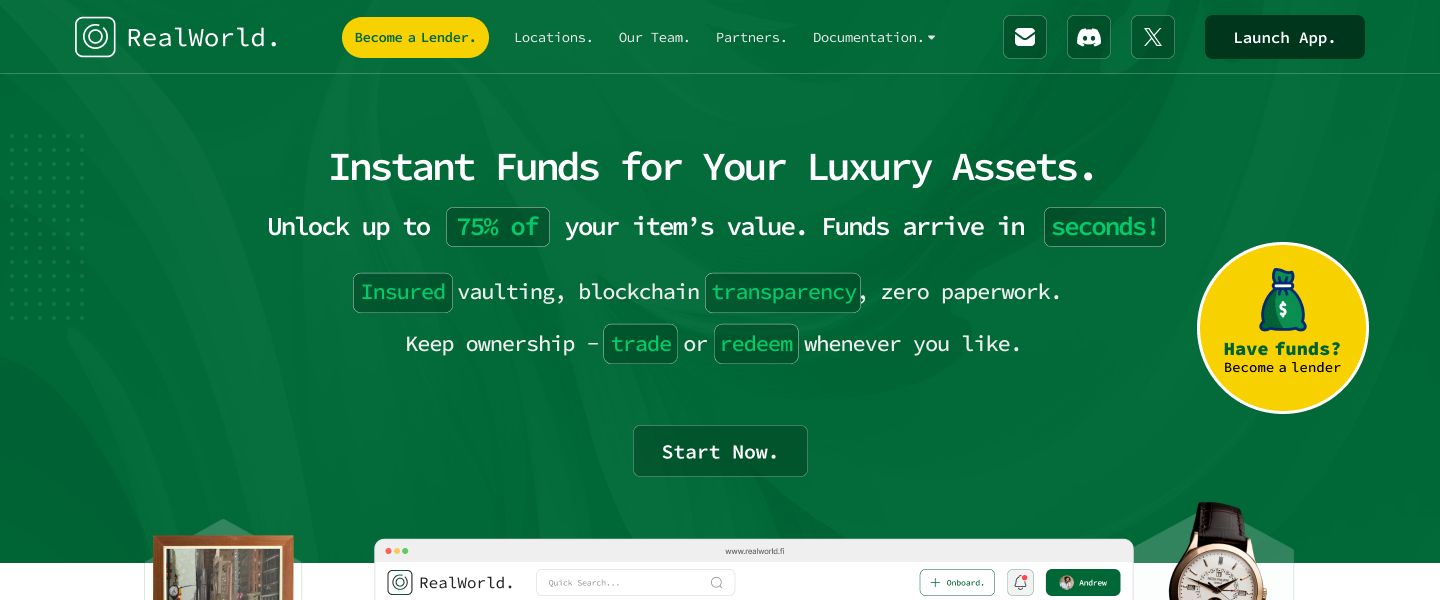

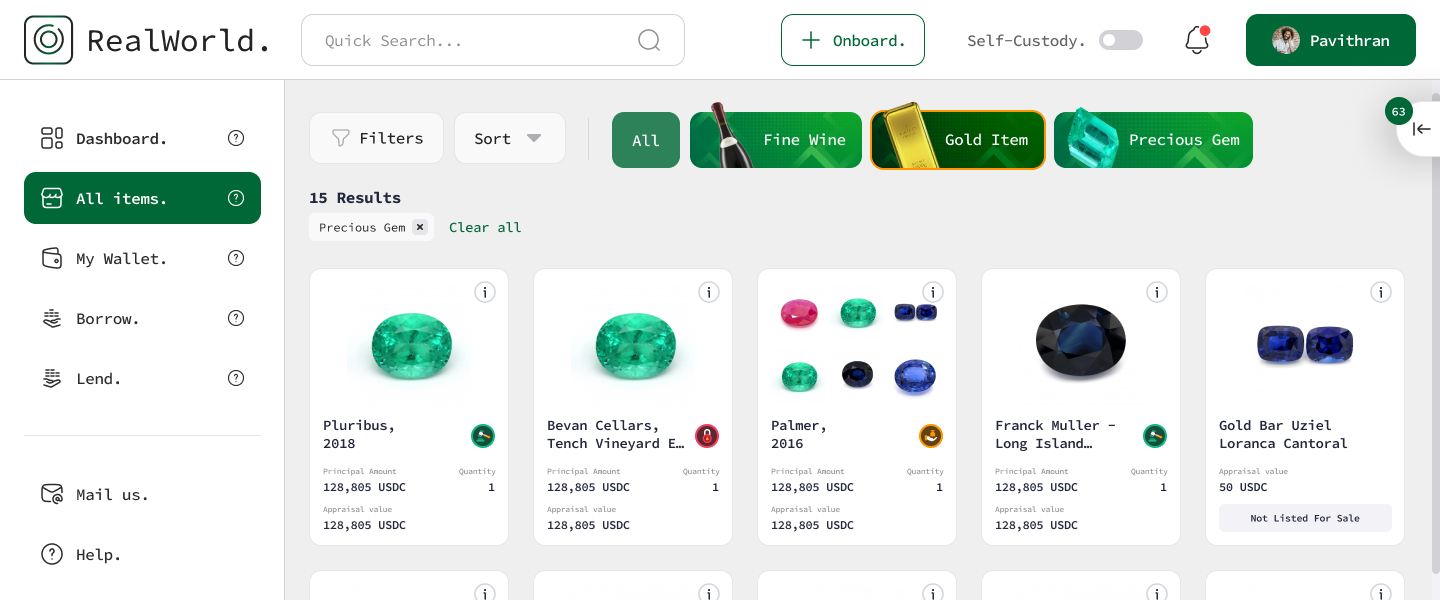

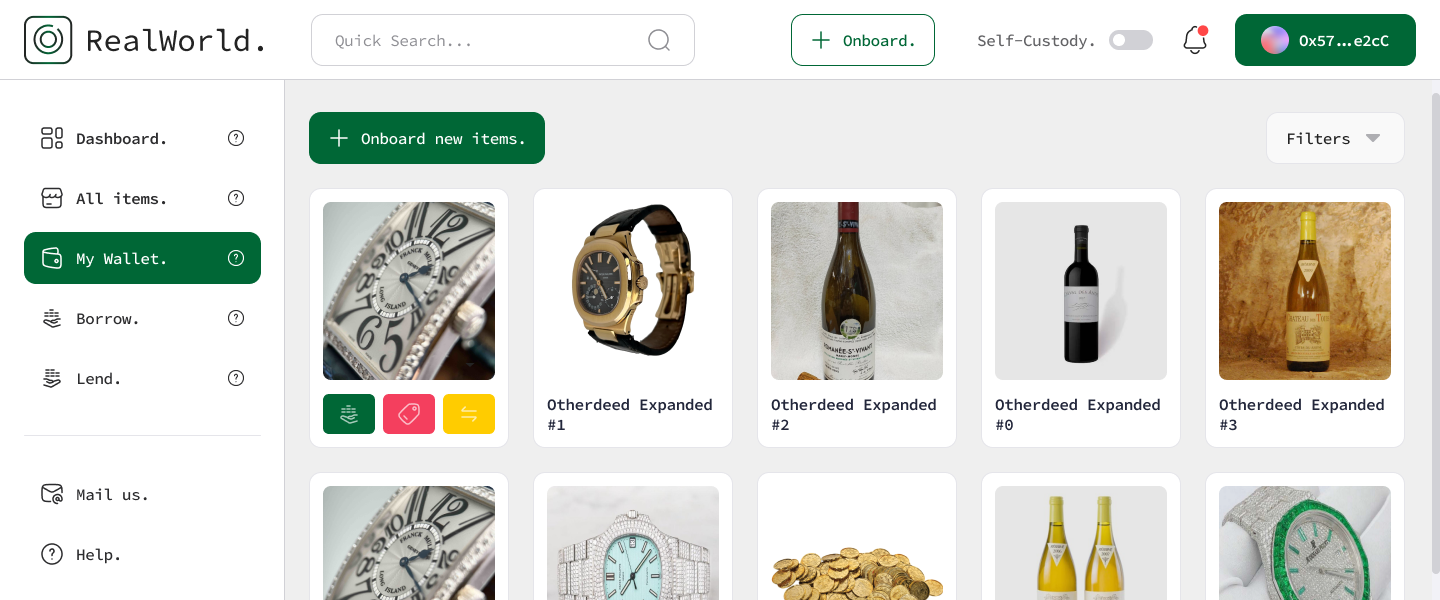

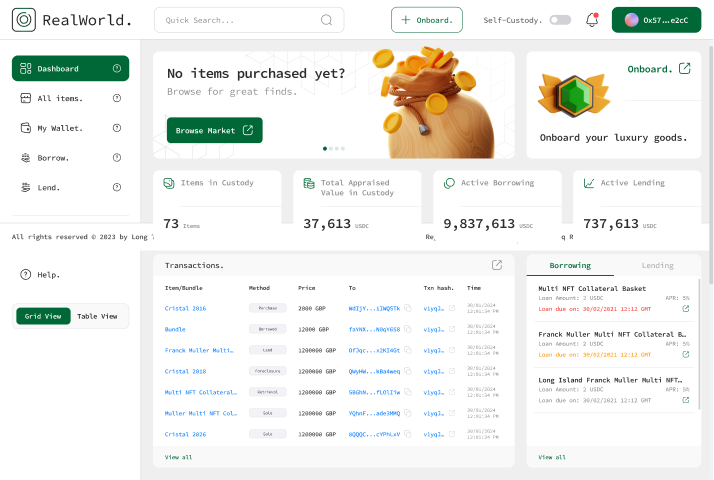

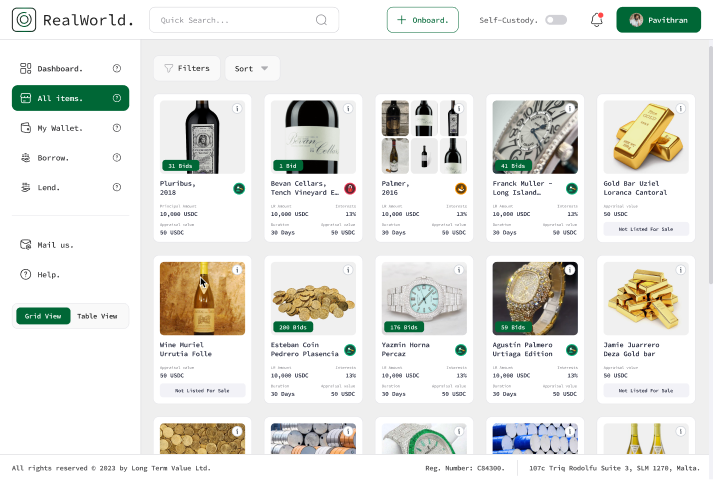

The process of creating digital tokens on a blockchain that represent ownership or shares of real, physical assets like fine wine, gold, precious gems, luxury watches and artwork is known as real world asset (RWA) tokenization.This makes it possible for a wider spectrum of investors to safely divide trade and access these valuable real-world assets transparently and effectively.

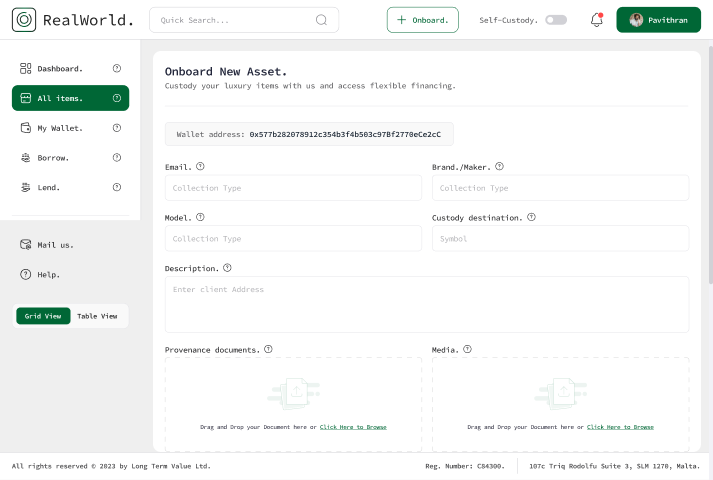

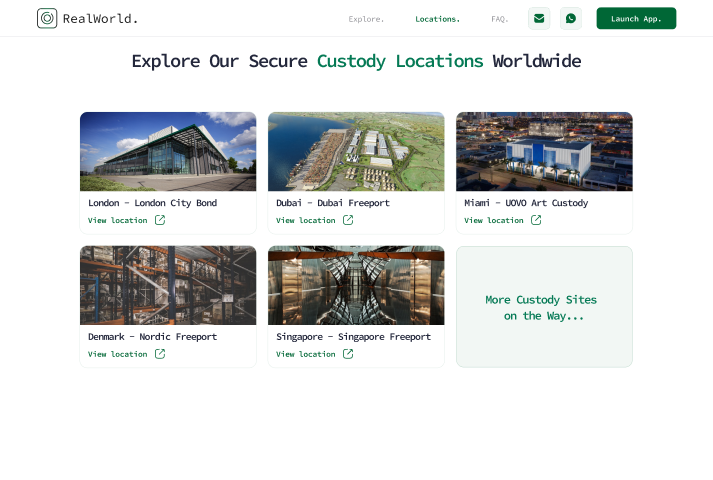

Our clients can currently use the following asset types to trade or execute loans such as fine wine and spirits, coins and gold bars, precious gems and luxury watches. We ensure that these valuable assets are secure, authenticated and simple to trade by converting them into digital tokens. Before being turned into a blockchain token, each asset is reviewed, evaluated and safely stored in insured vaults.Our platform combines blockchain technology with real-world assets to provide users with an easy, transparent and fair option to borrow or invest in luxury goods.