edgeX Exchange Clone Script

Use our edgeX exchange clone script to launch your high-performance perpetual DEX, such as EdgeX, with fast execution, 100x leverage, and self-custody. Get your personalized solution now.

Global Clients

Years of Experience

Developers

Repeat Businesses

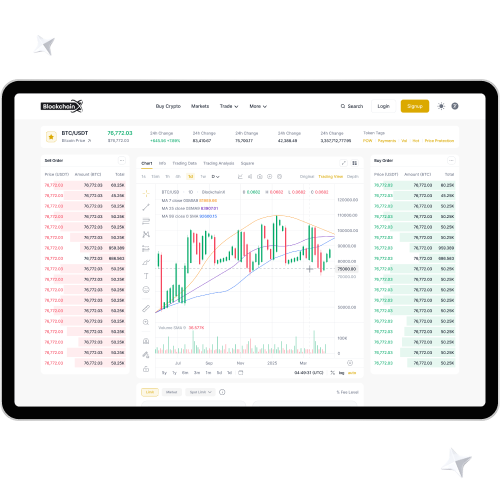

An edgeX exchange clone script is a pre-made crypto exchange software that replicates the essential features of the edgeX decentralized exchange (DEX). edgeX Exchange is a high-performance Layer-2 DEX built on Ethereum using StarkEx rollup technology. It specializes in spot trading and perpetual futures, providing CEX-like speed with sub-10 ms trade execution and support for more than 200,000 orders per second.

The platform offers deep liquidity, low costs, minimum slippage, self-custody, leverage of up to 100x, mobile apps, and on-chain asset management. EdgeX, which was developed by Amber Group and launched in 2024–2025, is in compete with Hyperliquid and other next-generation Perp DEXs. An edgeX exchange clone script enables businesses to build a similar decentralized trading platform without starting from scratch.

We offer traders a centralized exchange-like user experience and clear orderbook-based spot and perpetual trading with real-time price discovery.

Trades are executed in sub-milliseconds, allowing for huge volume while maintaining precision, stability, and low latency on a global scale.

We support perpetual futures contracts, which allow for constant trading, hedging opportunities, and no contract expiry limits globally.

Allows traders to use leverage of up to 100 times, increasing market exposure and capital efficiency, with potential profit opportunities.

Built on Ethereum Layer-2 rollup technology, it ensures safe on-chain settlement, scalability, lower gas costs, and faster transactions .

Allow non-custodial wallets to give users complete asset control, better security, transparency, and trust at all times.

Combines deep liquidity from multiple sources to reduce slippage, improve order execution, and allow huge transactions for institutions.

For accurate trading control and automation, it supports advanced order types such as limit, market, stop-loss, and conditional orders.

Offer competitive, cheap trading costs combined with flexible maker-taker structures, enabling traders to trade more actively.

Allow for quick exchange launch by using ready-made infrastructure, notably reducing development time and overall deployment complexity.

Provides centralized-exchange-level performance, including ultra-low latency, seamless order execution, and real-time trading response.

Use Layer-2 rollup architecture to effectively support large trading volumes without sacrificing security or speed.

Professional and institutional investors are attracted to advanced trading tools, high leverage, deep liquidity, and rapid execution .

Built with next-generation DeFi architecture to provide long-term adaptation, innovation, and competitiveness in growing crypto markets.

Even in huge trades or volatile situations, price slippage is minimized by deep liquidity and effective order matching.

Non-custodial design gives users complete ownership over their assets, boosting transparency, security, and platform trust .

Trades are executed in sub-millisecond periods, ensuring that active users have a smooth, fast trading experience.

White-label edgeX exchange clone software is a ready-to-use decentralized exchange solution that enables businesses to build an edgeX-like high-performance perpetual and spot trading platform. Built on Ethereum Layer-2 rollup technology, it is completely customisable, brand-ready, and offers CEX-like speed with DeFi-level security.

This white-label system features orderbook trading, perpetual futures, high leverage, deep liquidity integration, non-custodial wallets, and lightning-fast execution. The UI, branding, trading pairs, fees, and risk controls are all customizable by businesses, allowing for a faster go-to-market without complex development .

Charge maker and taker fees on each spot and perpetual trade to generate steady income.

Make revenue in perpetual markets by exchanging funding payments between long and short contracts on a regular basis.

When margin shortfalls or extreme market volatility cause leveraged positions to automatically liquidate, collect fees.

Charge low withdrawal fees to offset network costs while generating a stable income stream.

Let blockchain projects offer new tokens or perpetual trading pairs to generate income.

Use subscription plans to make revenue via advanced tools like priority execution, analytics dashboards, and increased leverage.

Receive a portion of the fees collected by liquidity providers and market-making partnerships on platform.

Provide institutional traders and high-frequency trading firms with specialized trading infrastructure and paid API access.

Self-custody wallets let users to have total control over their funds, thereby removing the risks related to centralized fund storage everywhere.

Ethereum settles transactions once they are processed on Layer-2, ensuring high security and lower gas costs .

It allows users to safely reclaim money on-chain at any moment, including in the case of platform failures or unavailability.

Regular audits of smart contracts find vulnerabilities early on, successfully avoiding exploits, logical errors, and potential financial losses.

Include insurance fund systems, auto-liquidation, and margin monitoring to protect traders and platform stability.

Strong encryption standards and widely used secure key management systems secure all sensitive user data.

In global trade contexts, multi-layer DDoS protection protects infrastructure against assaults, traffic floods, and attempts to disrupt services.

It limits access, reduces insider dangers, and upholds regulated operational governance for all platform management duties.

Real-time monitoring quickly detects unusual activity, setting out alerts to stop fraud and system abuse on a continuous, global basis.

Analyse market trends, user expectations, compliance needs, trading features, and technical specs to set accurate project goals.

Customize branding, features, trading pairs, fees, and leverage settings by selecting a reliable edgeX clone script.

Easily integrate frontend interfaces, wallets, trading engines, Layer-2 rollups, blockchain networks, and liquidity sources.

To avoid vulnerabilities, use encryption, risk controls, non-custodial security, and smart contract audits.

Conduct functional, performance, load, and security testing to ensure steady trading under large volume conditions.

Launch the platform for public user access, set up monitoring, and launch the exchange on scalable cloud infrastructure .

As user demand rises, offer ongoing updates, security patches, improved performance, feature upgrades, and scaling help .

BlockchainX takes a business-first approach to edgeX Exchange clone script development, emphasizing long-term growth, performance, and reliability. BlockchainX builds a strong trading ecosystem that mimics edgeX's deep liquidity management, high-speed execution, and Layer-2 efficiency rather than providing a basic clone, ensuring a high-quality trading experience from the start.

The firm focuses on flexibility and scalability, allowing startups and companies to launch with key features and effortlessly expand as demand develops. BlockchainX, with its extensive experience in non-custodial architectures, risk engines, and on-chain settlement techniques, ensures that your platform remains safe, compliant, and robust even during high trade activity .

Customization, supporting networks, security features, and liquidity integrations all impact an edgeX exchange clone script's development cost. Pricing is variable for startups and businesses across the world since it often varies according to project scope, technological complexity, and post-launch support.

Launching an edgeX clone exchange usually takes a few weeks, depending on the level of customisation, integrations, and testing needs. Developing a decentralized perpetual exchange from scratch is far more time-consuming than using a pre-made clone software.

Yes, edgeX exchange clone scripts are completely white-label, enabling total modification of branding. The logo, color scheme, user interface, trading features, fee structures, and domain may all be changed to fit your company's brand and market positioning objectives, strategy, audience, area, and vision.

Your operating country and company model determine the licensing needs. Although the software itself doesn't require a license, financial activities, KYC, and derivatives trading may require regulatory licenses. It is highly advised to speak with legal professionals prior to platform launch.