9 Simple Steps To Create Real Estate Token in 2026

Listen to the Audio :

Tokenization is bringing a new era of investment

opportunities to the real estate market. Tokenization

turns real estate assets into digital tokens that

investors can use to buy and sell portions of properties

on the blockchain. This makes it easier to get into the

real estate market. This process benefits everyone as it

increases liquidity, lowers barriers to investment and

makes things more clear. In this complete guide, we will

show you the most important steps to create real estate

token.

We will help you with every step from finding the right

property to getting to know blockchain technology. You

will also learn about smart contracts, how to follow the

regulations and how tokenizing real estate gives

investors new choices.

Tokenization is a powerful way to make investing in real

estate easier and more interesting whether you are a

seasoned pro or new to the business. Let us examine the

process and see what real

estate token development can do.

Real estate tokenization growth forecast

Real estate tokenization is the process of turning a real property into a digital token that can be used on a blockchain. For instance—tokenization of real estate divides an actual property into digital tokens each of which represents a fraction of the asset's ownership. It lets investors buy and keep part of the asset without buying the whole thing. Tokenization brings liquidity and transparency to illiquid markets and allows more investors to own assets.

Consider tokenizing a $50 million, 500000 square foot

property. We can divide it into 5000000 shares, each

valued at $100 and representing one square foot.

Alternatively—you could divide it into square inches and

use tokenization to make each token worth $0.69. This

strategy allows a wide variety of investors to

participate even with smaller sums. Similar to company

shares—a blockchain platform can sell real estate tokens

offering a digital, safe and convenient way to invest in

real estate.

According to industry analysts, the global tokenized real estate market may reach $3 trillion by 2030, accounting for 15% of all real estate assets under management.

The

Process of Real Estate Tokenization

Tokenizing real estate means turning ownership of real

estate into digital tokens that are stored on a

blockchain. This is how it works.

Asset selection

The property owner chooses which real estate asset such

as a house or commercial building to tokenize.

Token creation

We create a digital token to symbolize each of the

smaller shares of the property. For instance—a token

might represent a certain amount of square footage or a

portion of the property.

Smart contracts

Smart contracts are programmed by blockchain to regulate

transactions while guaranteeing security, adherence to

regulations and transparency.

Marketplace listing

Like stock exchanges—an online marketplace lists tokens

for purchase, sale or exchange by investors.

Ownership and profits

Token holders own a portion of the property and may get

a cut of any gains or rental income from its sale.

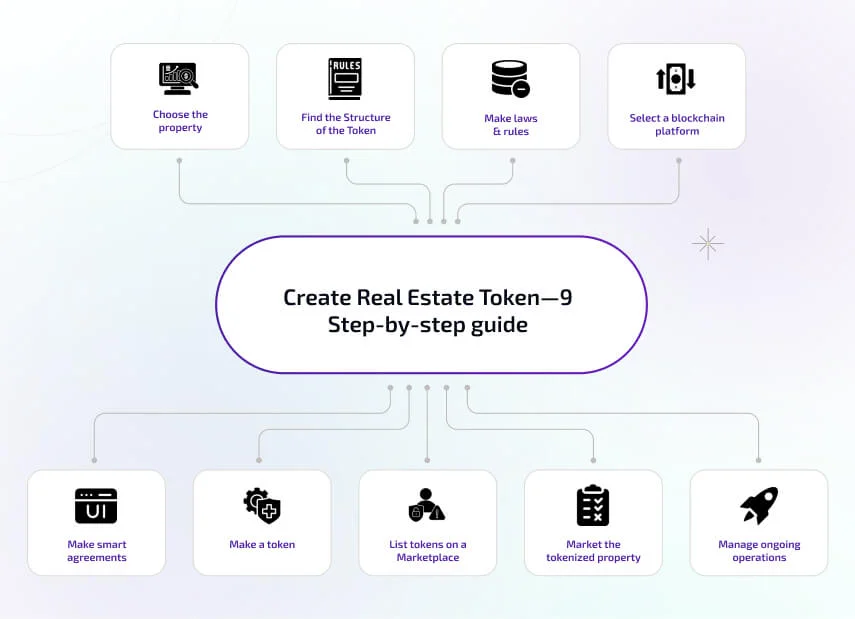

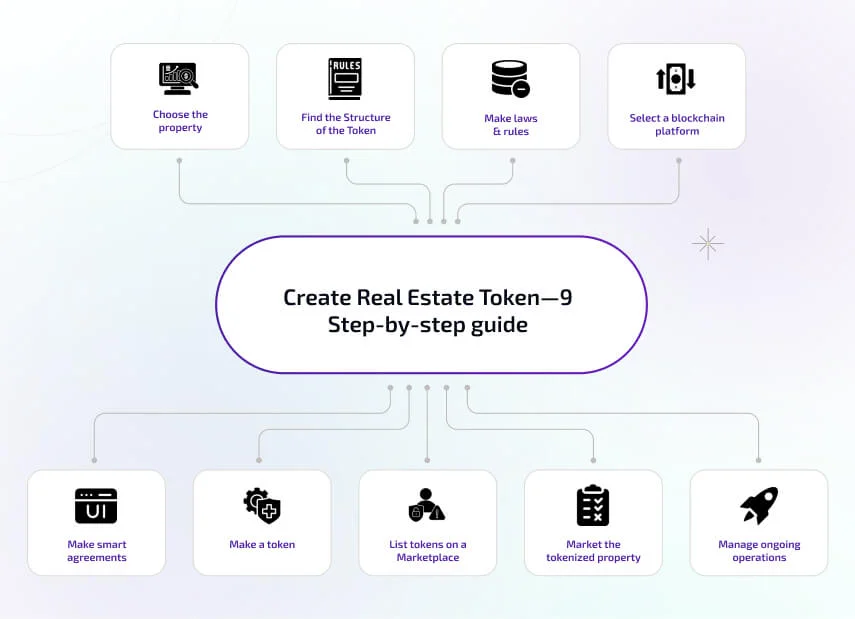

Create Real Estate Token - 9 Simple Steps:

By following these steps—you can create a real estate

token asset that gives investors an advanced and easy

way to get into real estate markets.

Step 1 - Choose the

property

Pick the property that you want to turn into a token.

This area may have both homes and businesses. Look at

tokenization's potential, legal status and market value

to make sure it fits.

Step 2 - Find the Structure of

the Token

Pick how many tokens you want to make and what each will

mean (for example—square footage or a share percentage).

This structure will determine token ownership

distribution.

Step 3 - Make laws and rules

Professionals can ensure you follow securities and real

estate laws. Real estate tokens are seen as securities

by most users. To avoid legal problems—this is very

important.

Step 4 - Select a blockchain

platform

Ethereum, Polygon or Solana can handle smart contracts

and real estate tokenization.

Step 5 - Make smart agreements

Smart contracts make it easy to transfer ownership and

pay out profits. Help blockchain developers write

contracts that follow the rules and keep tokens safe.

Step 6 - Make a token

Once you have set up smart contracts—you can "tokenize"

the property by giving different levels of ownership

digital tokens.

Step 7 - List tokens on a

Marketplace

For investors to buy or sell or trade tokens—you should

put them on a digital market that follows the

regulations. This step facilitates the easy trading and

accessibility of tokens.

Step 8 - Market the tokenized

property

When you pitch the tokenized property to potential

investors talk about its benefits such as its safety,

liquidity and fractional ownership.

Step 9 - Manage ongoing

operations

Following the sale of the tokens—you must monitor the

allocation of profits such as rental income or maintain

continuous compliance and keep the token holders

updated. This step is essential to keep investors' trust

and ensure that tokenized real estate works well.

How

Real Estate Token Help Your Business

Enhanced Liquidity

Fractional ownership is made possible by tokenization

making it simple for investors to purchase and sell real

estate shares. This improves liquidity in a sector that

is typically illiquid.

Greater access to investors

By lowering investment minimums—tokenization draws an

array of investors including smaller investors who would

typically be accessible in real estate.

Increased security and

transparency

Blockchain’s transparency and security enhance investor

trust by reducing fraud risk and providing clear

ownership records.

Effective transactions

Smart contracts automate transactions, reducing

paperwork, lowering expenses and speeding up and

improving operations.

Opportunities for international investment

Through Asset tokenization—you may connect with your investors worldwide increasing your market reach and funding choices.

Capital raising makes it

easier

By enabling you to provide modest and tradeable shares

to a wide range of investors—tokenized assets can

improve capital accessibility and raise fundraising

efforts.

Benefits

of Real Estate Tokenization

There are numerous benefits of tokenizing real estate

for investors, homeowners, brokers and companies.

Increased cash flow

Individuals can now own portions of buildings through

real estate token development services, freeing up money

previously allocated to hard-to-sell assets. Both buyers

and sellers who wish to sell their houses quickly can

take advantage of this perk.

Participate in something

big

Property owners can divide ownership of priceless items

through tokenization. This allows real estate investors

a wider variety of assets and more options for spending

their money.

Global accessibility

Tokenized real estate has enabled people from all over

the world to access the real estate market. This implies

that customers can purchase land from anywhere in the

world not just their local area.

Increased transparency

By identifying who owns what and how much it

costs—tokenized real estate transactions are more

transparent. Property owners, investors and real estate

companies will benefit from this.

Cost-effectiveness

Everyone can benefit from tokenizing real estate since

it can lower the costs of traditional real estate

transactions. As tokenized real estate assets increase

market liquidity and provide owners with additional

alternatives and properties, more real estate properties

are available for purchase.

24/7 Market

Regardless of time zone—tokenization enables users to access the market at any moment. Purchasers and real estate companies always have more freedom.

Simplified compliance

Real estate token development can aid compliance by

ensuring all transactions meet legal requirements.

Property owners, investors and real estate companies

will benefit from this.

Industries

Using Real Estate Tokenization

Commercial real estate

Tokenization makes major and big assets like office

buildings, shopping malls and warehouses more liquid by

giving buyers fractional ownership. This helps

commercial property owners speed up money.

Residential real estate

Tokenization lets many investors own shares of rental

property for residential properties. This makes it

easier to share income and opens up opportunities for

smaller investors.

Industrial and manufacturing facilities

Industrial businesses like factories and stores use

tokenization to attract investors. This provides them

with new funding and enables their operations to expand.

Farmland and agricultural

Real estate with an agricultural-focused allows for

tokenized investments in farmland. This allows buyers to

benefit from both land value growth and farming.

Hospitality and tourism

Tokenization allows investors to buy shares in hotels

and resorts which helps them pay for new projects,

buildings or upgrades. This allows investors to make a

profit.

Infrastructure projects

Tokenization facilitates the large amount of funds from

a diverse range of investors by enabling fractional

ownership. This makes for paying for large

infrastructure projects like ports, bridges and

highways.

Programming Languages Used for Real Estate Token Development

Real estate token development uses a variety of programming languages to ensure the safety and functionality of the solutions. To create real estate token—these languages are used.

Solidity

When creating smart contracts on Ethereum—it is crucial to ensure their robustness enabling you to specify the functionality of the tokens and their ownership in real estate tokenization.

Rust

Rust is very popular in the Solana ecosystem. Rust’s speed and security make it an excellent choice for complex financial applications such as real estate tokens.

Javascript with tools like Node.js

People often use JavaScript to create user-friendly web apps and tools that communicate with blockchain networks.

Python

It serves as a programming language for backend programming, data analysis and facilitating interactions with blockchain APIs. It helps with processing property data and automating processes.

Go

Go is a programming language that is known for being very useful. Blockchain systems like Hyperledger provide safe and scalable solutions for managing real estate tokens.

Security Considerations for Real Estate Token Development

When to create real estate tokens—security plays a crucial role in safeguarding investors' funds adhering to regulations and fostering trust. These are some important security factors.

Smart contract audit

Third party security firms regularly check smart contracts that manage token operations for flaws that can be used by attackers or cause integer overflows which stop issues like these.

Adhere to the regulations

Real estate tokens must adhere to regulations such as KYC (Know your customer) AML (Anti money laundering) and stock laws to prevent fraud and ensure legal compliance.

Secure control of access

To keep people from getting into token management platforms without permission, administrative tasks should use role based access restrictions and multifactor authentication (MFA)

Data privacy and encryption

Encrypt sensitive data such as financial records and ownership information in transit and at rest to prevent data breaches and unauthorized disclosures.

Token standard compliance

By ensuring tokens adhere to recognized standards (like ERC20 or ERC721), interoperability, security risks and wallet and marketplace compatibility are all involved.

Network security

Prevent attacks on APIs and blockchain nodes by putting firewall safeguards, DDoS mitigation and frequent penetration testing in place.

Wallet security

Secure wallets that use hardware based solutions or multi-signature configurations lower the possibility of money loss or theft for real estate tokens.

Continuous monitoring and incident response

Real-time monitoring, logging and an incident response plan can quickly identify and mitigate potential security threats.

Use Cases for Real Estate Token Development

To illustrate how tokenization could transform the real estate sector, consider the following use cases.

Fractional ownership and investment

By dividing real estate into fractional ownership tokens—real estate tokenization makes it possible for more people to invest in high-value properties with less money. This increases liquidity, democratizes property ownership and gives retail investors more access to real estate investment opportunities.

Global accessibility and cross-border investment

By converting real estate assets into tokens—investors from all over the world can purchase tokens that represent a portion of control. There are no normal legal or geographic limits on this. It is easier for people to trade and convert currencies which helps the global real estate market grow.

Streamlined transactions and lower prices

Tokens make the process of transferring real estate easier by cutting out middlemen like banks and real estate agents and reducing the amount of paperwork that needs to be done. Tokens based on blockchain technology make transactions quick and simple with lower fees making them more accessible and improving total efficiency.

Better liquidity for illiquid assets

Since real estate tokens can be exchanged on secondary markets—tokenization adds liquidity to the traditionally illiquid real estate market. Compared to traditional real estate sales- this makes it easier for investors to enter or exit their positions giving real estate a more flexible investment option.

Effective rental income distribution

Smart contracts tokenized real estate can automatically distribute rental income to owners ensuring timely, accurate and transparent payments.

Real estate investment trusts

Investors can purchase fractionalized shares of real estate portfolios through tokenized REITs. For investors who want to diversify through REITs—tokenizing REITs on the blockchain improves accessibility, liquidity and transparency.

Development of Real Estate and Pre-Sales

Developers can tokenize future projects to enable the pre-sale of shares in future real estate projects. Through this use case—early investors can take advantage of growth opportunities while also helping to raise money for construction and development.

Transparency about ownership and history

Blockchain technology ensures that all ownership records, property histories and transaction data are open and clear. This gives buyers more trust and makes it easier to do their research

Asset collateralization for loans

Real estate owners can get cash without selling the property by using real estate tokens as collateral for loans on decentralized finance (DeFi) platforms.

ESG factors and Carbon credits

Tokenizing green real estate can urge people to act in ways that benefit the environment. We can use ESG (Environmental, Social and Governance) factors such as properties with good environmental ratings or those that produce carbon credits to attract investors who care about their environment.

Our Real Estate Tokenization Services

Residential Real Estate Tokenization

Homes, flats, and villas can be tokenized into safe digital tokens with our help. This enables blockchain ownership tracking, rental income creation, and the buying of small shares by investors. It makes investing in residential real estate simpler, more accessible, and cheaper for buyers globally.

Commercial Real Estate Tokenization

Our team tokenizes commercial premises, stores, and office complexes. Investors can safely trade tokens, own fractions, and get rental profits. This gives investors access to high-quality commercial real estate assets while helping property owners to free up liquidity.

Multi-family Property Tokenization

We convert multi-family housing projects and apartment complexes into digital shares. Fractional ownership makes large real estate assets easier to buy and manage by allowing investors to diversify among several rental properties, generate consistent income, and lower risk.

Hospitality Real Estate Tokenization

For fractional investment options, we tokenize resorts, hotels, and serviced flats. The rise of tourist and hospitality activities provides income for investors, and property owners can get capital more quickly and connect with investors globally.

Land and Development Project Tokenization

To increase the efficiency of fundraising, we tokenize real estate development projects and land assets. With blockchain ownership, this enables investors to take part in high-growth projects early, monitor growth openly, and benefit from a future rise in property value.

Real Estate Investment Trusts (REITs) Tokenization

We allow fractional ownership of a number of real estate assets by converting REIT portfolios into blockchain-based tokens. REIT investing is more flexible and accessible as investors can trade tokens with ease, earn consistent income, and become exposed to multiple properties.

Fractional Ownership Tokenization

We allow investors to begin with lower amounts by dividing highly valuable assets into small digital shares. With safe blockchain-based ownership, this reduces entry barriers, diversifies investments across several properties, and opens up new liquidity options.

Rental Property Tokenization

We tokenize rental properties so that investors can use digital tokens to generate passive income. Property owners and investors benefit from faster, more transparent, and simpler income tracking, reporting, and settlement processes due to smart contracts, which automate rent distribution and ownership records.

Future Trends of Real Estate Token Development

The market is evolving quickly as a result of real assets becoming tokenized. Asset owners can better manage their ownership stakes and investors can transfer their money more effectively. Numerous other disputes support real asset tokenization and show its potential as the asset class of the future. Let us discuss some of the most advantageous ones.

-

The way we purchase and sell homes is evolving as a result of tokenization. Purchasing real estate is now quicker and simpler due to tokenization.

-

The potential growth of real estate tokenization is simply amazing. Experts predict that by 2032 the market which was valued at $2.7 billion and in 2022 will have grown to $18.2 billion.

-

Regulations are evolving as this new method of property ownership gains traction. Certain regions such as the UK, Singapore, Japan and the EU have regulations to safeguard consumers and maintain market stability. Additionally—it makes tokenizing and to create real estate token safer for those who wish to do so.

-

The traditional real estate sector benefits from improved market transparency, trustworthy ownership monitoring, increased liquidity prospects and real-time investing processes.

-

Instant exchange to create real estate tokens opens up new possibilities for ambitious and inventive real estate projects.

-

Real estate tokenization works well with other commonly known funding options like private equity and venture money.

Conclusion

By making it easier to create real estate tokens with its strong blockchain technologies—BlockchainX empowers real estate stakeholders. Blockchain’s technology digitizes real estate assets enhancing transparency and reducing transaction costs & enabling fractional ownership, simplified trade and increased liquidity. BlockchainX streamlines the exchange and investment of properties by ensuring a smooth, safe and scalable real estate tokenization process. As regulations tighten and technology develops—we should expect even more adoption and innovation paving the way for a truly revolutionary future in real estate ownership.

Are you ready to start your real estate tokenization project? Talk to BlockchainX—a topmost real estate development company with a great industry experience. Speak with us now to discuss your needs.