Table of Contents

Stock Tokenization: A Complete Beginner’s Guide in 2025

Listen to the Audio :

Thinking forward, stock tokenization is one of the most innovative concepts that integrates the traditional real-world assets with blockchain technology. Here, the tokenized stocks are transformed into digital tokens, marking a significant role in the modern digital economy.

A recent data indicates that the tokenized assets now represent 10% of the global Gross Domestic Product (GDP) currently and it is estimated to reach $24 trillion by the end 2027. Here, investors can easily trade and manage the stocks without any third parties or central authorities.

The main purpose of this blog is to provide a complete understanding of what tokenized stocks are, how they work in real-time, potential features, the rwa tokenization development process, and the best examples. It also clearly outlines the major similarities between traditional stocks and tokenized stocks to enable investors to capitalize on financial trading.

What is Stock Tokenization?

In simple terms, stock tokenzation is the process of converting the ownership of real-world company shares into digital tokens on an existing blockchain platform. Here, each digital token denotes a part or the whole share of the primary stock, which can be traded or transferred like traditional shares. These tokenized digital assets are used to track the real-world company shares through digital platforms.

However, these tokens are often issued by smart contracts and offer similar rights to the traditional shares, including voting rights, dividends, and more. The tokenized stocks here are generated by public or permissioned blockchains like Ethereum, Solana, or Polygon. They can be accessed and traded 24/7 with broader investment opportunities.

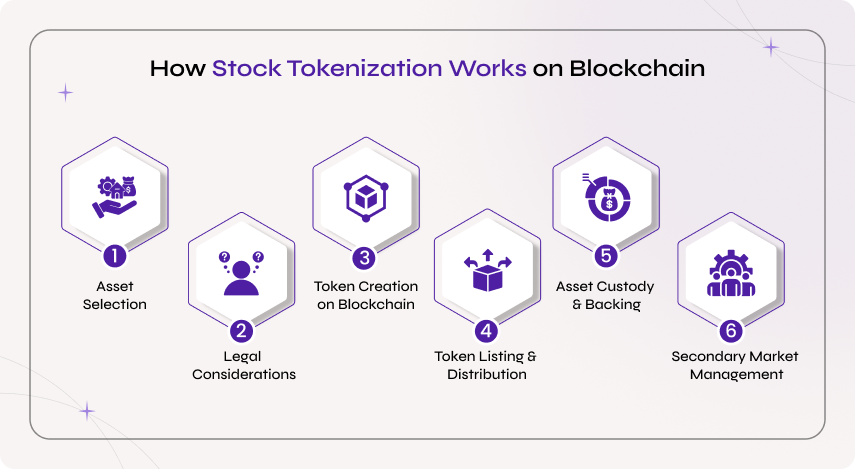

How Stock Tokenization Works on Blockchain

Asset Selection:

As an initial step, the asset manager selects a real-world stock to be tokenized. This may be a specific single stock or a group of stocks that are listed on the traditional exchange.

Legal Considerations

The selected stock ensures that each token complies with relevant security laws and legal frameworks like KYC, AML, and other licensing requirements that are legally backed by the real-world stock.

Token Creation on Blockchain

Using the smart contracts, the digital tokens are now minted on popular blockchain platforms like Solana, Ethereum, and more to denote the original underlying real-world assets.

Token Listing & Distribution

The tokens will now be listed on the trading platform, making them visible for investors. Any user can trade the tokens 24/7 on their own, without any central authorities or intermediaries.

Asset Custody & Backing

Here, each token containing the actual shares is stored and owned by a licensed custodian, considering its safety. This also ensures one-to-one backing of the token to improve its transparency.

Secondary Market Management

Finally, the tokenized stocks will be available on the secondary marketplace, where investors can buy and trade them seamlessly. Now, they can buy, sell, or trade them as per their choice, with enhanced transparency and efficiency.

Why Tokenized Stocks?

Why depend on tokenized stocks? Tokenized stocks—a small digital representation of the traditional stocks of a company on the blockchain platform—come with various features incorporated into them. It attracts a wide range of users and investors by providing improved efficiency, liquidity, transparency, and accessibility.

With the integration of blockchain technologies, tokenized stocks provide fractional ownership and allow users to trade the market 24/7 with instantaneous settlements. Their potential of providing stocks at low cost without any middlemen is gaining traction among corporations and increases their business opportunities. In short, they are smarter, cheaper, and faster than conventional stock trading.

Traditional Stocks vs Tokenized Stocks

| Features | Traditional Stocks | Tokenized Stocks |

|---|---|---|

| Structure | Paper or electronic shares of the asset | Digital tokens of asset on a blockchain |

| Ownership Record | Verified and maintained by centralized authorities | Maintained by a decentralized blockchain ledger |

| Trading Hours | It depends on the trading hours with certain limitations | Tokenized stocks provide 24/7 trading opportunities worldwide |

| Settlement Time | These stocks take a minimum of T+2 or more days for settlement | It offers instantaneous settlements |

| Liquidity | Depends on the stock exchange hours and is limited | It potentially offers higher liquidity and is available 24/7 globally |

| Fractional Ownership | Stocks can be traded only as complete shares | Stocks can be easily divided into small fractions |

| Transparency | Traditional stocks are less transparent and controlled by central authorities | Tokenized stocks provides auditability and verifiable asset ownership |

| Fee Structure | They offer higher fees due to intermediaries, brokers, and central authorities | They come at less cost with their smart contract integration and peer-to-peer support |

| Security | It is highly vulnerable to theft, cyberattacks, and fraud | It is secured via blockchain consensus mechanisms & smart contracts |

| Regulatory Compliance | It is regulated by traditional financial authorities | It comes with both security laws and blockchain regulations |

Features of Tokenized Stocks

Fractional Ownership

Tokenized stocks are divided into small fractional units, making them easier and more accessible for every user. This allows investors to own a partial ownership of the high-value shares at affordable investment. Hence, it boosts market participation.

Around-the-Clock Trading

In contrast with the traditional stocks that come with limited time, blockchain-based tokenized stocks are available 24/7 in the market and enable investors to flexibly trade the stocks any time.

Cost-Effective

Investors who look to maximize returns and minimize their costs can go with tokenized stocks, which offer low transaction fees. As tokenized stocks eliminate the need for central authorities, companies can save money in huge amounts.

Increased Liquidity

Tokenization allows users to have digital and fractional ownership of the stocks by enabling liquidity for traditionally illiquid or restricted assets. This creates the market opportunity to increase widely and unlocks new capital, increasing the participation of investors.

Global Accessibility

Using the blockchain networks, the tokenized stocks can be purchased and traded globally by reducing the regulatory barriers and geo-restrictions. This expands the potential investor base by making assets more accessible to a wider audience.

Instant Settlement

The transactions done here are settled instantly with the help of blockchain infrastructure. It takes a maximum of T+2 days to boost up and increase the transparency of transactions. Thus, it reduces counterparty risks and increases investors' confidence.

Transparency & Security

All transactions are recorded on a public blockchain by providing an immutable and verifiable trail of ownership and trade history. This ensures high transparency and enhances trust among asset investors and reduces the fraud risks.

Faster Fundraising

Unlike traditional fundraising methods, tokenized stocks enable companies or enterprises to raise funds more quickly to reach a wide range of investors worldwide. This primarily increases liquidity, fractional ownership, and the process of blockchain.

How to Get Started With Stock Tokenization Development

Getting started with stock tokenization development is not as difficult as you think. It just needs a basic understanding of the core concepts of smart contracts, blockchain, and other key characteristics. However, here’s a breakdown of how to get started with the process.

Step 1: Understanding the Core Concepts

Begin by getting to know about the basics of stock tokenization and the conversion process behind it. Familiarize yourself with the relevant regulatory frameworks, smart contracts, token standards, and other necessary concepts.

Step 2: Choosing the Blockchain Platform

Consider platforms like Ethereum, Solana, Polygon, and more, and choose a wise blockchain network that suits your needs and requirements. You can pick the best platform by examining factors like security, cost, features, & smart contract support.

Step 3: Ensuring Regulatory Standards

Consult expert assistants to ensure your tokenized asset complies with both local and international regulatory standards. It must also support the KYC and AML frameworks, prioritizing the security of assets.

Step 4: Smart Contract Creation

Collaborate with a licensed custodian who ensures that each digital token is backed by an underlying asset, holding the actual shares. Proceed to develop smart contracts using languages like Solidity to work on Ethereum. Integrate features such as transfer rules, ownership tracking, and voting rights.

Step 5: Build a Tokenization Platform

Now, you need to create your own platform using certain frameworks and TaaS providers. Make sure to build the platform with certain features, like an investor portal, dashboard, secondary market support, and compliance engine. Once done, you can issue the tokens via STOs.

Step 6: Launch & Monitor the Platform

Finally, launch the tokens on a secondary exchange platform or a customized tokenization platform. Then, continuously monitor its performance and make sure to update and provide necessary reports to investors.

Step 7: Security & Ongoing Support

Conduct a security audit of your smart contracts and follow the best practices in cybersecurity to protect your data. Then, provide dashboards and updated reports to investors and issuers.

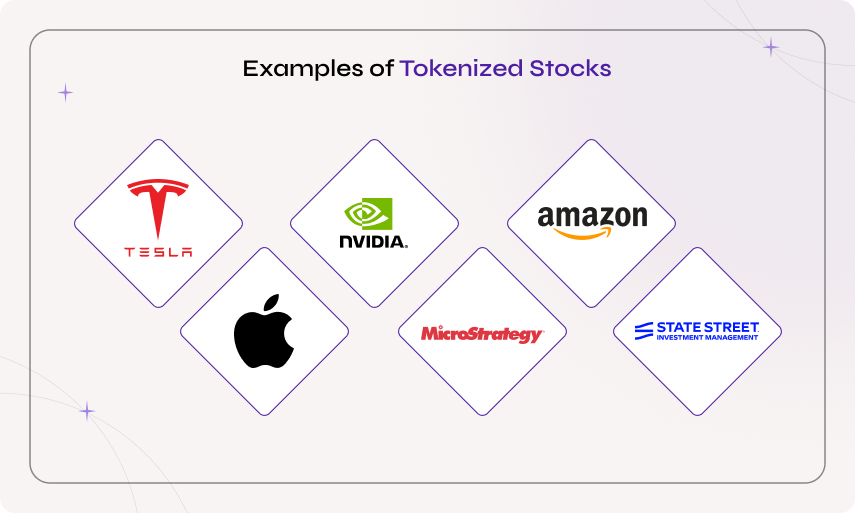

Examples of Tokenized Stocks

The tokenized stocks are transforming the investment landscape by blending traditional equity with blockchain technology. However, below are some of the popular and best examples of tokenized stocks in this ever-growing market.

Tesla Token (TSLA)

Tesla token is created using blockchain technology and is referred to as TSLA. It denotes the tokenized version of Tesla stock.

Here, each TSLA token is represented by a digital asset, which is backed by a 1:1 ratio of the real Tesla shares.

Some of the popular platforms that support Tesla tokenized stocks are FTX, Swarm Markets, Binance, and some DeFi platforms.

Apple Share Token (AAPL)

The Apple Share Token (AAPL) allows investors to own a piece of the most valuable company in the world.

It mirrors Apple’s real-time market price and offers exposure to its price fluctuations.

However, the AAPL is backed by a 1:1 ratio of the actual Apple company shares held in custody by a licensed third party.

Nvidia (NVDA)

Nvidia’s tokenized stock leverages blockchain-based tokens and allows investors to gain exposure to the company’s market performance.

This tokenized version of NVDA stock uses FTX and allows users to gain a fractional part of the stock.

This is an advanced digital asset trading platform, which is developed with an easy-to-use interface for users.

MicroStrategy (MSTR)

Gemini has launched a tokenized version of MicroStrategy’s stock, making it accessible on their platform.

The MSTR stock has become popular in this field due to their significant holdings of Bitcoin.

This allows users in regions like the European Union to gain exposure to both Bitcoin and MicroStrategy's stock through a single, on-chain platform.

Amazon (AMZN)

Amazon is one of the largest e-commerce companies, which uses a popular digital token called AMZN, representing the Amazon stocks.

The popular platforms like Binance, Fusang, DeFiChain, and FTX offer AMZN tokenization.

These tokenized shares are often known as xStocks, which are often backed by the original shares and can be traded 24/7 outside the traditional markets.

SPDR S&P 500 ETF (SPY)

It is a type of blockchain-based asset that represents the ownership of trusted shares of SPDR S&P 500 ETF.

This is one of the most actively traded exchanges worldwide, which has a track record of the S&P 500 index.

This SPY tokenized asset is basically issued on blockchain platforms like BNB Chain, Ethereum, or other smart contract platforms.

Download the PDF : Stock Tokenization.pdf

Conclusion

Stock tokenization is a powerful and transformative process that uses blockchain to convert the traditional equity shares into digital tokens. It changes the way investors interact with equity marketers. This simplified form of accessing the traditional stocks increases the overall accessibility, transparency, and efficiency of the real-world assets. Now, by having a solid understanding of what stock tokenization is and how it works, you can start exploring and shape the future of the global financial system.

We at BlockchainX help you tokenize your equity shares into digital tokens and help to meet your business needs and objectives. Our experts are built with in-depth blockchain skills in real time. Connect with our team and get started now.