Table of Contents

10 Steps to Launch Your Own Real Estate Tokenization Platform

Listen to the Audio :

The real estate sector is being transformed by the advent of the real estate tokenization platform. Real estate tokenization platform is a decentralization solution that facilitates property assets investments by providing fractional ownership, transparency and liquidity as well as better reach.

A tokenized real estate platform makes it possible to turn real world property into digital tokens that makes trading safer and simpler. Be it real estate developer, investor, or tech entrepreneur, the choice to create your real estate tokenization platform brings new business opportunities and confidence to investors.

In light of the growing need for ensuring efficiency and reliability, real estate tokenization platform development has gained popularity in the markets across the globe. A tokenized real estate platform allays regulatory concerns, eliminates existing barriers to entry, and promises a more inclusive and larger cross-sectional of investors.

This article provides a guide for those who wish to learn how to launch a real estate tokenization platform with the right approach and tools; step by step and within the reader's understanding.

What is a Real Estate Tokenization Platform?

The real estate tokenization platform is a blockchain-based system that allows to convert the physical property into digital tokens thus fractionalizing the asset for ease of investments. In a real estate tokenization platform, each property is linked to a digital token that represents a share of ownership in that property.

This allows investors to easily purchase, replace or transfer their assets. This advancement has allowed many more people to venture into real estate, particularly those who are small-scale investors and those who are in a different geographical region.

A tokenized real estate platform brings about a level of transparency, security and liquidity that is not offered by the much less flexible, conventional real estate. Businesses that want to keep up with changes in real estate can create a tokenization platform to reach more investors and run their operations more smoothly.

Thanks to the illustrative real estate tokenization platform development, it made it possible to automate compliance, keep records of ownership and manage assets digitally. By choosing to launch your own real estate tokenization platform, you establish a scalable and legally compliant infrastructure that digitizes real estate assets.

Why Launch Your Own Real Estate Tokenization Platform?

The real estate industry is going through a rapid technological transformation at the moment, and the heart of such a process is the real estate tokenization platform. This latest technology employs blockchain to digitally represent ownership of the property, simplify transactions and democratize property investments. Here are top reasons to launch your own real estate tokenization platform:

1. Unlock Liquidity in Traditionally Illiquid Markets

Real estate was always an illiquid asset class quite out of reach for the ordinary investor. But now, with the invention of the real estate tokenization platform, it becomes possible where the ownership of property can be converted into digital tokens.

A tokenized real estate platform enables property owners to sell their holdings in smaller parcels and gives access to investors to new ways of investing that they can enter and exit as and when they wish. More diversification and cash flows options will be possible in the portfolios that were previously not feasible with conventional methods.

2. Attract a Global Pool of Investors

Blockchains don't know international boundaries; likewise, a nicely designed real estate tokenization platform is boundless. When you create your real estate tokenization platform, you can come into contact with a global network of accredited, and, yes, retail investors.

The whole thing reduces dependence on traditional financing sources and opens the international investor a secure aperture to promising real estate projects via your own tokenized real estate platform.

3. Ensure Transparency and Security

Real estate transactions have high stakes in terms of trust. Using blockchain, the real estate tokenization platform registers everything that happens in terms of token creation up to the secondary market trades.

With immutable records, real-time audit can now be performed with all activities and can make investors enjoy trusting the investment. Robust real estate tokenization platform development shall also use smart contracts to check compliance and reduce the risks of fraud or dispute toward the secure investment environment.

4. Reduce Costs with Smart Contract Automation

At the present time, real estate deals require a lot of parties to be involved with large sets of documentation and serious legal apparatus. Smart contracts automate important tasks like investor onboarding, KYC/AML checks, dividend payouts, profit sharing, and property ownership transfers. With smart automation, there's less manual work.

This means lower costs and faster operations. A well-built real estate tokenization platform also reduces paperwork and delays. By focusing on efficient real estate tokenization platform development, you can save time, cut admin tasks, reduce costs, and improve investor trust.

5. Enable Fractional Investment for Retail Buyers

For the longest of times, ownership of assets such as property has been out of reach for many due to high capital requirements. Nevertheless, with property tokenization, one wants to change this landscape.

Launch your own real estate tokenization platform and enable acquisition of real estate by including accessibility of investing in the smallest fractions. This opens up new opportunities for those among an emerging class of millennial and digital-native investors seeking diversity in their portfolios without the burden and control of whole ownership.

6. Enhance Scalability and Streamlined Asset Management

Without the proper tool, it gets a bit tangled now to manage multiple properties, investor profiles, and transactions. A competent real estate tokenization platform development will give you a strong infrastructure to expand properties.

Your real estate tokenization platform can possess components like real-time tracking of assets, automatic investor notifications, rent-disbursing mechanisms to investors and seamless integration with valuation and analytics tools. This helps manage properties more effectively, even on a large scale.

7. Stay Ahead in a Digitally-Driven Market

Real estate tokenization isn’t just a passing trend — it’s a step forward in how the industry works. Thus, take advantage of being a pioneer when there are fewer blockchain conventions and more powerful uses throughout the world in which real estate as an asset is going to improve.

Starting now with a real estate tokenization platform should protect the business from being an outdated and slow, paper-heavy model. Technology-driven investors are attracted to platforms for delivering speed and accessibility along with transparency, something your real estate tokenization platform can do.

8. Open Doors to Secondary Market Trading

One of the most attractive benefits of real estate tokenization platform is that it will bring liquidity into the secondary market. Once you launch your own real estate tokenization platform, you can begin trading the tokens on compliant exchanges or integrated marketplaces.

This solves the problem of asset liquidity, boosts user engagement, and enhances the value proposition of your system to retain its long-term investors. It also provides an exit strategy without requiring full property sales.

Creating your own tokenization platform goes far beyond a technology uplift. Rather, it's a strategic orientation on reimagining how property enjoys ownership, management, and trade. With a professional real world asset tokenization platform development, the solution you intend to make will become a secure, scalable, and globally accessible investment platform.

Whether your goal is the attraction of retail investors, enhancing liquidity, or fully automating the management of properties, the decision to create your real estate tokenization platform sets you ahead in the future of real estate.

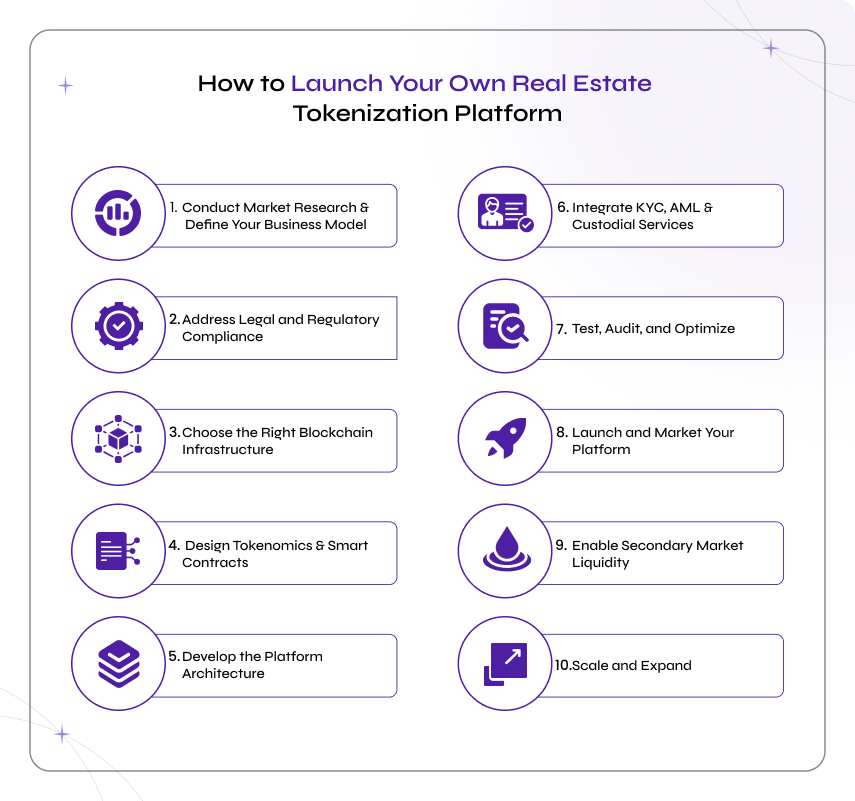

10 Steps to Launch Your Own Real Estate Tokenization Platform

Launching a real estate tokenization platform is more than simply employing blockchain technologies, it would have to include strategic planning and legal structuring, robust architecture, and safe platform development.

The success of your own real estate tokenization platform development all boils down to structured development, regardless of whether you are a real estate firm, a start-up, or a blockchain innovator looking to create your own real estate tokenization platform.

Step 1: Conduct Market Research and Define Your Business Model

Before embarking on the technical aspects of the real estate tokenization platform development, it is critical to:

Figure out who you want to reach—individual investors, big institutions, or maybe both.

Define the kind of real estate assets to be dealt with: residential, commercial, or REITs.

Understand regional regulations and investor behavior before proceeding.

Assess if your tokenized real estate platform will be engaged in primary offerings or will it focus on secondary trading or will it be doing both.

By having appropriately defined business models, you get to ensure a real estate tokenization platform that meets market demand successfully.

Step 2: Address Legal and Regulatory Compliance

Legal scaffolding is a must for any real estate tokenization platform that must be in line with everything else. The initial step towards it shall be contacting legal experts and:

Deciding the classification of the tokens at the platform such as security, utility, or hybrid tokens.

The compliance of the operation with securities laws like that of SEC, ESMA, or other local financial authorities must be assured.

Deploying robust KYC/AML mechanism.

Preparation of investor disclosure documents such as whitepaper or prospectus.

Step 3: Choose the Right Blockchain Infrastructure

The most important portion of the real estate tokenization platform is the blockchain layer. Its technology choice is likely to affect scalability, transaction costs, and cross-functionality. Possible platforms include:

Ethereum: Most secure and well followed which apparently comes with higher gas fees.

Polygon: Provides scalability and lesser transaction costs.

BNB Chain or Solana: Speed and cost-efficiency.

Real estate operations-specific smart contracts must include exact token issuance, tracking of ownership, automation of compliance, and revenue distribution.

Step 4: Design Tokenomics and Smart Contracts

Tokenomics plays a key role in a real estate tokenization platform. Each token has to represent a fractional share of a real-world asset and be legally tied to real asset deeds or financial assets.

Smart contracts should cover:

Create tokens using popular Ethereum standards like ERC-20, ERC-1400, or even a custom one based on your needs

Ownership rights and regulations about dividends

Restrictions like lock-in periods or jurisdictional limitations

Automated distribution of revenue

It is an inevitable phase for the real estate tokenization platform development where significant security auditing and testing should be prospectively performed for fixing and removing vulnerabilities.

Step 5: Develop the Platform Architecture

For a real estate tokenization platform to be operational, it must scale, be intuitive, and user-friendly. Hence, it must be further modularized into interdependent working modules:

Investor Dashboard

Secure account creation with KYC/AML verification

Simple UI to buy property-backed tokens

Portfolio tracking and performance analytics in real-time

Admin Dashboard

Tools to list properties and issue tokens

Investor management to track investor activity and engagement

Document storage and compliance management systems

Token Management Engine

Instant control over token supply

Complete visibility of transaction history and automated audit trails

The Tokenized Real Estate platform must be provided with a well-thought-out system backing good user experience and transparency to metamorphose adoption and to keep engagement alive.

Step 6: Integrate KYC, AML & Custodial Services

Security and compliance are core to a credible real estate tokenization platform. It is best to deploy trusted and reputable third-party service providers to ensure that your platform complies with international standards.

Your real estate tokenization platform should include:

Automated KYC/AML verification process

Accreditation checks on investor eligibility

Use secure custodial services to safely store legal property documents and ownership records

In case you develop your own real estate tokenization platform, embedding these services will reduce your operational risk and make the business ready for smooth regulatory audits.

Step 7: Test, Audit, and Optimize

Testing should occur before the launch of the real estate tokenization platform. Testing must address functionality, performance, and security in operations, such as:

The audit should be from smart contracts to ensure an analysis into the attempts made to detect known weaknesses being corrected

Penetration testing, as well as vulnerability scans, should be carried out to suggest that there may emerge any unforeseen tendencies from lax security

Functional QA testing should be done for all users in all modules of the system

Load testing is suggested to verify its ability to sustain heavy network activities from users

Beta testing and user feedback are further leveraged to fine-tune the experience

Teaming with an experienced real estate tokenization platform development company can readily enhance solutions for performance, compliance, and security at the enterprise level.

Step 8: Launch and Market Your Platform

Just after the development and testing, now it is your turn to launch your own real estate tokenization platform. An effective launch plan helps to attract a first set of users, forming early credibility for the market.

To be handled include:

Train new users and investors by means of guides and webinars and provide support

Supervise digital marketing campaigns on the right channels

Make sure to list the tokens on approved secondary markets and exchanges that follow legal regulations

Team up with real estate companies and broker networks to grow your reach and build trust

A real estate tokenization platform must have an investor onboarding procedure and customer support to address all inquiries, compliance issues, and trading requests.

Step 9: Enable Secondary Market Liquidity

Unarguably, liquidity remains a potent advantage that a tokenized real estate platform brings to traditionally illiquid real estate assets. It should allow secondary market participants to trade the token once the primary sale has been completed.

This can be achieved by:

Listing your tokens on regulated secondary exchanges

Or, by having your own in-house marketplace within your real estate tokenization platform

Liquidity allows for flexibility in buying, selling, or exiting a position, which, in turn, augments investors' confidence and, therefore, gives more practical utility to your real estate tokenization platform.

Step 10: Scale and Expand

Initially, the successful launch of the platform will allow for the scaling and improvement of your real estate tokenization platform in order to stay competitive. Consider the following growth strategies:

Tokenize new classes of assets such as hotels, co-living, or REITs to have a diverse set of offerings

DeFi implementations such as staking, lending, and loans against token collateral for more engagement

Mobile app roll-outs for convenient investing

Real-time introduction of Artificial Intelligence tools for asset valuation, portfolio insights, and predictive analytics

With such a strong vision and the constant innovations being done, the real estate tokenization platform has the potential to become the most powerful ecosystem for property investment, both retail and institutional, worldwide.

Launch your own real estate tokenization platform and step into the future of digital property ownership. Within the right framework of background strategic choices, legal compliance, correct choice of blockchain infrastructure, and implementation considerations, your real estate tokenization platform will push traditional real estate into a borderless world accessible unto every individual as well as a liquid investment opportunity.

If you're a real estate developer, fund manager, or blockchain startup, create your real estate tokenization platform, and help usher in the next wave of innovation.

Features Your Real Estate Tokenization Platform Should Have

Your real estate tokenization platform must leverage critical features that have been instituted to assure investors and property managers alike, to build trust, gain adoption, and ensure long-term success.

These features would otherwise necessarily automate asset tokenization while ensuring compliance and offering a smooth investment journey on the digital level. Whether you intend to launch your own real estate tokenization platform or look at a custom build, here are must-have components:

1. Secure Investor Onboarding & KYC/AML Integration

In any credible real estate tokenization platform, the secure onboarding process is the important component. Investors shall be able to register and complete their identity verification in an easy manner while investigators can automate KYC (know your customer) or AML (anti-money laundering) questions.

Key highlights:

Automated verification of identification document

Biometrics and two-factor authentication

Accreditation verification given jurisdiction rules

Third-party integration with the likes of Sumsub, Chainalysis, and Jumio

2. Property Tokenization Module

This module tokenizes the given real estate into fractional tokens. The main core of a tokenized real estate platform is the possibility of securing ownership to bring transparency and programmability using smart contracts on the blockchain.

Key highlights:

Smart contracts work for each property for secure transactions to execute automatically.

Fractional ownership is possible, with several investors behind one property.

Token minting and burning occur in real time along with the distribution of tokens.

Integration of software to perform property valuation and legal documentation for transparency.

3. Investor Dashboard

In your real estate tokenization platform, you will need to provide a user-friendly investment dashboard. Above all, it should be able to simply manage and quickly access the holdings, follow real-time performance, and carry out transactions with ease.

Key highlights:

Portfolio snapshots and token balances in real time

Asset value tracking and dividends history

A secondary window for token sales

A digital wallet embedded-with support for crypto and fiat

4. Admin Dashboard for Asset Managers

Your real estate tokenization platform development must also include an all-in-one desk for asset managers and real estate owners to manage the listings, investor relations, and legal compliance.

Key highlights:

Add or edit property listings and associated tokens

Set rules for dividends, ownership limits, and smart contracts

Monitor and communicate investor activity

Store legal docs, KYC data, and audit trails

5. Built-in Token Marketplace

A token marketplace is built into your real estate tokenization platform, thereby allowing users to directly buy or sell real estate tokens from your system without resorting to any third-party exchange. This option tends to create liquidity in favor of the trading process.

Key highlights:

Peer-to-peer and order book trading models

Instant swaps of tokens by smart escrow

Live charting, transaction histories, and price tracking

Having this option uncommon on the market makes your tokenized real estate platform more investor-friendly and thus much attractive for active investors.

6. Smart Contract Security & Auditing Tools

Trust cannot be designed without security. When you create your real estate tokenization platform include all possible tools for assessing whether the smart contracts are sound and free from any problems before they arise.

Key highlights:

Smart contract verifier dashboard

Realtime alerts for any unusual activity

Access controls stopping the execution of risky operations

When you launch your own real estate tokenization platform, these security features will assist in protecting the users' interests, as well as serve as a base for regulatory compliance.

7. Mobile Responsiveness & Cross-Platform Compatibility

An investor must be able to work their assets on the go! Ensure that your real estate tokenization platform guarantees a UI consistent with any device or screen size used.

Key highlights:

Mobile user interface intuitive and easy to navigate

Local iOS and Android apps

API integration with wallet and third-party apps

Regardless of the user whatsoever device they would like to put to use-a mobile, tablet, or desktop-the best customer experiences are offered.

8. Integration of Custodial & Escrow Services

Real estate transaction processes real estate transactions with legal documents and physical assets. Integration of custodial and escrow services helps in ownership, compliance, and legality.

Key highlights:

NFT ownership certificates for real assets

Third-party escrow applications for off-chain transactions and payments

Blockchain notarization to create-secure, instantly auditable records

Your real estate tokenization platform stands to benefit your users by furnishing legal clarity and protection.

9. Analytics & Reporting

With data, investors would be able to make informed decisions. Thus, the real estate tokenization platform has to provide investors with clear and relevant data-based reports and analytics.

Key highlights:

Performance analysis of every tokenized asset

Track investor behavior and transactions

Exportable logs for compliance and auditing purposes

With better analytics, your real estate tokenization platform becomes praiseworthy by transparency in regard to the very users and administrators.

10. Multi-Jurisdictional Compliance Layer

Suppose that the aim is to launch your real estate tokenization platform with actual users internationally; the platform should then be legally approved in many countries.

Key highlights:

Carry out KYC/AML processes as per the respective local laws

Activate smart contract rules based on the user's physical location

Regional tax calculation and reporting

This will lay the foundation for having the tokenized real estate platform needed for operating legally in the world market.

Combining these core features into your real estate tokenization platform, it will make it ready to handle all those complicated factors related to real estate investment, yet still present a seamless and secure experience to the user. These features lay the groundwork for growth, investor confidence, and full-fledged success, which logically means that it is the right set of features for any real estate tokenization platform being developed, be it for residential property or commercial assets.

Download the PDF : Launch Your Own Real Estate Tokenization Platform.pdf

How BlockchainX helps you launch your own Real Estate Tokenization Platform?

At BlockchainX, we help you launch your own real estate tokenization platform with confidence. Beginning with concept formulation and ending with execution, our end-to-end solutions remain flexible and adaptable to your business objectives. If you desire to create your real estate tokenization platform for residential buildings, commercial assets, or mixed-use properties, we make sure that the platform is in compliance, secure, and scalable.

We focus on real estate tokenization platform development featuring an integration between blockchain, smart contracts, investor dashboards, and regulatory compliance into one system. All tokenized real estate platforms are built by our expert teams integrating automated KYC/AML, auditing of smart contracts, issuance of digital ownership certificates, and secondary market access—enabling property investments to be easy for users all over the world.

With BlockchainX, you don’t just get developers—you get a partner who thinks strategically. We collaborate with you on navigating the legal, technical, and operational processes required to launch your own real estate tokenization platform successfully. We provide on-screen optimization, cross-border compliance, and all the other responsibilities—while you concentrate on growing your business.