Table of Contents

Launch Tokenization-as-a-Service Platform for Asset Tokenization in 10 Simple Steps

Listen to the Audio :

Searching for the best platform to perceive and manage your assets in this dynamic financial landscape? Tokenization-as-a-Service has got you here! Currently, the TaaS platform is one of the powerful ways to digitize and store illiquid real-world assets like art, real estate, commodities, and many more.

Whether it’s a startup or a large enterprise, those who wish to create a TaaS platform need a clear understanding of the basics and must be experts in asset tokenization solutions, robust technologies, and regulatory compliance.

What does TaaS really mean, and how does it work? The blog below will guide you through the fundamentals of the TaaS platform and the creation of the platform from planning to integrating it with regulatory protocols and post-launch monitoring.

What is Tokenization-as-a-Service (TaaS)?

Tokenization-as-a-Service (TaaS) is a cloud-based solution that enables businesses to convert real-world assets (RWA) into verifiable digital tokens with its end-to-end rwa tokenization solutions. Here, the non-sensitive tokens can be used in various processes like identity verification, transactions, analytics, and more.

This tokenization process gives the company the right to access or trade digital tokens seamlessly on the blockchain platform with enhanced security, tailored to regulatory compliance. However, this method is a safe process for every business, including startups and large e-commerce companies by handling their data safely, reducing security breaches to enhance their production.

The TaaS process provides APIs, ready-made tools, and infrastructures to simplify the tokenization processes, allowing businesses to avoid handling cryptographic or blockchain systems on their own. Overall, this process is used in various sectors, including e-commerce & retail, financial institutions, technology companies, healthcare, and more.

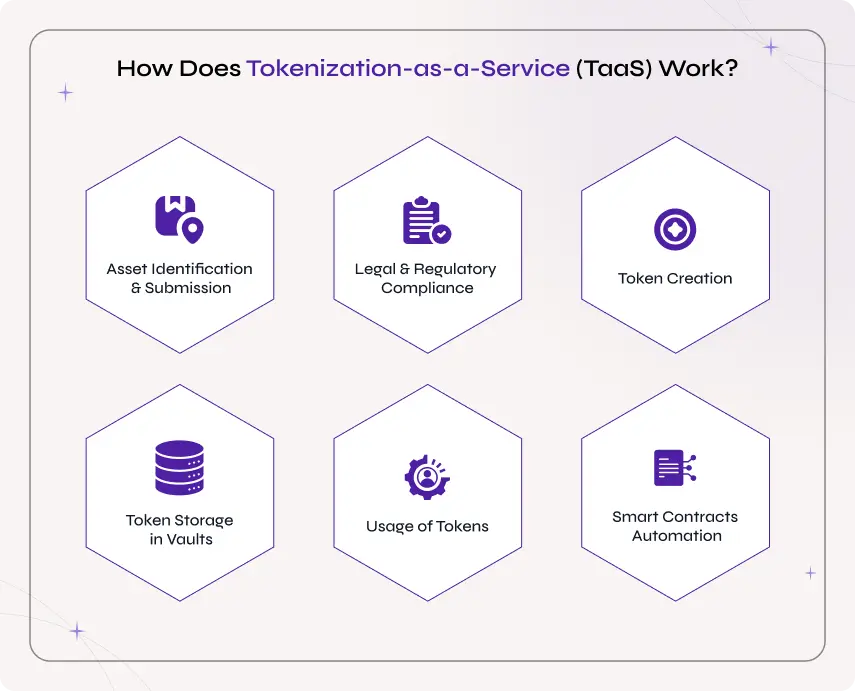

How Does Tokenization-as-a-Service (TaaS) Work?

Before beginning to secure your assets using the Tokenization-as-a-Service (TaaS) platform, you need to understand how well the platform works. However, below is a typical workflow of how TaaS works in real-time.

Asset Identification & Submission

The working process begins by identifying the real-world assets that should be tokenized by holding specific value and fractional ownership. Then, any individuals or businesses submit certain details like the value of the asset, ownership rights, required compliance, and more.

Legal & Regulatory Compliance

The TaaS provider checks whether the assets undergo both local and international regulatory laws, including KYC, AML, SEC rules, GDPR, and other jurisdictional regulations. This ensures that the asset is secure and free from security breaches and undergoes the process smoothly.

Token Creation

Now, the Tokenization-as-a-Service platform creates a unique digital token by replacing the original sensitive information. It uses smart contracts and creates token standards like ERC-20, ERC-721, ERC-1400, and much more based on the business's use case or requirements.

Token Storage in Vaults

The original information is now stored in secure vaults, and the provider offers tools for managing tokens. These tools may include smart contract deployment, fractional ownership tracking, dividends, and transfer restrictions. Using these tools, the data is kept securely, preventing it from unauthorized access.

Usage of Tokens

Users can now trade the tokens on the secondary trading platform. They are used in various applications and blockchain platforms for multiple purposes, including the transfer of assets, executing transactions, compliance purposes, and record-keeping.

Smart Contracts Automation

Finally, the TaaS provider uses smart contracts & infrastructure, allowing the token holders to manage the distribution processes, transactions, updates, and regulatory compliance reporting. In this way, Tokenization-as-a-Service (TaaS) helps organization and businesses to tokenize their real-world assets easily.

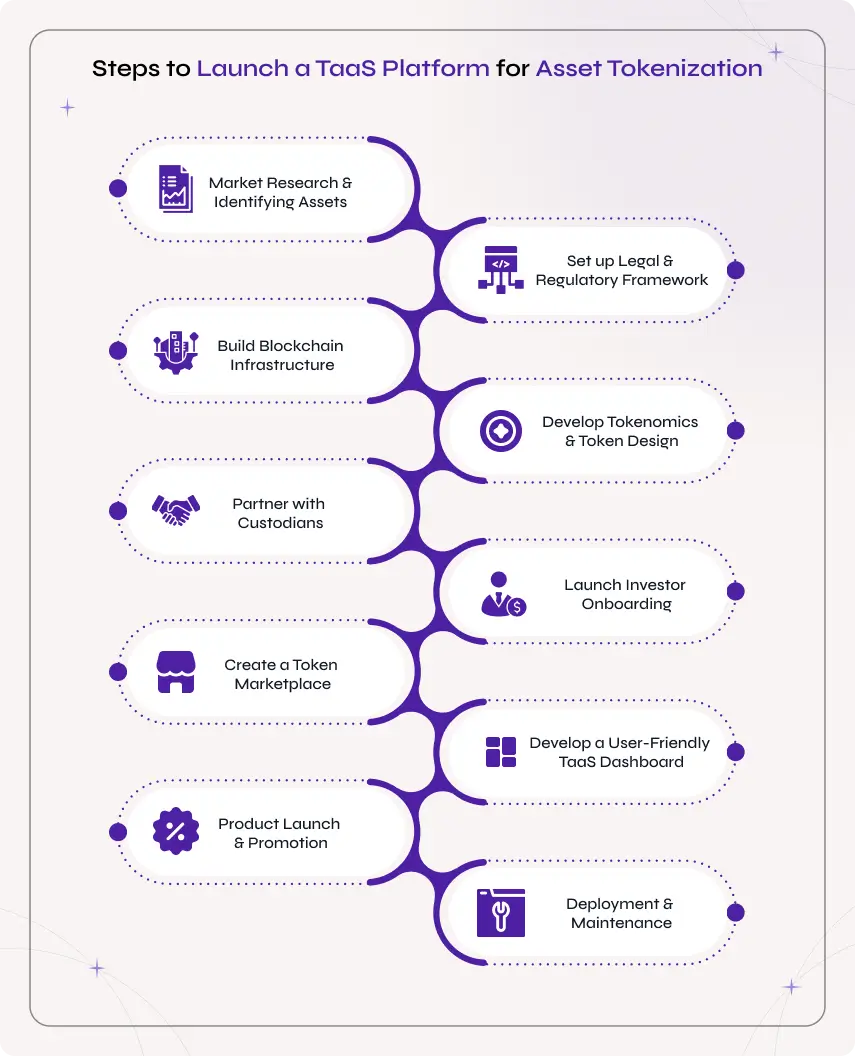

10 Steps to Launch a TaaS Platform for Asset Tokenization

Step 1: Market Research & Identifying Assets

The launching process of the TaaS platform in asset tokenization commences by identifying the types of assets to be tokenized. Say, for example, art, commodities, real estate, intellectual property, etc. Then, define the purpose of tokenization and make it valuable to the target audience.

Step 2: Set up Legal & Regulatory Framework

As a next step, engage with partners and consult a legal expert to undergo the KYC, AML, and other security laws. It is also important to establish a compliance framework that covers all the legal protections of asset tokenization for investors, issuers, platform operations, and implementing cross-border transactions.

Step 3: Build Blockchain Infrastructure

Now, select a suitable blockchain platform like Ethereum, Solana, or Polygon, based on the tokenized assets requirements. Also, finalize the platform by considering factors like gas fees, smart contract capabilities, and transaction speed, and ensure it supports the token standards like ERC-20 and ERC-1400.

Step 4: Develop Tokenomics & Token Design

Build safe and efficient smart contracts for asset tokenization to access and manage token creation, token issuance, and transfer. Then, conduct security audits individually to ensure the smart contracts are error-free, safe, and comply with the important legal frameworks and standards.

Step 5: Partner with Custodians

Further, partner with licensed custodians and wallet providers to secure and manage the underlying assets, tokens, and private keys. You can even use verified oracles for checking the assets and their prices and to maintain the tokenized assets transparency.

Step 6: Launch Investor Onboarding

Ensure to verify the KYC, AML, risk screening, and other verification tools. Use automation to onboard investors and to maintain strict regulatory standards across jurisdictions. Probably this reduces friction and enhances the ability to purchase asset-backed tokens.

Step 7: Create a Token Marketplace

Develop a trading partner with a compliance secondary market, following the regulatory compliance standard to enable peer-to-peer token transfer and liquidity. Also, make sure the platform supports trade settlements, token transfers, and other functions with enhanced transparency and compliance-friendly protocols.

Step 8: Develop a User-Friendly TaaS Dashboard

As a next step, create a beginner-friendly interface that comes with easy-to-use dashboards and provides enriched features like investment tracking, real-time analysis of transaction history, and more. However, this TaaS interface should be responsive and easily accessible for every investor, issuer, and admin.

Step 9: Product Launch & Promotion

Now, use the tokenized assets and deploy the platform on the main network. Initiate campaigns to attract a wide range of clients, including investors, asset owners, institutions, and organizations. In addition to this, you can even offer enhanced sales support, demo sessions, and customizable white-label solutions to acquire trustworthy clients.

Step 10: Deployment & Maintenance

Finally, it’s important to continuously monitor the platform’s security, performance, and compliance issues. We provide robust customer support to guide the client by providing regular updates about the platform and compliance adjustments. This can make the platform stay long-term in the market by attracting more users.

Benefits of Launching a TaaS Platform

Enhanced Security & Compliance

The TaaS platform often provides a high level of security and robust security measures for controlling asset management. With the integration of access control, strong data encryption, and secure vaults, the TaaS platform provides an easy way for businesses to meet the regulatory compliance standards smoothly.

Scalability & Flexibility

Tokenization-as-a-Service offers improved adaptability and easily matches with the projects specific needs and goals. It enables businesses and organizations to manage large volumes of data and transactions with minimal security risks and allows them to adapt to new market trends and technologies.

Improved Operational Efficiency

The transactions done in TaaS are now automated and cut down the human manual errors. This automation within the TaaS platform significantly speeds up the testing process, thus making it more efficient and consistent.

Cost-Efficient

TaaS significantly reduces the overall cost and often comes within a low budget by eliminating intermediaries, expensive software and hardware tools and reduced paperwork. The platform is flexible with the pay-as-you-go pricing model, allowing businesses or companies to pay only for the testing services they utilize.

Transparency

Tokenization on blockchain provides a tamper-proof record of every transaction and its verifiable data. This enhanced transparency enables businesses to track their progress and identify the potential problems and issues associated with it. This eventually reduces the risk of fraudulent activities.

Increased Liquidity

In TaaS, the traditional financial systems are converted into blockchain-based tokens, allowing users to unlock and access a wide range of liquidity pools and new business opportunities. Here, the tokenized assets like art, real estate, collectibles, etc, can be traded in secondary markets, DEXs, or other platforms.

Global Accessibility

Launching a TaaS platform can help businesses to reach their products and services among a wide range of global audiences to increase their market reach and user experience. This enables investors to invest in the tokenized assets without any geo-restrictions or limitations.

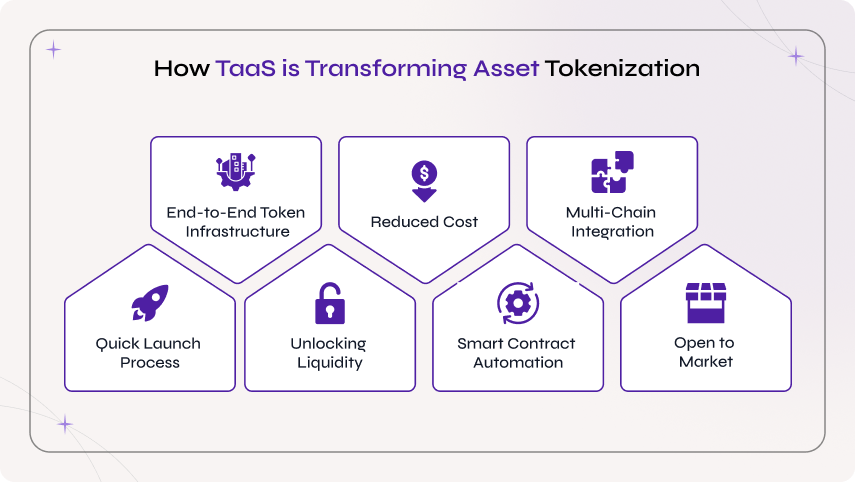

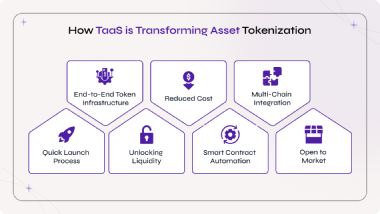

How TaaS is Transforming Asset Tokenization

Tokenization-as-a-Service (TaaS) plays a crucial role in revolutionizing the way real-world assets are represented, exchanged, and managed on blockchain networks. However, below is a small glimpse of how TaaS transforms asset tokenization with its end-to-end features.

End-to-End Token Infrastructure

The TaaS platform comes with exclusive solutions and covers the entire asset tokenization process right from asset engagement and token formation to smart contract creation and regulatory standards. This ready-to-use solution offers centralized control for investors, maintaining complete transparency.

Reduced Cost

The TaaS platform often comes with its pre-built tools & infrastructure, allowing businesses to avoid creating their own complex systems from scratch. With their minimal upfront investment, TaaS allows issuers to launch their assets in a minimal days, and this boosts the performance for smaller firms.

Multi-Chain Integration

Tokenization-as-a-Service supports cross-chain asset tokenization and supports a wide range of blockchain networks like Solana, Ethereum, Polygon, and more. Additionally, it also supports popular token standards like ERC-20, ERC-721, etc., and enhances the asset users' flexibility.

Quick Launch Process

With the plug-and-play solutions of TaaS, any businesses & organizations can launch their own asset-backed tokens quickly and easily with enriched compliance features and smart contract templates. In essence, this minimizes the development time from months to days.

Unlocking Liquidity

The TaaS integrates with DEX platforms and permissioned markets to fractionalize the ownership of illiquid assets like art, real estate, commodities, private equity, and more into tokens. This enables the assets to reach a wide range of users, including startups and established companies.

Smart Contract Automation

Smart contracts automate various processes with asset tokenization, and serve as a crucial factor. They automate tasks like token transfers, compliance checking, voting rights, identity verification, and more on their own, eliminating the need for central authorities or intermediaries.

Open to Market

As launching a tokenized asset from scratch takes more time, TaaS makes the process simple with minimal investment, allowing a vast range of users to have a fractional ownership of the original assets. This reduces the barrier to entry and minimizes the capital required to invest.

Download the PDF : Launch Tokenization as a Service.pdf

Conclusion

In conclusion, Tokenization-as-a-Service serves as a new era in asset tokenization, offering predominant solutions, including security, efficiency, transparency, faster launch time, liquidity, and more. By using this technique, businesses and organizations can safeguard their assets from illegal activities and security breaches. With the above guide, you can create your TaaS platform for asset tokenization and embrace the future of asset management to seize new opportunities.

Looking forward, if you are ready to tokenize and access your assets across borders with enhanced security, partnering with a tokenization service provider like BlockchainX is important. With our cutting-edge solutions and expert guidance, we look forward to the success of asset management powered by TaaS.