Leverage Trading In Defi Borrowing Dominate

Leverage trading is now becoming a buzzword in the digital market. You know about the DeFi lending and borrowing process , but leveraged trading is the crypto trading that is gaining popularity today. Then, what is leverage trading? Leverage trading is a trading approach traders use in both traditional and crypto markets to maximize profits. Here the traders use borrowed money to increase the potential return on investment.

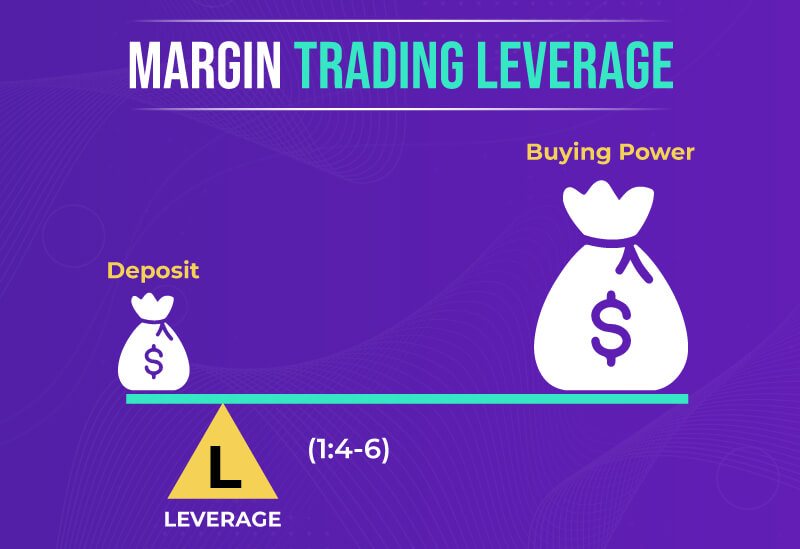

For starters, let us explain what crypto trading is. Let's see how leverage can be used in crypto trading. We will look at how leverage relates to margin trading. Margin trading is nothing but a common type of leveraged trading that involves placing assets as collateral to increase purchasing power.

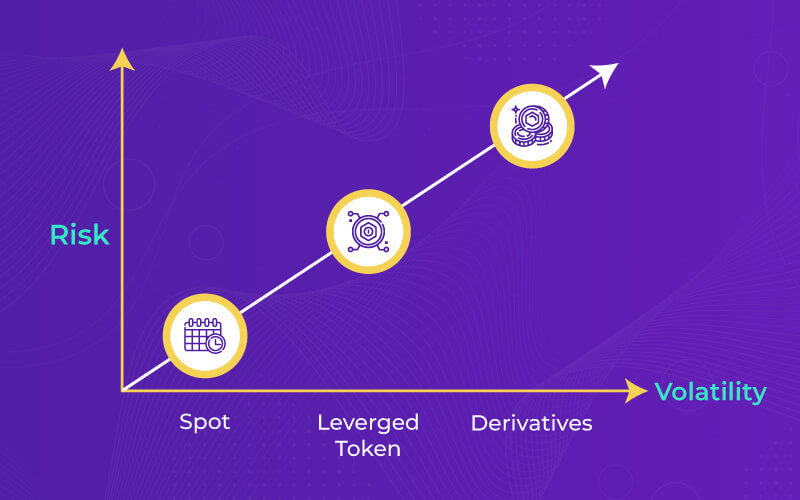

Just as there are ups and downs, it's worth pointing out how profitable leveraged trading can be, along with its downsides. Leverage trading is a risky business when compared to other crypto trading. But here we provide some tips and tricks on how leveraged trading can be useful to increase your business profits.

Leverage Trading

Leverage and margin trading are often used interchangeably, or one may be synonymous with the other. However, the difference between these is that leverage is a trading instrument used to streamline margin trading.

In finance, leverage is a plan of action using borrowed money to get a bigger potential return on investment. Simply put an investor or trader borrows money to increase their exposure to a certain type of asset, business, or instrument, more than would be possible by relying on their investment alone. Generally, by using leverages, investors can increase their buying power in the market.

Simply put, we use leverage in our daily life. By buying household appliances using a credit card, there you are borrowing money and using leverage.

For example, if you want to buy a crypto worth $5000 but you only have $2000 in your account, what would you do? There are two options, one, you have to wait for the price to drop or you can take a loan to buy crypto. When you go for the second option, you get 2X leverage, meaning half of your assets are loaned while the other half is yours.

Leverage Tokens

Leverage Tokens Leverage tokens are a newly emerging concept. The 3X Short Ethereum is the leverage token, which you can buy like any other crypto you buy on the crypto market.

In short, leveraged tokens are assets developed using the ERC-20 standard. As such, they work like other Ethereum-based tokens, Leverage tokens can be considered as one of many risk management tools. They are designed to automatically reinvest your profits and can sell on demand to avoid forced liquidation if a margin call is close to being issued.

Another thing to mention is that you don't need to provide collateral to use leveraged tokens. Because they can rebalance automatically, their value can be affected by sudden market movements. Unlike regular ERC-20 tokens, you usually cannot withdraw them to your wallet, and holding them may incur additional fees.

Pros and Cons of Leverage

From a trader's perspective, there are two types of leverage trading, one is shorting and the other is longing.

Shorting: The assumption you make is when you expect the value of the asset to down over time. Small traders are expected to sell the tokens at a low price and return the borrowed money to lenders.

Longing: The approach you take when you expect the value of the asset to increase over time. By holding or going long the asset, traders hope to sell the tokens for more than they are worth at the time of the trade. By making a profit, they can start repaying their loan.

Let's do a quick overview of the pros and cons of crypto-leveraged trading.

Experienced traders get more profit

High reward/ risk friendly

It applies to spot and derivatives markets

Leveraged tokens can be used

More complicated for beginners

High-risk process

Requires additional fees

An understanding of technical indicators is required

Leverage Margin

A common leverage trading strategy used by experienced traders to enhance their buying power rather than being limited by their in-hand amount.

Margin trading can help you to enter the market with a larger position, which means you can make a bigger profit on successful trades compared to using your in-hand amount. If your margin trade is successful, high leverage ratios will help you maximize your returns.

Margin trading allows you to get a stance quickly without having to invest more funds to own the same position size. This allows you to save time and act faster if you time the market.

With the funds you borrowed through margin trading, traders can open multiple positions with relatively less cost and no compromising position size.

Higher returns usually come with higher risks, and this is no different for margin trading. While the returns are likely to increase, so are the potential losses if the tide is not in your favor. With leveraged trading, your market exposure is increased so losses can be very damaging to your portfolio. Unlike regular trading, margin trading can result in a loss that exceeds your initial investment.

Leverage DeFi & Borrowing

The concept of leverage not only applies to digital finance, rather it encompasses traditional and crypto finance as well. Their main difference is in the action of borrowing.

Alphabetic codes, which are blockchain identities, are used in most cases, so credit card borrowing through these codes is not available. DeFi borrowing is usually fully leveraged.

When it comes to DeFi applications, DeFi borrowing, and lending is one of the oldest and most widely used. with giants already operating in the market. The logic of benefiting from borrowing crypto assets is simple.

For example; If you hold $5000 of ETH and feel bullish, you can invest your ETH in the compound as collateral and borrow $3000 USDC, then trade another $2000 for ETH. You get $8000 exposure in ETH, which increase your initial capital by 1/3 times.

Limitation of Leverage Trading

When it comes to crypto leverage trading, there is a high risk and high reward potential. Leverage trading is a process that goes hand in hand with strict regulations and is considered speculative. In short, don't jump into this service if you don't have your risk management tools ready first.

If you want to be among the qualities of a good trader, don't be afraid of the dangerous risks of leverage trading, instead think very logically and reasonably. Before starting a trade, sketch out all the necessary plans and move ahead.

Although crypto trading is not as widely available as basic spot trading, there are traditional and crypto market strategies to help you, so don't panic even if the markets start to look favorable.

The first and last thing to say is never to make rash decisions. Which means:

Don't trade beyond your means

Don't open too many positions impulsively

Don't go all in

Conclusion

Now it's time to wind up, let's collect together what leverage trading is. This is the result of borrowing assets to trade cryptocurrencies. Alternatively, leverage is used to determine how much your trade will increase if it wins or how much you will lose if the price falls. The risk of trading crypto with or without leverage is never zero, so take steps and strategies to ensure your assets are as safe as possible. One note - of course, don't trade beyond your capacity.