockchain .

Tokenized Assets with Real-Time Intelligence

AI allows tokenized assets to continually monitor market data, asset performance, and signals from outside in real time. This intelligence turns static tokens into data-driven, responsive financial instruments by enabling assets to deliver accurate insights, react to shifting circumstances, and update values dynamically.

Autonomous Marketplaces & AI-led Liquidity

AI helps autonomous RWA markets by optimizing liquidity via predicted demand research and automated market-making tactics. With less reliance on human interaction, these tools enhance trade depth, match buyers and sellers effectively, and modify prices to ensure seamless transactions and long-term liquidity.

Risk Prediction, Fraud Detection & Asset Protection

AI keeps an eye on user activity, asset performance, and transaction behaviour to predict risks and catch fraud early. Investors and platforms using tokenized real-world asset markets can work in a more secure environment due to advanced pattern recognition, which detects irregularities, prevents manipulation, and protects assets .

AI + DeFi– Smarter Yield & Collateral Models

AI integration with DeFi protocols allows RWA systems to optimize collateral management and yield strategies. In decentralized lending and yield-generation models, AI improves capital efficiency while retaining stability by modifying interest rates, collateral thresholds, and risk characteristics according to market conditions .

Cross chain Intelligence & Interoperability

By managing data flows, asset transfers, and liquidity across several blockchain networks, AI improves cross chain interoperability. More access and unified operations across various blockchain ecosystems become possible by intelligent routing and monitoring, which ensure constant value, minimal friction, and smooth flow of tokenized assets .

Scalable Asset Management

AI empowers RWA systems to grow effectively by automating asset tracking, reporting, and transaction management. Platforms can manage high asset quantities, sustain performance, and reliably and accurately enable institutional-grade adoption by removing human processes and operational bottlenecks.

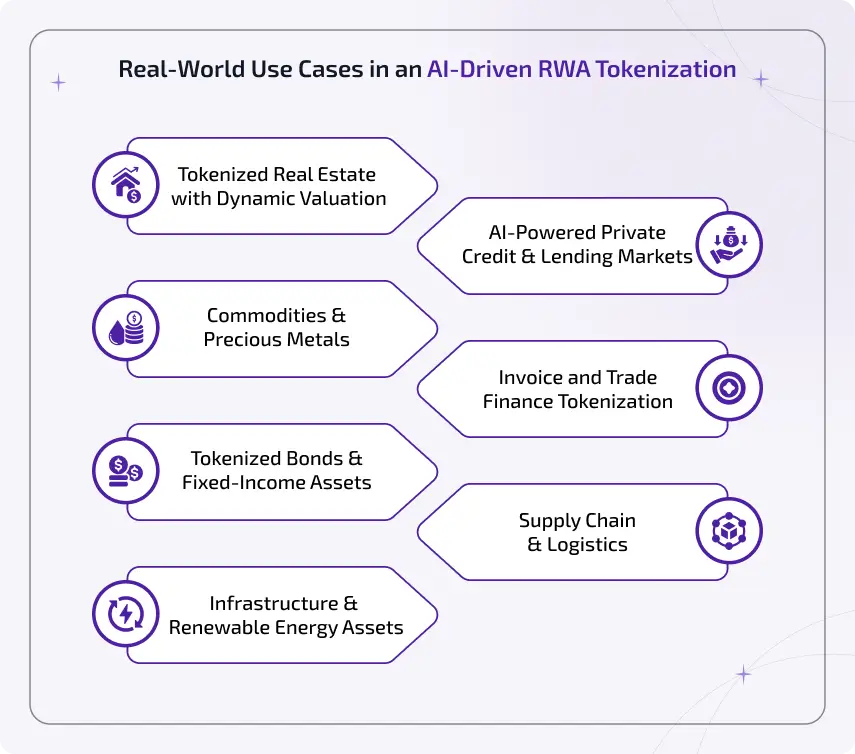

Real-World Use Cases in an AI-Driven RWA Tokenization

AI-driven asset tokenization is changing the way real-world assets are digitized, evaluated, and managed. Industries get smarter valuation models, automated risk control, more transparency, and scalable opportunities for investment across many asset classes by combining artificial intelligence and blockchain.

Tokenized Real Estate with Dynamic Valuation

AI improves real estate tokenization by allowing for continuous property assessment based on market circumstances, location data and demand trends. Through fractional ownership setups, real estate assets become more transparent, liquid, and available to investors globally.

Real-time property price changes

Automated rent yield analysis

Fractional ownership prospects

Increased transparency and liquidity

AI-Powered Private Credit & Lending Markets

By analyzing borrower details, repayment patterns, and market risks, AI enhances private credit tokenization. This increases efficiency in both institutional and decentralized lending markets and allows for more smart loan decisions, dynamic interest rates, and lower default risks.

AI-driven credit risk assessment

Dynamic interest rate fluctuations

Automated monitoring of loans

Reduced default rates

Commodities and Precious Metals

AI driven commodity tokenization allows predictive pricing and real-time market information. Improved transparency and data-driven valuation models make it simpler to trade, hedge, and manage assets like gold, oil, and agricultural products .

Predictive analysis of commodities prices

Tracking supply and demand in real time

Secure records of digital ownership

Enhanced market efficiency

Invoice and Trade Finance Tokenization

By evaluating payment risks, identifying fraud, and projecting settlement times, AI helps with invoicing and trade finance tokenization. Besides giving investors safer access to short-term, asset-backed financial products, this enables businesses to unlock faster resources.

AI-driven evaluation of invoice risk

Quicker access to working capital

Anomaly and fraud detection

Predictive payment schedules

Tokenized Bonds and Fixed-Income Assets

Bond tokenization is optimized by AI through yield performance predictions, issuer risk monitoring, and payout automation. As a result, fixed-income markets become more transparent, settle faster and attract more investors.

Forecasting yield automatically

Monitoring issuer risk in real time

Smart coupon distribution.

Faster settlement of bonds

Supply Chain and Logistics

AI-powered RWA tokenization provides visibility and insight into supply chain assets. Businesses can increase trust, efficiency, and transparency across global logistics networks by tokenizing physical assets, monitoring deliveries, and predicting problems.

Real-time tracking of commodities and assets

Predictive study of supply chain risks

Transparent tokens backed by assets

Enhanced efficiency of operations

Renewable Energy & Infrastructure Assets

Infrastructure & Renewable Energy Assets

AI allows the intelligent tokenization of infrastructure and green power projects by monitoring performance, predicting income, and assuring transparency. This encourages sustainable and capital-efficient project finance while creating long-term investment opportunities.

Monitoring performance in real time

Analysis of predictive energy output

Open tracking of revenue

Accessibility of long-term investments

Building AI-Powered RWA Platforms With BlockchainX

BlockchainX seamlessly integrates safe blockchain infrastructure with artificial intelligence to help businesses and startups to create intelligent RWA tokenization platforms. Our solutions turn real-world assets into intelligent, tradable digital instruments by combining automated asset valuation, predictive risk analytics, AI-driven compliance, and scalable tokenization frameworks.

BlockchainX helps companies in launching future-ready RWA systems that are transparent, effective, and flexible to changing market and regulatory demands through cross-chain support, regulatory-ready designs, and custom AI agent development. BlockchainX serves as a technological partner for companies seeking to launch RWA systems that are AI-driven, scalable, and compliant.

We provide end-to-end development skills for projects involving various asset types. Our offerings include

RWA tokenization services

White-label tokenization platforms

Cross chain interoperability

AI agent development

Compliance-ready frameworks

Custom dApps and infrastructure

Download the PDF : AI in RWA Tokenization.pdf

Conclusion

In the digital economy, AI-powered RWA tokenization is changing how real-world value gets created, managed, and traded. Platforms that combine blockchain technology with artificial intelligence will define the next wave of financial innovation as assets become more intelligent, liquid, and accessible worldwide. AI driven RWA solutions are becoming essential, not optional, from intelligent valuation and predictive risk management to automated compliance and scalable infrastructure.

It's time to take action. Partner with BlockchainX to create future-ready AI-powered RWA platforms that increase liquidity, transparency, and long-term value in a rapidly changing global market.