Table of Contents

Real Estate Tokenization Guide 2025: Smart Property Investing

Listen to the Audio :

The tremendous growth of tokenization has brought a major change in various industries, including real estate. This form of tokenizing real estate adopts blockchain technology and converts any physical or financial assets into a bit-sized digital representation, allowing each individual to hold a share of real-world assets in a digitized form. However, this process can be achieved with our real estate tokenization guide.

Tokenization in real time opens new ways for investors and enables property owners to gain new opportunities to raise capital. So, if you are truly ready to grasp the concept of tokenization, then walk through our tokenization guide to know its concept, benefits, and the real estate tokenization development process in detail.

By understanding these concepts, you will come to know how this innovation is reshaping modern real estate investment and targets the right audience with its applications.

What is Real Estate Tokenization?

To make it simple, real estate tokenization is the process of converting a property's value into a digital token on a blockchain. Here, each digital token represents a partial or full ownership of a particular real estate property, enabling access to multiple investors from various locations to buy, sell, and trade the property shares at a low cost.

However, this method of representing real estate assets as digital tokens eliminates the central authority and increases transparency, liquidity, and security. In short, this innovative approach of tokenizing real-world properties or assets raises funds and enables fractional ownership, making real estate investments more accessible to global investors.

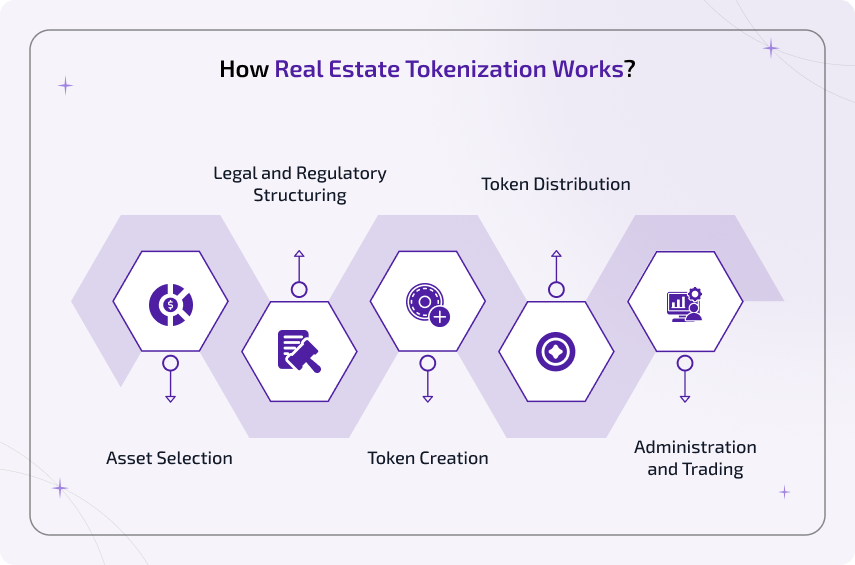

How Real Estate Tokenization Works?

Any investor who is unclear about the working of the real estate tokenization process can find an overview in the section below.

Asset Selection

Start the tokenization process by choosing a real estate property, like a commercial building or a residential property. Then, carefully examine each specimen, including its value, location, legality, and the asset's popularity in the market.

Legal and Regulatory Structuring

Once the asset is selected, ensure the property complies with the necessary legal structures and laws. This step is usually carried out to verify the asset’s legality and to find the risks associated with the tokenization process.

Token Creation

Now, you need to create the tokens on popular blockchain platforms like Ethereum, Solana, or Polygon to represent the fractional ownership of the chosen asset property. Here, each token represents a partial share of the original property. Say, for example, if you own 50,000 tokens, you hold an effective share of 10% of the actual real estate asset.

Token Distribution

As a next step, the tokens will be issued on the marketplace or any platform to make them available for investors. Once done, any investor can purchase these tokens by paying valid cryptocurrencies or fiat currencies, based on the platform.

Administration and Trading

In the last step, the property is controlled and managed according to the trade's terms and conditions. Investors can now place their tokens on the market to earn income from the rent or sell them on secondary markets for high profits.

Types of Real Estate Tokenization

Generally, the tokenization types can be classified into three categories and below is a detailed overview of each of their types.

1. By Tokenization Method

Entire Asset (EA) Tokenization

As the name indicates, EA tokenization involves tokenizing the entire value (100%) of a real estate property, like buildings, into a single digital token on a blockchain platform. Here, the asset owner owns complete ownership of the entire property. However, this tokenization method requires comprehensive compliance with property laws.

Benefits:

Comes with increased liquidity

Offers greater transparency

Reduces operational costs and transaction fees

Simplifies ownership

Fractional Ownership (FO) Tokenization

A fractional ownership is in contrast with the entire asset or full property tokenization, which divides a particular property’s ownership into multiple fungible tokens. This tokenization process allows various investors to participate with a minimum investment and own a small fraction of the asset’s ownership.

Benefits:

Reduced Entry Barrier

Enhances liquidity

Supports broader global investment opportunities

Provides faster settlement times

2. By Asset Type

Residential Tokenization

Residential tokenization denotes the conversion of individual residential properties, such as apartments, houses, or other residential buildings, into digital tokens on a blockchain platform. This simplifies the property into smaller and tradable digital units, enabling a wide range of investors to access the real estate properties easily with a partial ownership.

Benefits:

Improved transparency and security

Reduce the entry barrier with enhanced fractional ownership

Supports global accessibility

Offers increased liquidity

Commercial Tokenization

The conversion of actual assets, like business properties such as retail centres, office buildings, and industrial properties, into digital tokens is called commercial real estate tokenization. This tokenization of commercial real estate properties with blockchain technology can modify traditional real estate properties, making them more transparent and accessible to investors.

Benefits:

Offers improved customer experience

Provides robust compliance and security

Cost-effective

Unlocks new revenue streams

Trophy Tokenization

It is the process of using blockchain technology to convert the ownership of high-value, iconic assets such as famous buildings, landmarks, or luxury properties into digital tradeable tokens. This process of tokenizing high-value assets in an immutable ledger represents the ownership of an achievement in the form of a token.

Benefits:

Opens up new fractional ownership opportunities

Provides global accessibility

Offers enhanced security and transparency

Increased liquidity

3. By Token Type

Debt Tokens

The debt tokens in a real estate tokenization represent the digital representation of fractional shares of debt instruments like bonds, mortgages, or loans on a blockchain platform. This token enables any user to own a fractional portion of the real estate loan and gain liquidity without any traditional intermediaries.

Benefits:

Lowers the barrier to entry

Enhanced liquidity

Supports real-time ownership record

Comes with low transaction costs

Equity Tokens

Another type of real estate token that can be categorized by considering security is the equity token. The equity tokens symbolically represent a verifiable ownership of a real estate-related company. These tokens modernize the traditional equity systems by allowing investors to gain a share of the company’s profit.

Benefits:

Provides 24/7 trading on secondary markets

Enables faster transactions with reduced cost

Provides enhanced liquidity

Opens up global investment access

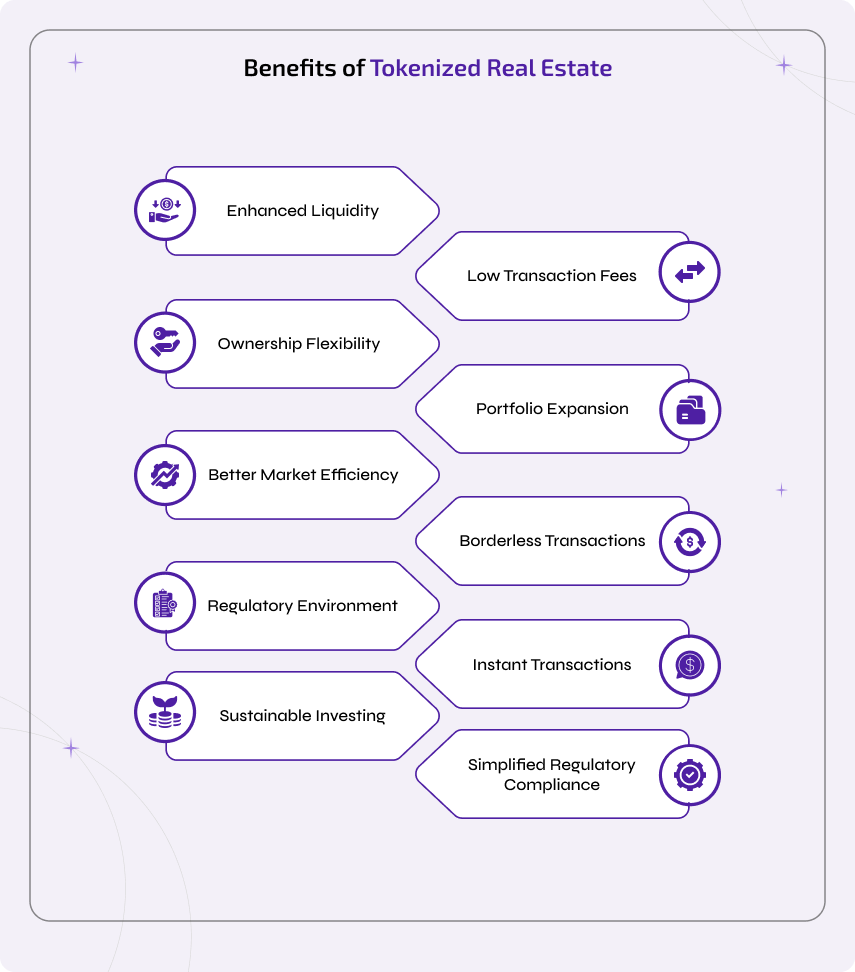

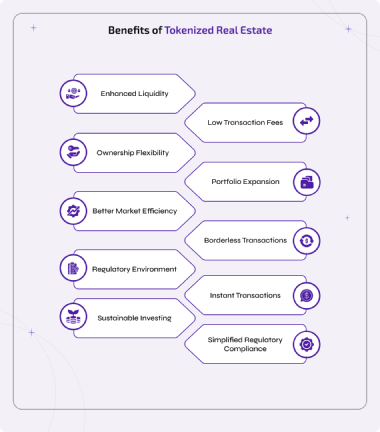

Benefits of Tokenized Real Estate

Tokenization allows a group of investors to invest in the real estate sector directly without any middlemen, with numerous benefits integrated.. .Below are some of the notable features that every investor must consider before tokenizing their real estate property.

Enhanced Liquidity

Generally, real estate is difficult to access, buy, or sell quickly. But tokenization makes it much easier by enabling property shares to be traded on digital marketplaces, providing investors with more flexibility and speed in their investment strategies. This creates liquidity, making real estate more dynamic and attractive among users.

Low Transaction Fees

With the help of smart contracts, tokenized real estate cuts down the legal and management expenses. This automated process eliminates intermediaries, middlemen, and other central authorities from entering into the field, ensuring that the transactions are done in a cost-effective way for both buyers and sellers.

Ownership Flexibility

One of the biggest aspects of real estate tokenization is its fractional ownership. Unlike traditional methods, tokenization offers extensive fractional ownership options to every investor. This enables any investor to customize their investments, features, budget, and security according to their business needs.

Portfolio Expansion

Investors have the option to distribute their capital across multiple tokenized properties or asset classes. This includes commercial or residential assets or properties, as well as geographic markets. This tokenization minimizes risk exposure and helps you build a secure and structured investment portfolio, allowing a broader audience to enjoy real estate.

Better Market Efficiency

Frequent trading of tokens on the secondary market improves the real estate value and becomes more visible in real time. This ongoing trading support ensures fair pricing and more accurate value and minimizes the inabilities associated with traditional real estate transactions.

Borderless Transactions

Tokenized real estate eliminates physical barriers and allows investors from various locations to participate in global asset opportunities. Any investor, whether a businessperson or an individual with a strong internet connection, can access and invest in the global properties digitally without any restrictions.

Regulatory Environment

Tokenization creates a structured framework where governments and regulators can monitor property investments in a better way. This environment enhances investor protection, reduces fraudulent practices, and promotes wider adoption by providing clearer legal validation of digital property ownership.

Instant Transactions

Unlike the traditional method, which takes weeks or months to undergo the process, tokenized real estate transactions are executed digitally in a much faster way. This eventually minimizes settlement times and reduces costs and makes the ownership transfers instant.

Sustainable Investing

Blockchain in real estate tokenization helps to minimize the need for manual processes and paperwork and eliminates intermediaries. This form of digitizing ownership supports a greener investment ecosystem and aligns with the growing market demand for modern sustainability goals.

Simplified Regulatory Compliance

Using simplified regulatory measures, real estate platforms directly integrate protocols like KYC, AML, and other security laws into smart contracts. This automation ensures that all transactions meet legal standards efficiently and minimizes the risk factors by building trust among investors.

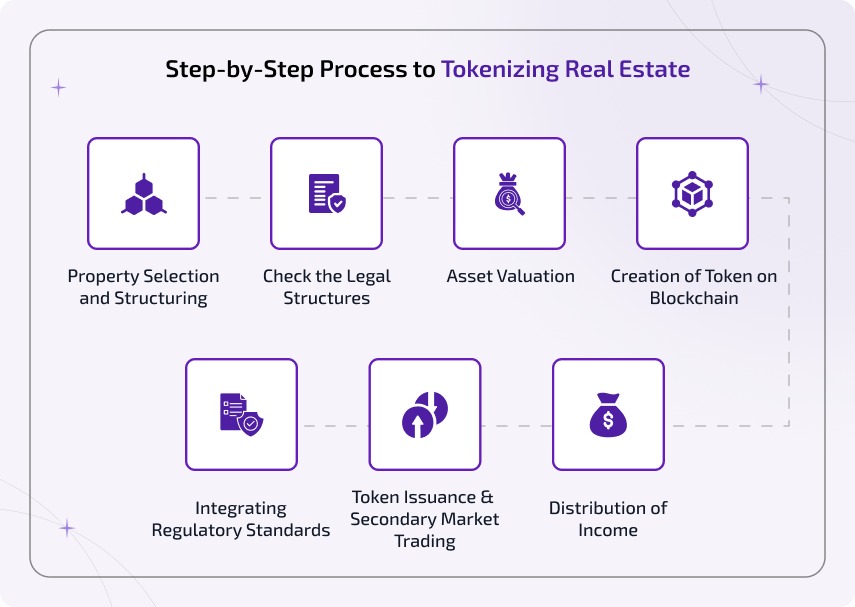

Step-by-Step Process to Tokenizing Real Estate

Tokenizing real estate assets or properties can be achieved on suitable blockchain platforms, and below are simple steps for it.

Step 1 - Property Selection and Structuring

Start the tokenization process by identifying a suitable real estate property or an asset. This might be residential, commercial, or land. Once chosen, define the ownership’s structure, stating whether the token represents debt or equity rights.

However, these steps ensure that the digital tokens directly represent the asset ownership in a legal way.

Step 2 - Check the Legal Structures

Tokens are generally represented in a Special Purpose Vehicle (SPV) to ensure their legality. In spite of this, checking the tokens' legal and regulatory frameworks is one of the most crucial steps in tokenizing real estate. So, ensure that the tokenizing property aligns with the necessary security regulations and local and international laws.

Step 3 - Asset Valuation

Now, it’s time to analyze the chosen property’s market value. Here, each digital token represents a partial share of the original asset, holding a certain value. For example, $1 million worth of physical property will be tokenized to represent a share of $1 in the market. This fractionalization of property allows investors to easily access the property, making it accessible to a wider range of users.

Step 4 - Creation of Token on Blockchain

Once you have verified the asset’s value, you need to create tokens on popular blockchain platforms like Ethereum, Solana, etc. Before that, make use of smart contracts and define the token’s functionalities, including its rules, legalities, ownership rights, and much more. Also, ensure the issued tokens align with popular token standards for enhanced security.

Step 5 - Integrating Regulatory Standards

Now, it’s important to integrate the platform with relevant compliance regulations and protocols to make it easily withstand vulnerabilities. So, use popular regulatory protocols like KYC (Know Your Customer) and AML (Anti-Money Laundering) and other laws. Then, enable investors to access the digital wallet to store and access their real estate tokens at any time.

Step 6 - Token Issuance & Secondary Market Trading

The next step is to distribute the tokens on the market, like a Security Token Offering (STO) or Initial DEX Offering (IDO), to make them accessible for verified investors. From here, any investor can purchase tokens for rental purposes or for resale value. This enables any investor to own a partial ownership of the property or asset without the need to purchase the entire property.

Step 7 - Distribution of Income

Once the secondary trading takes place, the rental income or profits will be generated and automatically distributed to the token holders with the help of smart contracts. From here, each investor will get a transparent and immutable record of token ownership via blockchain technology.

Use Cases of Real Estate Tokenization

Real estate tokenization has a wide range of potential applications in both commercial and residential markets, making a new way for investors, businesses, and property owners. However, below are some of the prominent use cases of real estate tokenization worth considering in 2025.

Cross-Border Property Transfers

Tokenized transactions, with the help of blockchain, can make cross-border property investments much simpler and faster than traditional real estate methods. This enables investors to buy the property tokens across various jurisdictions without much complexity.

Commercial Real Estate Investment

Tokenizing high-value commercial assets or properties like hotels, malls, warehouses, and office space into fractional shares with low capital requirements enables investors to get exposure to high-value projects. This normalizes access to prime real estate markets, which were once reserved only for large institutions.

Real Estate Investment Trusts

Tokenization allows investors to invest in real estate investment trusts (REITs) for the long term through property ownership. This enhances liquidity by enabling peer-to-peer trading with transparent record-keeping and low entry costs.

Hospitality Funds

By fractionalizing the ownership of resorts, hotels, etc., tokenization allows investors to earn revenue from various sources, including bookings and tourism growth. This enhances the participation of smaller investors towards tokenization and increases tourism opportunities.

Farmland or Agricultural Property Funds

The real estate tokenization platform in the agricultural field divides the farming area or yields into smaller tradeable digital tokens. This creates a wide opportunity for sustainable investment and allows farmers to access capital globally.

Infrastructure Projects

Using real estate tokenization you can access large-scale infrastructures like roads, smart cities, or bridges to get partial ownership in these high-value assets. This approach enhances investor participation in large scale building projects with high transparency.

Sustainable & Green Investments

Eco-friendly projects and sustainable properties like green buildings and renewable-powered housing projects can be tokenized under real estate tokenization platforms. This socializes eco-minded investors to support sustainable growth and gain returns with ecological awareness.

How to Get Started With Real Estate Tokenization Development

Getting started with real estate tokenization development is much simpler than you think. Here, you need to carefully navigate throughout the entire procedure to make this innovative investment process successful. Initially, analyze the market and understand the basics of what real estate tokenization is.

Explore how it differs from the conventional methods. Then, update yourself with the latest trends and technologies that are relevant to real estate tokenization. Further, choose a tokenized property or asset that meets your investment goals, and evaluate its value, location, demand, and other aspects clearly.

Then, choose or launch a reliable real estate tokenization platform that specializes in handling technical aspects and comes with a proven track record of its past projects. You can even consider the platform’s fee structure, user experience, security measures, and more for its confirmation.

Further, conduct a survey to investigate the asset property and the team managing the investment opportunities. Access its legal structures and confirm whether the tokenized asset is free from risks. Once done, get started with tokenized real estate investment by investing wisely and gaining fractional ownership of high-value assets.

Download the PDF : Real Estate Tokenization Guide.pdf

Conclusion

Beyond a technological trend, blockchain real estate tokenization is a fundamental aspect that unveils how property investment and fractional ownership should be approached in this digital era. By bridging blockchain with real estate, tokenization provides enhanced transparency, security, and liquidity and increases its global reach in the market.

Besides this, whether you are an investor seeking to own fractional ownership, this tokenization guide will take you forward to unlock the new funding opportunities effectively.

Are you prepared to begin your tokenized real estate investment for real? Speak up with BlockchainX, one of the leading real estate tokenization companies, which comes with a team of professionals having hands-on experience to support you through the entire development phase.