Table of Contents

Top 10 Assets Tokenization Companies in 2025

Listen to the Audio :

Asset tokenization is revolutionizing businesses, and investors through its approach towards ownership and investment. Converting real-world assets like real estate, art, and commodities as digital tokens on blockchain networks, unlocks a lot more than fractional ownership, liquidity, and accessibility. This has created Asset tokenization companiesdemand in the market and evolved them as a player with a pivotal role in facilitating and contributing to the transformation.

With global markets increasingly embracing tokenized assets, this trend reshapes traditional industries, creating new opportunities for investors and asset holders alike. With regulations evolving to support tokenized assets, this innovation is set to redefine asset management and investment strategies, making asset tokenization a cornerstone of the future digital economy.

Here in this blog let us uncover the top 10 asset tokenization companies, their services speciality and more. Slide down!

What Is Asset Tokenization?

Asset tokenization is the process of converting real-world assets, such as real estate, commodities, art, or intellectual property, into digital tokens on a blockchain. Each token represents ownership rights or a fraction of the underlying asset, enabling secure and transparent transactions. By utilizing blockchain technology, asset tokenization enhances liquidity, provides fractional ownership opportunities, and eliminates traditional barriers to entry, such as geographic or financial constraints.

The concept of asset tokenization involves issuing tokens through smart contracts, which define the rules and conditions for ownership, transfer, and governance. These tokens can be traded on decentralized marketplaces, opening assets to a global pool of investors. Tokenized assets are particularly transformative for illiquid markets like real estate, where properties can be divided into smaller units, making them accessible to a broader audience.

Additionally, tokenization ensures transparency through immutable blockchain ledgers, reducing fraud and disputes.This process is gaining traction across industries, as businesses recognize its potential to unlock value, streamline operations, and foster innovation.

For instance, tokenized bonds or equities allow faster settlement times, while tokenized art provides provenance tracking. With increasing regulatory clarity, asset tokenization is set to redefine traditional finance, democratize investments, and pave the way for a decentralized digital economy.

Why Are Asset Tokenization Companies Needed?

Asset tokenization companies play a major role by bridging the gap between traditional assets with blockchain technology. However, below are some of the reasons that insist on the importance of asset tokenization companies.

Fractional Ownership

Fractional ownership, one of the primary key factors in asset tokenization breaks down the barrier to entry and divides the high-value assets into smaller, tradable units. This enables a wide range of investors to participate in trading, with increased liquidity and accessibility.

Technical Expertise

Asset tokenization heavily relies on smart contracts, blockchain development, and data handling processes. So, the demand for depending on a company’s technical capabilities lies here for an efficient tokenization with enhanced salability and security.

Improved Liquidity

Asset tokenization companies create fractional ownership of assets into digital tokens, enhancing the trading processes. This enables investors to have partial investment and peer-to-peer trading with reduced transaction costs and minimal settlement time.

Enhanced Transparency & Security

Every asset tokenization company uses smart contracts and blockchain to provide a safe, secure, and tamper-proof ownership of assets. They even provide secure wallet integration and advanced encrypted data to build trust among users and investors.

Rapid Commercialization

Bringing the tokenized assets to the market in a quicker time helps the asset to reach a wide range of investors. Here, asset tokenization companies come with built-in frameworks and standards, which will reduce the asset’s development time, cost, and delays.

Trust and Credibility

The transactions done in asset tokenization are highly confidential. A company that prioritizes trust and credibility can minimize the risks associated with the tokenized asset and can increase confidence among investors, ensuring the overall integrity.

Customization

Customizing the asset properties with specific characteristics and requirements will improve the asset's value. A well-established company will allow users to tailor to unique operational needs and developments as per investors' requirements.

Legal & Regulatory Compliance

A tokenized asset must strictly adhere to the security laws and other regulatory compliances for better security. Here, a trusted tokenization firm will ensure compliance with both local and international standards and other regulations such as KYC and AML.

List Of Top10 Asset Tokenization Companies

1. BlockchainX

BlockchainX as a leading Asset tokenization company, develops tokens with versatility, and innovation, turning tangible and intangible assets into liquidity-providing tokens on the digital blockchain networks. Vetting on cutting-edge blockchain technology we curate your tokens with security, compliance, meeting all regulations, and perfect with versatility. They are transparent, and secure, and provide enhanced liquidity.

We develop Asset tokens for different sectors including real estate, art, commodities, and more offering end-to-end support from conceptualization to deployment. Our robust infrastructure ensures seamless integration support, encouraging investor contribution.

Why Choose BlockchainX?

- We have a proven track record of developing custom solutions and innovating new asset tokens.

- Our expert blockchain developers are open and trained to develop in different networks like Eteruem, Solana, NEAR, etc.

- We strongly agree on regulatory norms and security

- We provide end-to-end support.

Key Features of BlockchainX Asset Tokenization

- We provide a fractional ownership option for the tokens integrated into them.

- The blockchain’s immutable records make it tamper-proof and transparent.

- We provide enhanced liquidity opportunities through secondary market trading.

- We also provide cross-chain compatibility, interacting with multiple blockchain

- We adhere to the legal regulatory compliance and global framework in asset management

Service Offered At BlockchainX

- We develop custom asset tokens development, creating various asset tokens for diverse industries.

- We do smart contract development, which is a full-fledged service from contract coding, analysis, auditing, and report generation.

- Apart from end-to-end development service, we also contribute 100% to your Asset tokenization process committing to provide valid, and constructive consultation.

- We develop versatile platforms for different networks ensuring they are user-friendly, secure, and safe.

- Post-launch Support is also extended by our team of expert developers helping you upgrade your operations based on need.

Looking to tokenize your assets? Work with a leading asset tokenization development company

2. Tokeny Solutions

Tokeny Solutions is one of the top leaders in Asset tokenization development, enabling secured, compliant, and versatile tokens, easy to transfer, and manage digital tokens. They provide simplified solutions to complexity and adhere to blockchain technology and global compliance standards.

Why Choose Tokeny Solutions?

- Extensive experience in diverse networks

- User-centric solutions that are simple

- They follow Stringent compliance mechanisms

Different Services Offered At Tokeny Solutions

- Token development and management services

- Identity compliance management

- API integrations for Asset

- Post-launch services

3. Securitze

Securities is an asset tokenization company that can bridge traditional finance with blockchain providing a platform for Secured compliance for digital securities. They are well known for their integration regulatory framework that seamlessly operates on Blockchain technology.

Why Choose Securities?

- They are industry leaders in securely tokenizing assets

- Provide robust compliance systems

- Having strategic partnerships with major players

- End-to-end solutions from token issuance.

Different Services Offered At Securitize

- They provide digital security issuance

- Secondary trading platform development

- Investment and investor management tools

- Legal and Regulatory compliance services.

4. Tokensoft

This company specializes in providing secured and compliant token issuance solutions that enable businesses to launch tokenized assets effectively across various jurisdictions.

Why Choose Tokensoft?

- Expert security token launch strategies

- They focus on regulatory compliance across regions

- Support multiple blockchain networks with versatility.

Different Services Offered At Tokensoft

- Token Designing and issuance

- Regulatory framework development

- Investors onboarding KYC solutions

- Post-launch token maintenance support.

5. Polymath

Polymaths is keen on creating and managing token security effortlessly, they empower businesses to get their dream tokens to live and incentivize on it. Eventually leveraging blockchain technology the potential to improve asset liquidity and transparency is very high and possible.

Why Choose Polymath?

- They are pioneer in security token standard development

- They focus on simplifying blockchain adoption for enterprises.

- They create an open ecosystem ensuring compliance and security.

Different Services Offered At Polymath

- Token creation and management

- Token Compliance, tools, and framework development

- Platform integration with financial services

- Developers supporting tokenized ecosystems.

6. RealT

RealT provides revolutionizing real estate tokenization services from tokenizing assets, and providing fractional ownership with the power of blockchain, they provide versatile, transparent, and accessible investment models for investors and creators.

Why Choose RealT?

- They specialize in real estate Tokenization

- Provide fractional ownership with global access.

- Transparency and automated investment processing

Different Services Offered At RealT

- Real estate asset tokenization services

- Fractionalized ownership token platform development

- Automated dividend distribution services

- Property management tools and compliance support

7. Antier Solutions

As your Asset tokenization company, they provide excellent services and are renowned in blockchain development services offering versatile services and solutions. They contribute their services to versatile industries and ensure liquidity and global investment reach.

Why Choose Antier Solutions?

- Extmulti-assets asset class experience

- End-to-end tokenization solutions with customization

- Focussing on security, scale, ability, and user engagements.

Different Services Offered At Antier Solutions

- Real estate and art tokenization development

- Blockchain consulting and strategizing

- Smart contract creation and auditing

- Post-deployment support

8. Bitbond GmBH

The Bitbond GmBH is a blockchain service provider extending enterprise-grade tokenization services focusing on regulating financial securities that offer comprehensive solutions for businesses across the globe.

Why Choose Bitbond GmBH?

- Specialized Token securities for financial institutions

- Expertise regulatory compliances

- Focus on providing an Efficient asset management system

Different Services Offered At Bitbond GmBH

- Security token issue and management

- They onboard investors

- Provide compliance frameworks

- Asset token trading platforms

- Custom tokenizing Consultation.

9. Spydra

At Spydra, they deliver blockchain-based token solutions tailored for enterprises, focusing on enhanced asset liquidity and investment accessibility. They provide custom development services for businesses catering to their needs.

Why Choose Spydra?

- Offering a custom Blockchain tokenization platform

- Focus on Cost-effective and scalable solutions.

- Expert integration with advanced blockchain features

Different Services Offered At Spydra

- Asset tokenization consultation and development services

- Smart Contract development, they also audit

- API integrations and others

- Token Maintenance and upgrade.

10. tZERO

The tZERO brings Blockchain together with traditional finance creating a secured trading platform for tokenized securities. They focus on compliance and liquidity and are positioned as one of the market leaders in blockchain-based Asset Tokenization services.

Why Choose tZERO?

- Using advanced security Features for token trading

- Seamless blockchain integration into financial system

- Transparent and regulated trading operations.

Different Services Offered At tZERO

- Tokenized Security Trading platform

- Real-time trading solution with Liquidity

- Asset management platform for investment

- Blockchain financial ecosystem with engagement tools.

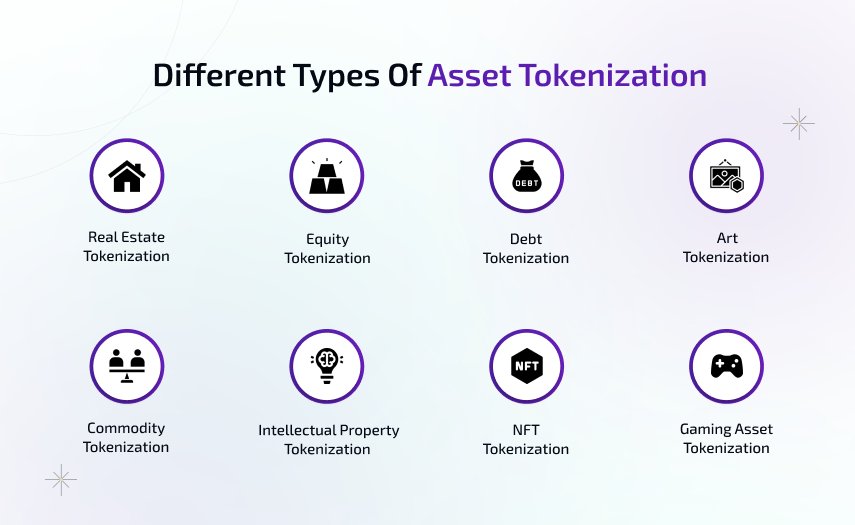

Different Types Of Asset Tokenization

Different types of Asset tokenization are very much available in the market, and they are utilized based on their use case, business needs, and market.

Real Estate Tokenization

The process of converting physical properties into digital tokens, which represents ownership and right over a share of the asset is real estate tokenization. This democratizes real estate investments, enables fractional ownership, and increases liquidity over traditionally illiquid markets.

Equity Tokenization

It's now possible with tokenization services for companies to tokenize their equity shares, which offers investors digital tokens representing ownership. This simplifies issuance, and share trading and reduces the costs associated with traditional processes.

Debt Tokenization

Debt instruments like bonds and loans can be tokenized, which offers blockchain-based assets. And through tokenization, it ensures faster settlements, enhanced transparency, and wider investor reach.

Art Tokenization

Art was the very first aspect of the scene of Tokenizing enabling investors to own assets as a whole or fraction for high-value pieces, this makes art more accessible and a tradeable investment option.

Commodity Tokenization

Physical commodities like gold, silver, oil, or agricultural products can be tokenized and represent ownership of the underlying asset. This simplifies trade, increases liquidity, and enhances accessibility.

Intellectual Property (IP) Tokenization

Patents, trademarks, or copyrights are a few Intellectual property that can be tokenized to allow fractional ownership or royalty-sharing arrangements. This benefits creators and contributes toward monetary benefits enabling secured revenue streams.

NFT Tokenization

Non-fungible tokens (NFTs) are unique assets, like digital art or collectibles allowing ownership of distinct digital or physical items, and leveraging blockchain for security and authenticity.

Gaming Asset Tokenization

In-game assets can also be tokenized into digital collectibles as characters, skins, or weapons are tokenized, this allows players to trade and own their assets independently in the gaming platforms.

Tips For Hiring Asset Tokenization Companies

It's important to hire the right real world asset tokenization company in this transforming environment where real-world assets are evolving. Here are a few tips to help to consider when hiring asset tokenization service companies.

Assess Their Expertise

Look into companies that have proven experience in blockchain development and asset tokenization. By verifying their portfolio you can ensure they have a track record of success and confirm their diversity in tokenization services like real estate token development, art, commodities, and more.

Evaluate Blockchain Proficiency

Ensure the company is experienced in popular blockchain networks like Ethereum, Binance Smart Chain, Solana, Polygon and others. A versatile company can help you guide in different directions and provide specific asset tokenization services.

Prioritize Regulatory Compliance

Asset tokenization involves the company navigating complex legal frameworks. By ensuring the company you choose understands jurisdictional regulations and offers compliant solutions, you will be in complete alignment with your local and global legal requirements.

Check for Customization Options

Every asset and business worldwide has unique requirements. When the company can offer flexible and customized tokenization solutions, in terms of smart contract configurations, fractional ownership features, etc., there will be no disruption in the future in case of updates.

Security Focus

Security is paramount in tokenization on blockchain. When choosing a company, ensure they build robust protocols, encryption, and audit trails that ensure to protect your tokenized assets from fraud, hacking, and unauthorized access.

Transparency in Processes

The asset tokenization company you choose should provide clear documentation and communication on the development process, costs, timelines, and deliverables. This transparency builds trust, and in the long run, also gives clarity which ensures smoother collaboration.

Look for End-to-End Services

Don't get your services scattered. It's best to opt for a single company that can offer you the in and out of the comprehensive services you would require. That shall include token creation, smart contract development, platform integration, wallet solutions, ongoing maintenance, and other advancements.

Post-Development Support

Ensure the company provides maintenance, upgrades, and troubleshooting services after deployment. Blockchain systems evolve, and reliable support is essential for longevity.

Competitive Pricing

The company you choose to get your Assets tokenized should be placed affordable and meet market standards, by comparing pricing models across multiple companies you can pick the right one. Where affordability is important, you will also have to prioritize value over cost, ensuring to receive quality services.

Client Reviews and Testimonials

It's very crucial to research the company’s client feedback to better understand the company's reliability, professionalism, and performance. Positive reviews often indicate dependable service.

These steps can help you land on a clean developer or Asset tokenization company that meets your requirements and navigates toward progress.

Roles And Functions Of An Asset Tokenization Companies

Asset tokenization companies are crucial in bridging traditional industries with blockchain technology, they extend their expertise, tools, and platforms to digitize real-world assets. Here listed below are a few primary roles and functions these companies can fulfill.

Tokenization Process Facilitation

As these companies assist in converting physical or intangible assets into digital tokens, they will have to define the token structure, compliance measures, and functionality of the tokens.

Smart Contract Development

Smart contracts are those that ensure automation, transparency, and security in asset management, transfer, and transactions. As Asset tokenization companies designing and deploying these contracts to govern token functionalities is a crucial take.

Regulatory Compliance and Legal Support

The asset tokenization company you choose should ensure the tokenization process adheres to relevant legal frameworks and meets industry regulations. It includes securing necessary licenses aligning with jurisdictional requirements, and other legal compliances.

Platform Development

The tokenization companies develop user-friendly platforms where assets can be tokenized, traded, and managed, which are integrated into blockchain to feature seamless operations.

Security Implementation

Ensuring the token's safety is paramount. Asset Tokenization companies, deploy encryption, and anti-fraud measures, and provide robust protocols ensuring security over digital tokens and preventing unauthorized access.

Fractional Ownership Enablement

Asset tokenization companies ensure they structure the tokens to represent as fractionalized assets, which provides shared ownership and increased accessibility for small-scale investors.

Marketplaces and Liquidity Solutions

The partner who creates and integrates secondary markets that facilitate token trading for assets improves liquidity over traditionally illiquid asset classes like real estate or art.

Auditing and Transparency

The company can provide transparent systems that maintain immutable records of ownership and transactions, this boosts trust among investors and other stakeholders.

Customization Services

Any asset tokenization company needs to provide tailored tokenization services that are very much aligned with their specific asset types, business models, or investment needs, which therefore helps in meeting voluntary needs.

Education and Consultation

Asset tokenization companies that educate clients on the potentials of blockchain and facilitate tokenization services, provide benefits, clarify, and guide businesses through the entire process are gems.

Download the PDF : Asset Tokenization Companies.pdf

Conclusion

Asset Tokenization companies are becoming essential players in the modern financial ecosystem and leveraging Blockchain Technology, Businesses see this as a gateway to digitize, fractionalize, securely handle, manage, and transparently monitor assets and properties. They leverage Blockchain digitizing tokens with fractional ownership benefits, addressing the escalating demand for more efficient, secured, and transparent illiquid assets in the market.

Asset tokenization provides opportunities for these high-value assets, making them more dynamic and open to versatile investment opportunities. Moreover, they also benefit as and when integrated into decentralized finance (DeFi), allowing faster transactions at lower costs, and providing greater transparency when compared to traditional systems.

With blockchain’s inherent advantages of transparency, immutability, and decentralization, tokenization will continue to reshape traditional markets, creating new opportunities. The role of asset tokenization companies will be crucial in ensuring the seamless integration of blockchain into existing industries, driving forward a more inclusive, decentralized, and accessible economy.